Multiple Debts

With the continuous empathize on the competition by different policies and liberalization of the economy. Indian consumers now have better access to the vast array of dazzling products present in the world.

Whether it is the latest LED television, smartphone, luxury car; these products are available in India at the same time as they are introduced in the developed countries too.

With the easy availability of loans in the form of Personal Loan and others has fueled the consumerism to buy everything they desire. One can make payments for these products if he cannot afford these products with his monthly income.

Many consumers find themselves stuck in a sticky situation due to rising costs of consumer durable items and their high financial charges. Though the Emi related to Unsecured Loan is very smaller, but these loans can add a lot of pressure in the form of debt that has to be paid in the specified period of time.

The Personal Loan Interest Rates vary from 14 % to 16 % making these debts very expensive in the loan market. If you have multiple loans and credit cards running from different lenders, it may be quite difficult for you to track all of the loans at the same time. If a person is not able to pay all of the loans on time, he can look up for debt consolidation.

What does it involve?

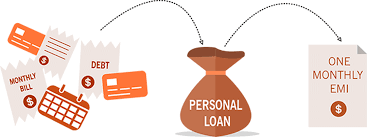

Debt consolidation is simply and basically an act of combining different loans into one loan. It involves taking out a new loan to pay off other pending loans and debts. It can be attained at a lower interest rate with greater ease in the repayment of a single loan rather than paying off multiple debts.

Under this scenario, one can easily gain Loan Against Property. It is an ideal consolidating financial aid that can be availed at a lower interest rate and longer tenure periods. Thus, it includes lower EMI’s which enables a consumer to pay off the debts easily.

How does It work?

A person can avail Loan Against Property by mortgaging his personal or commercial property to the bank. A person can attain about 70 % loan amount of the property provided. This loan is unsecured in nature that is backed up by some sort of security.

Have a systematic Plan:

When a person decides to consolidate different debts from Lap it would be wise to follow a systematic plan. It should be followed in a disciplined manner.

Special Note: An individual must examine the whole EMI amount payable to the lender with the Personal loan EMI calculator.

Disclaimer: The information provided on www.dialabank.com is collected from public sources and is believed to be accurate and genuine. This site should be used as an information provider for different product offerings of Insurance companies and the visitor should make an independent verification with the Insurance companies to verify the claims made in the policy before making any purchase. The decision to Apply and/or Purchase a policy is at the sole and complete discretion of the website visitor and Dialabank.com cannot guarantee or can be held liable for loss or damage caused by claims made by insurance companies through their agents, partners, products or services, directly or indirectly.

Read Other Related Articles:

| Maruti Suzuki Launches Baleno on January 27 2015 | |

| No Credit Check Personal Loan | |

| Meet your financial requirements with a Personal Loan | |

| Mortgage Faults | Loans for Professionals |