Form 26AS – Income Tax Form 26AS

Income Tax Form 26AS is the consolidated annual tax credit statement issued by the Income Tax Department. It contains information about the taxes deducted on your income by employers and banks, including any tax in advance or self-assessment tax paid throughout the year. Apart from that, it also contains details of any refunds received during the meaningful fiscal year. It is one of the most vital paperwork that you need to submit while filing Income Tax returns.

Purpose of Form 26AS

Form 26AS is a consolidated statement issued under Section 203AA of Income Tax Act and rule of 31AB of Income Tax rules to the Permanent account number(PAN) holders. The form is one of the most important Income Tax documents for a taxpayer.

With this form, a taxpayer is not required to attach a photocopy of the TDS certificate along with his Income-tax return. It is important to check Form 26AS thoroughly before filing Income Tax Return to avoid demand notices and penalty from the Income Tax Department and allow for speedy processing of your return.

26AS Statement and Information

Form 26 AS provides detailed information about all transactions where tax has been deducted by various entities on behalf of the taxpayers. The form also captures details of other taxes paid by you and high-value transactions conducted by you. Form26AS is one of the important forms required at the time of filing an Income Tax Return and is divided into seven parts:

Parts of IT Form 26AS

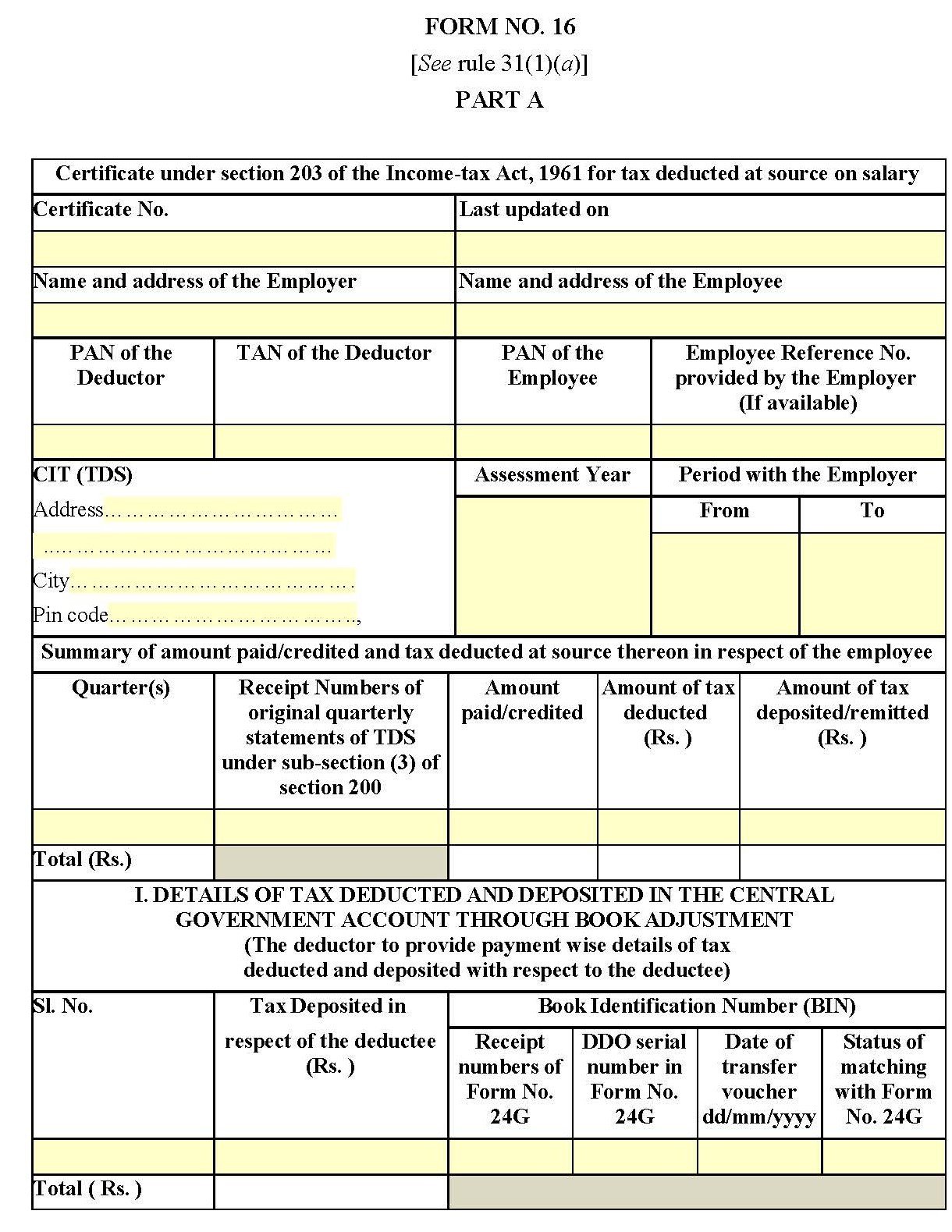

Part 1: Details of Tax Deducted at Source (TDS)

Part A of Form 26AS provides a detailed transaction wise record of tax deducted by various entities on your behalf while making a payment to you. This Section of Form 26AS displays the information in the following format:

| Serial No: | Name and details of the Deductor | TAN of Deductor | Total Amount paid/credited. | Total Tax Deducted | Total Tax Deposited |

Details provided in this section are the name and details of the deductor and the date and amount of transaction and tax deposited/credited with tax booking status. It allows the taxpayer to verify that all deductors have duly deposited tax on his behalf and allows the taxpayer to check with the deductor if he finds any discrepancy.

In case you have a query on any entry in Part A of Section 26AS, you need to contact the deductor for clarification and necessary correction, wherever required and found.

The deductor refers to the entity that has deducted tax on your behalf while making the payment. For each deductor along with his name, the following details are also provided:

Part A has two more sections Part 1A and Part A2, which provide further details on TDS on other transactions.

Part 1A: Details of TDS for Form 15G or Form 15H

There may be a case when your earned income is below the exempted income as per Income Tax Act, or you earn no income during the year, but you have some income from FDs or other savings scheme that attracts TDS. In such a case, to avoid TDS, you are required to submit Form 15 G (in case of taxpayer below 60 years of age) or Form 15H (in case of senior citizens) with your bank.

Once you submit Form 15G or Form 15H, you are exempted from paying TDS, and the information will emerge in Part 1A of Form 26AS. The section captures the same details as those captured in Part A of Form 26AS. For any discrepancies, you should contact the buyer or deductor for necessary correction.

Part 1B: Details of TDS on sale of immovable property (in case of the seller of property)

The form includes the details of Tax Deducted at Source (TDS) on sale of immovable property under section 194 (IA) of the Income Tax Act. Details included in this section are extremely useful for the seller of a property as proof that accurate TDS has been deducted and deposited. The details captured are the same as those captured in other parts of the Form. For any discrepancies, you should contact the deductor for the necessary correction.

Part 2: Details of Tax Collected at Source (TCS)

Part 2 of the form furnishes information on Tax Collected at Source (TCS) by the seller of specified goods that have been sold. It is an income tax taken by the seller from the buyer/payer on the sale of certain goods. Details in this section include information on the collector of tax and tax collected:

For any discrepancies, you should contact a collector for necessary correction.

Part 3: Details of tax paid other than TDS or TCS

Part 3 displays the details of advance tax and self-assessment tax paid by you other than TDS or TCS. It also furnishes the details of the challan through which you have deposited the tax in the bank. The section provides information on

In case of problems/issues between the amount deposited by you and the amount displayed in the Form, you need to contact the assessing officer or concerned bank for necessary clarifications.

Part 4: Details of paid refund

This section shows the details of a tax refund received by taxpayers. The information provided includes the assessment year for which the refund is being made, along with the details of the mode of payment, the amount paid, interest paid, and date of payment if you need to contact the assessing officer or ITR-CPC for necessary clarification and correction in case of any discrepancy.

Part 5: Details of AIR (Annual Information Return) transactions

This part of the Form is the Annual Information Return of high-value transactions. As per section 285BA of the Income Tax Act, tax filers who have made any high-value transaction during the financial year must furnish a statement of such transactions to the tax authority. The information is provided for transactions such as mutual funds, a cash deposit of ₹ 10 Lakh or more during the financial year, high-value corporate bonds, property purchases etc. The information included in the section is:

The last acceptable date for filing Annual Information (AI) return by specified entities (Filers) is 31st August, immediately accompanied by the fiscal year in which the transaction is recorded. The transaction amount is the total amount reported by the AIR filer and does not reflect each individual’s respective share in the joint party transaction. In case of discrepancies between the amount deposited by you and the amount displayed in the Form, you need to contact the concerned AIR Filer for necessary clarifications.

Part 6: Details of tax deducted on sale of immovable property under section 194IA (in case of the buyer of property)

This part of the form displays the details of Tax Deduced at Source (TDS) on sale of immovable property under section 194 (AI) of the Income Tax Act. This section of the form provides a record of tax transaction for the buyer of the property. In case of discrepancies between the amount deposited by you and the amount displayed in the form, you need to contact NSDL or the concerned bank branch for required clarification and correction.

Part 7: Details of tax defaults (includes processing of defaults)

The information about the tax defaults (if any) is displayed in this section of Form 26AS. Defaults relate to the processing of statements and do not include any demand raised by the respective Assessing Officers. Details included in this Part of the Form are:

You should contact the deductor for required clarification and correction if there is an issue.

How to View and Download Form 26AS?

You can view and download Form 26AS from the official portal of TRACES or through the net banking account if your PAN is linked with your bank account.

Here is a step-by-step wise guide to view and download Form 26As through the e-Filing portal.

The process to view Form 26AS.

Form 26AS- Points to Remember.

Dialabank provides you with all the required information about the IT form 26AS in the simplest format.

FAQs about the IT Form 26AS

✅What is Form 26AS?

It is the annual tax credit statement issued by the Income Tax department for every taxpayer. It contains a detailed report about the taxes deducted against your income by employers, banks, including any advance tax or self-assessment tax paid during the year. It also states details of any income tax refund received from the tax department during the relevant financial year.

✅How can I see my form, 26AS?

Form 26AS is available on the official portal of TRACES; you can view and download the form from there. Else, if your PAN card is linked with the bank account, you can see the tax credit statements through your net banking account. However, there are limited be registered with NSDL to providing a view of the Tax Credit Statement. You must view the list of these banks to download Form 26AS through your net-banking account.

✅Who will provide Form 26AS?

The Income Tax department keeps everyone taxpayer’s record about the details of tax paid and refunds received against the income for a financial year. You can view and download Form 26AS from the income tax department’s official website or through the net-banking account of your bank to check the record of income tax statement provided by the Income Tax department under section 203AA of the Income Tax Act.

✅Why do we need Form 26AS?

We need Form 26AS because it provides proof that tax has been deducted and collected on our behalf. Further, it confirms that employers and banks have deducted the accurate taxes on our behalf and deposited them into the government’s account.

✅What is Form 26AS TDS?

The information provided in Part A of Form 26AS contains details of TDS ( Tax deducted at source) deducted on your salary, interest income, pension income etc. If you have provided the form 15G/H, if your income is not eligible for TDS, you can track the status using Form 26AS TDS.