What is insurance?

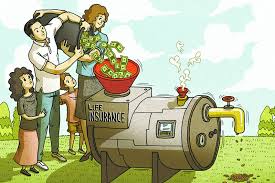

Insurance means a type of protection from financial loss. It is a form of risk management used to cover the risk of an uncertain loss. An entity that provides insurance is known as an insurer or insurance company.

About Insurance

ULIPs have become very consumer-friendly with the introduction of IRDA’s 2010 guidelines. The new guidelines that were supposed to come into effect from October 1 will now be more effective from January 2014. However, those guidelines are not introduced with the same energy.

What is new in guidelines offered by IRDA?

- It ensures a high surrender value for the Insurance policyholders.

- It has reduced the minimum time period.

What is new in the guidelines for Health Insurance?

For Health Insurance new guidelines includes:

- Now 65 is the minimum entry age.

- Now you can renew your policy lifetime.

- There is a provision to change from a group plan to an individual policy.

- The contribution clause to claim the proportionate amount if a person has raised more than one insurance policy has been abolished.

|

Lessons from the Year 2013 |

|

Though IRDA has tweaked the insurance commission, but have reduced the commission on insurance plans. |

|

ULIPs are a good source of investment, but insurers are not selling them due to low commissions. |

|

Group cover will become more useful with the removal of the contribution clause. |

Strategy for the Year 2014:

- Apply for E- Insurance Account: The first and upcoming thing in the coming year is to open an e-insurance account with one of the Five insurance companies approved by IRDA. After doing this, try to convert your life insurance policy into a Demat form.

- Avail Insurance policies at one place: Availing policies at one place will make it easy for you to monitor and transact the policy. No cost is involved for the policyholder.

- The new changes made by IRDA, endowment, and money-back insurance policies are not good source of investment. Even though the surrender value has been raised, on the other hand, the policyholder will lose a lot when a person will lose his insurance policy before the mature period.

- If you want to avoid loosing go carefully before buying an insurance policy.do don’t buy it for useless reasons just to save tax.

- Go for a traditional policy if you have content with 6-7 % returns and you can afford to pay the premium for the entire term period. If you are looking for a tax-free income, make sure the insurance cover is ten times the annual premium you will pay for the cover.

Read More Article with Dialabank

Read Other Related Articles

| Health Insurance | |

| Car Insurance Scams | |

| Bharti AXA Life launches Secure Income Plan | |

| Why Child Insurance is Important? |