PAN Card Application Form

PAN stands for Permanent Account Number. It happens to be a unique identification number that is issued by the Income Tax department of India to identify every taxpayer living in the country. Some of its features are:

GOLD LOAN @ 0.75%*

APPLY NOW

How to Apply for a PAN Card Online

Applying for a PAN Card is very easy for people these days. People can now apply for a fresh PAN offline as well as online. Anyone who has lost their PAN card can apply online for a reprint of the card. The following steps should be followed to apply for a PAN Card.

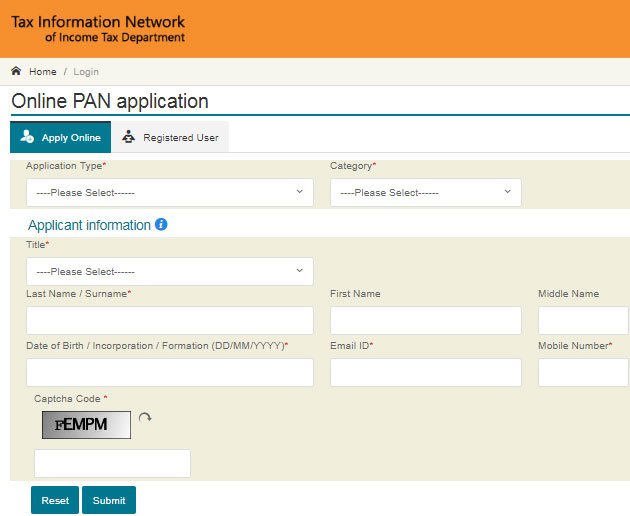

Step 1: Click open the NSDL site (https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html) to apply for a new PAN.

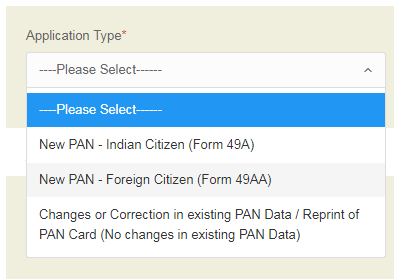

Step 2: Select the Application type from the options- New PAN for Indian citizens, foreign citizens, or change/correction in existing PAN data.

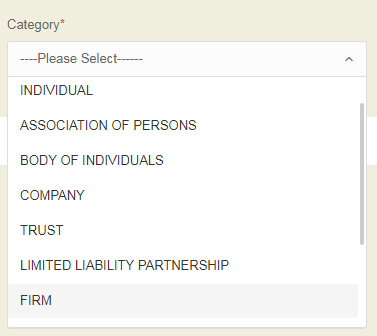

Step 3: Select your category from individual, associations of persons, a body of individuals, etc.

Step 4: Fill in all the required details such as your name, date of birth, email address, and mobile number in the PAN form.

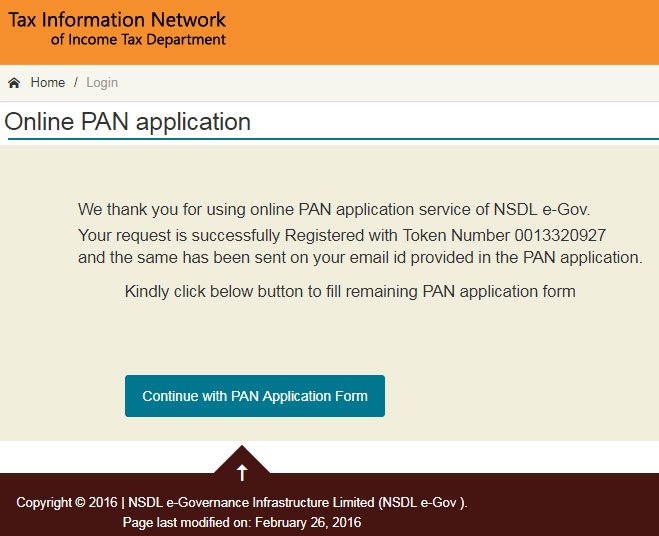

Step 5: After submitting the form, you will get a message that will guide you through the next step.

Step 6: Click on the option that says “Continue with the PAN Application Form”.

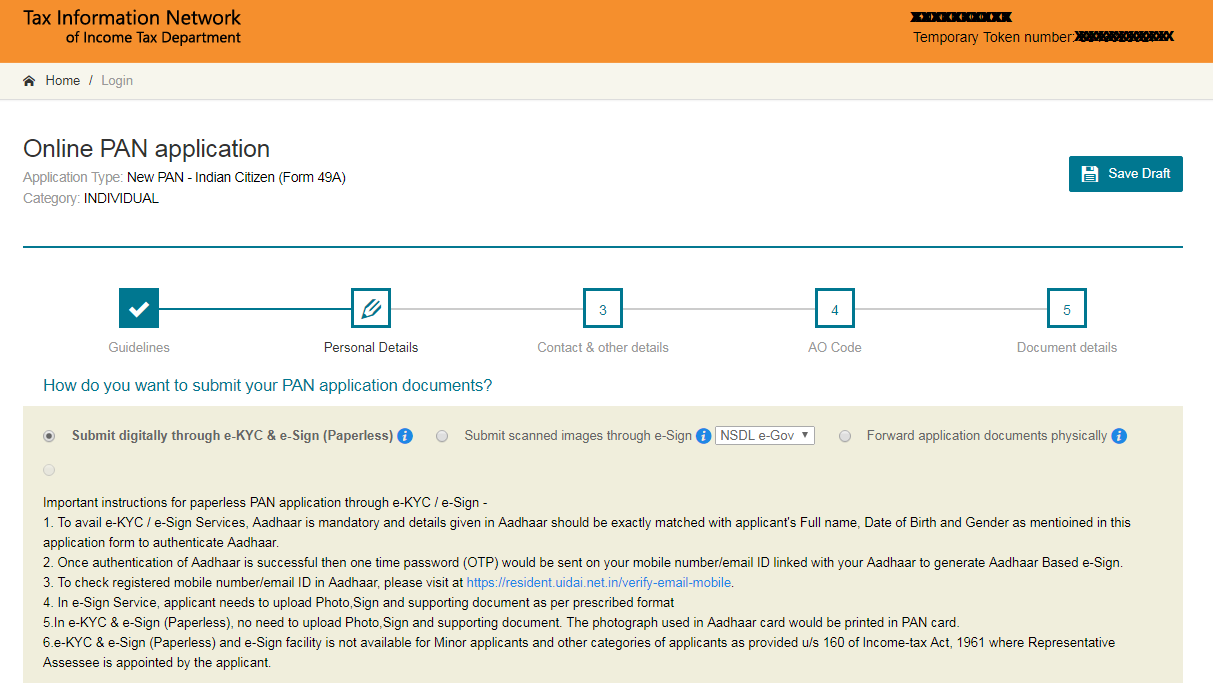

Step 7: You will be redirected to the new page where you have to submit your KYC digitally.

Step 8: Enter the personal details, that they ask for in the next part of the form.

GOLD LOAN @ 0.75%*

APPLY NOW

Step 9: You can then enter your contact and other details.

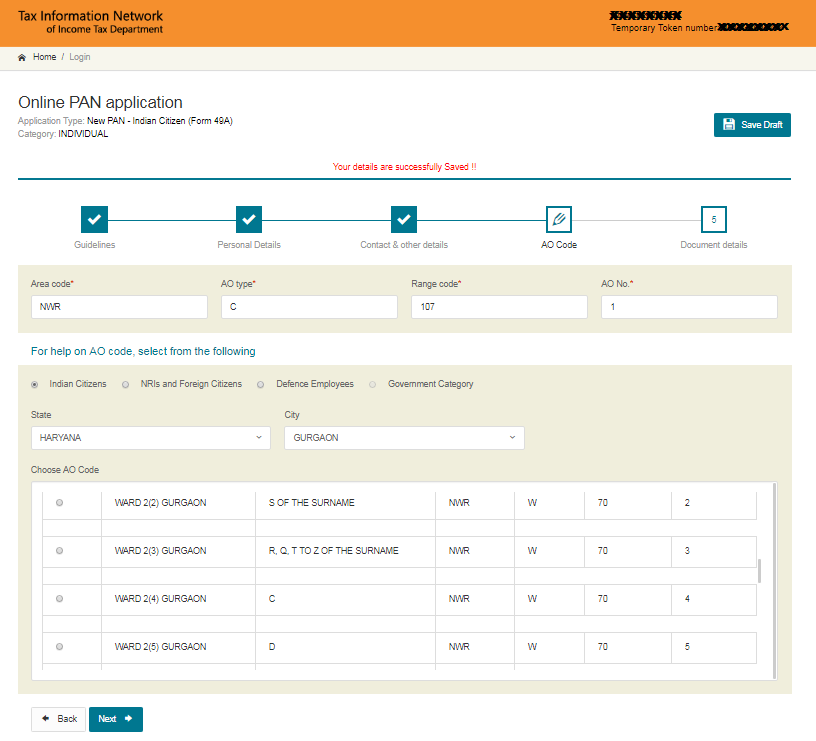

Step 10: Enter your area code, AO Type, and other important details in this part of the form.

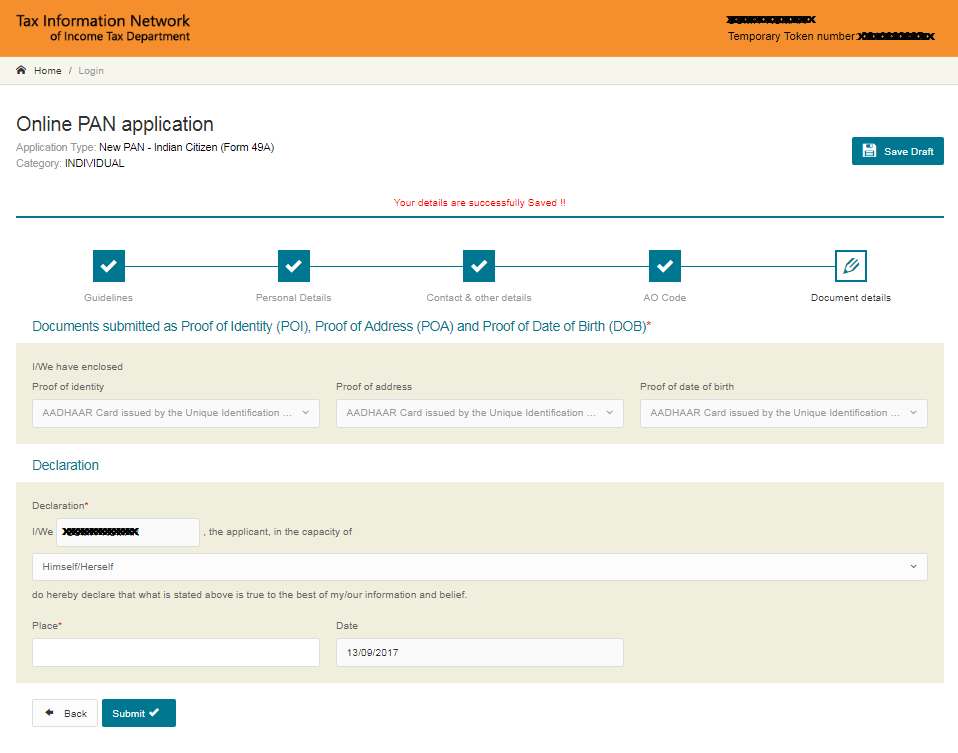

Step 11: The last part of the form is document submission and declaration.

Step 12: Once all of the above is done, you get to see your form and make corrections if any. If there are no changes to be made, click on the Proceed button.

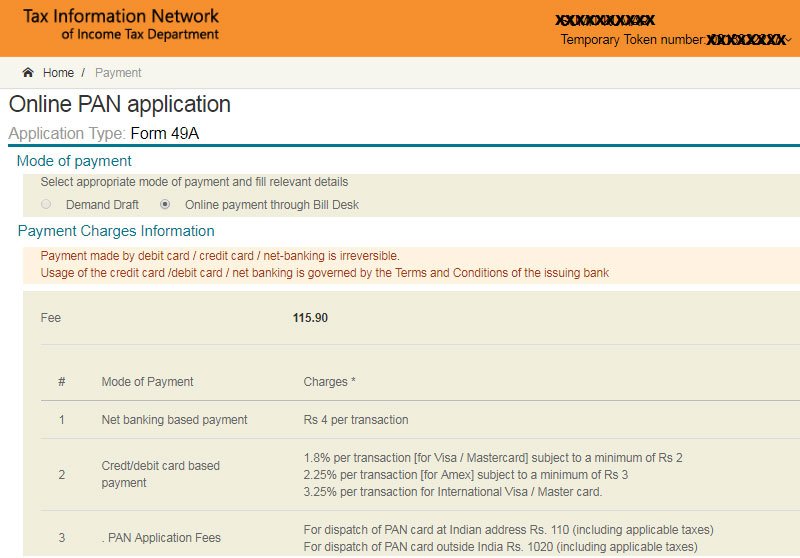

Step 13: You will be redirected to the payment section where you have to make the payment through demand draft or net banking/debit/credit card.

Step 14: Once you make the payment, you will receive the acknowledge form with the 16 digit acknowledgment slip.

Step 15: You can take a print of this acknowledgment form.

Step 16: Attach two recent passport-size photographs signed in the space provided on the form.

Step 17: Enclose all the self-attested documents, and mentioned in the form along with the Demand draft.

Step 18: Post the envelope containing all of these documents to the NSDL address mentioned below.

GOLD LOAN @ 0.75%*

APPLY NOW

PAN Application Form

A PAN Card is needed by an individual to avail of many services and many other tax-related transactions. Owning a PAN Card is not specific to Indian citizens but also to any other foreign individual or entities who are operating in India. For getting a PAN, one has to submit the PAN card application form along with the documents that are required.

The form and other documents needed for applying for the PAN application procedure is different for any Indian citizen and foreigners. Any fake or incorrect details in the PAN card can result in your application being rejected. One should opt for PAN card correction in such a case. A PAN Card can be used as an address or ID proof by anyone.

New PAN Card Forms

Different PAN card forms are available for Indian and non-Indian individuals. The forms are:

| PAN Application Form | Description | Download Link |

|---|---|---|

| 49A | Form for | https://www.tin-nsdl.com/downloads/pan/download/Form_49A.PDF |

| 49AA | Form for | https://www.tin-nsdl.com/downloads/pan/download/Form_49AA.PDF |

The PAN card application form 49A can be used for both applying for new PAN cards and a PAN card correction. The procedures and charges for both, however, are different. For any of the two purposes, you can download the PAN card form in PDF format.

GOLD LOAN @ 0.75%*

APPLY NOW

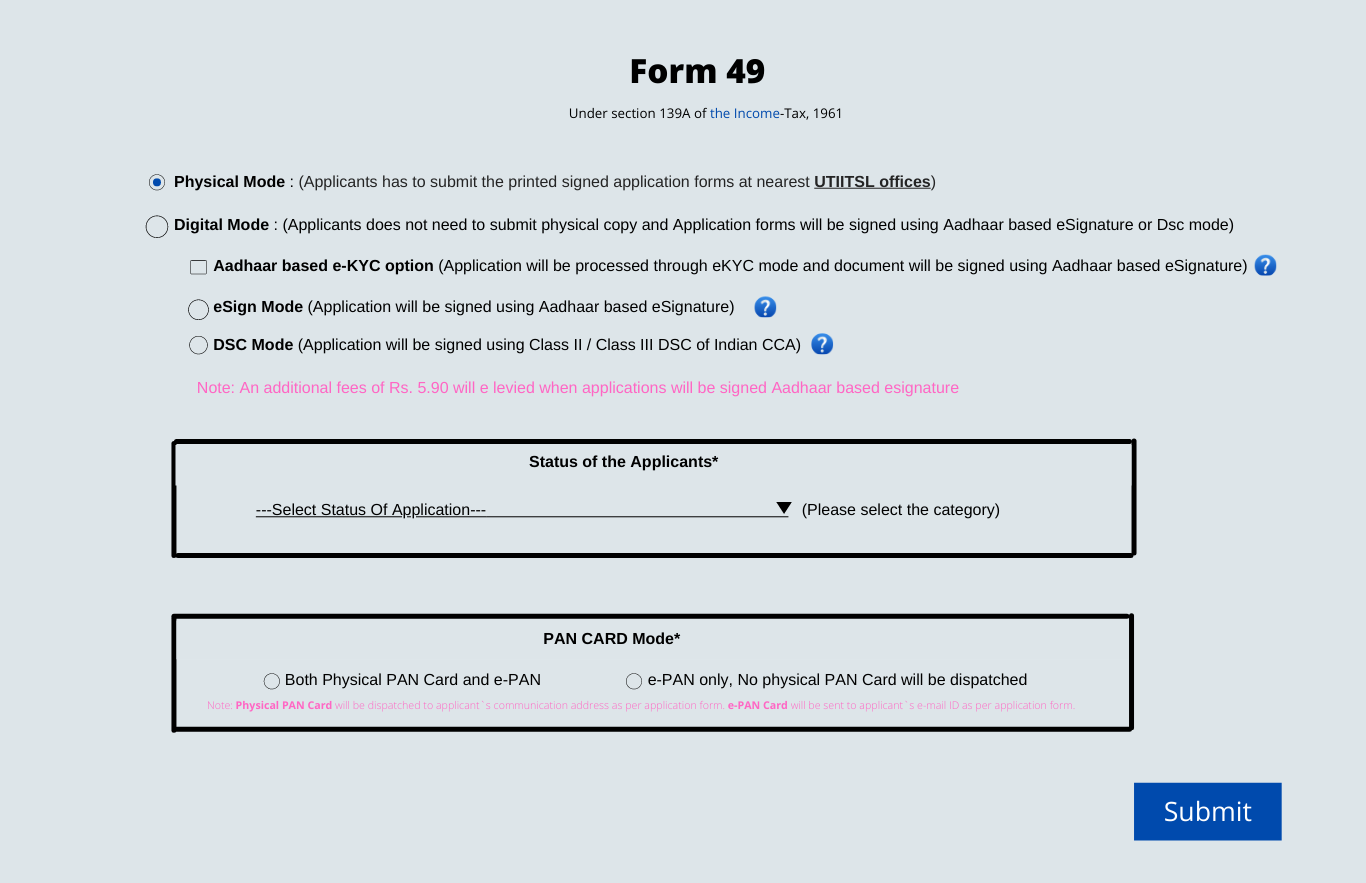

Procedure for Filling Online PAN Card Form 49A / Form 49AA

Both PAN card forms 49A and 49AA work under the 114 section of Income Tax Rules. An individual has to fill in the application form with all correct details and sign the self-declaration that is present at the end of the forms. The contents of the forms are more or less the same, although, there are a few differences between the form for individuals and the form for entities or companies.

To fill a new PAN card form, there are three online procedures, which are listed below.

Steps to download PAN Card Online

Accessing a PAN card application form has been made very easy by the introduction of platforms like a TIN of NSDL and UTIITSL. One can follow these steps and download the forms:

For Physical submission mode

GOLD LOAN @ 0.75%*

APPLY NOW

After providing all the necessary information online, applicants need to collect the form and submit it along with other requirements. Mentioned below is the procedure for the physical submission mode:

Tips to Fill PAN Card Application Form (Form 49A /Form 49AA)

While filling up a new PAN card form or a PAN correction form check the list of dos and don’ts for your benefit and to avoid confusion.

| Do’s | Don’ts |

|---|---|

Fee Charged When applying for a PAN Card

The charges applied for a PAN Card is Rs. 93 (Excluding Goods and Services Tax) for any Indian communication address and Rs. 864 (Excluding Goods and Services tax) for foreign communication address.

GOLD LOAN @ 0.75%*

APPLY NOW

FAQs

✅ What is an application form?

An application form is a form that one has to fill up and submit while applying for something. An individual must fill up form 49A or 49AA depending upon their communication address while he or she applies for it.

✅ What is Pan Card Form 49a?

PAN Card Form 49a is required while applying for a new PAN card or PAN correction. Indian citizens, companies, incorporated and unincorporated entities in India are required to submit form 49a for making the PAN card application.

✅ Where can I get a PAN card application form?

You can get a PAN card application form on the online portal of PAN UTIITSL (https://www.pan.utiitsl.com/panonline_ipg/forms/pan.html/preForm). Enter the required data and receive the PAN card application form via your Email ID. You can also try and get a hard copy of the application form.

- Go to the website of NSDL or UTIITSL.

- Access the form and make the payment.

✅ Is a PAN card free of cost?

No, the PAN card is not free of cost. Applicants must pay the following fees.

✅ Can I get a PAN card in 2 days?

Yes, you can get a PAN card in two days. Generally, PAN cards are delivered within 15 to 20 working days. However, now you can apply for the PAN card on the NSDL website and receive it within two working days.