How does a CIBIL Score affect you?

The most key areas through which a lending institution generates the necessary revenues are the loan segments. It includes all sorts of secured and unsecured loans like Personal Loan, Business Loan, Auto Loan, and many more.

In recent years, the lending sector has offered various features like easy repayment options and many more. However, with the increase in borrowers, the number of defaulters has also been increased. Defaulters are those people who do not pay their loan EMI’s on time. These days every public as well as a private lender relies on a Credit Score generated by CIBIL before granting the finance.

What is CIBIL Score?

CIBIL is an independent credit rating generating agency that gives full credit information of the borrower applying for the loan. The whole credit history of the borrower is recorded by CIBIL from the member sources like financial institutions, NBFCs, etc. A loan that has not been settled or paid by the borrower yet gets mentioned in the Credit Report. This CIBIL report helps a lender to decide whether to grant the loan to the borrower or not.

CIBIL is an independent credit rating generating agency that gives full credit information of the borrower applying for the loan. The whole credit history of the borrower is recorded by CIBIL from the member sources like financial institutions, NBFCs, etc. A loan that has not been settled or paid by the borrower yet gets mentioned in the Credit Report. This CIBIL report helps a lender to decide whether to grant the loan to the borrower or not.

What does a CIBIL Score report Contain?

A CIBIL report contains the details of all of the borrowings made by consumers in the past. Since the date of the whole report is collected from all of the lenders, thus it also contains the data of any part settlement done by the borrower.

For instance, a credit card company agrees to make a settlement of Rs 50,000 on submission of the amount of Rs 30,000. This will bring in the notice to the lender in the Credit Report.

How does it look like?

This report is like the company’s annual balance sheet. Like a balance sheet doesn’t comment about the financial parameters of the company, a credit report doesn’t tell a lender whether to grant the loan to the borrower or not.

It is a brief overview of the consumer’s credit history. It is the lender who decides to grant the loan to the borrower. This decision purely depends upon the CIBIL report generated from the CIBIL agency.

How to Maintain a Good Credit Score?

A person can ensure clear credit history by making prompt loan repayments on time. He must ensure that the loan repayment will be done by his income account every month in the whole tenure period.

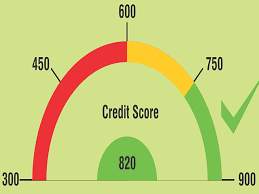

If a person wants to access his credit information, he will need to pay an amount of Rs 450 for credit rating and Rs 142 for credit information. A credit score ranges from a low of 300(unfavorable) to a high of 900(favorable).

Read Other Related Articles:

| CIBIL Marketplace | |

| CIBIL Credit Report | |

| Chit Fund Vs Personal Loan | |

| How to select the best Personal Loan deal? |

Special Note: An individual must examine the whole EMI amount payable to the lender with the Personal loan EMI calculator.