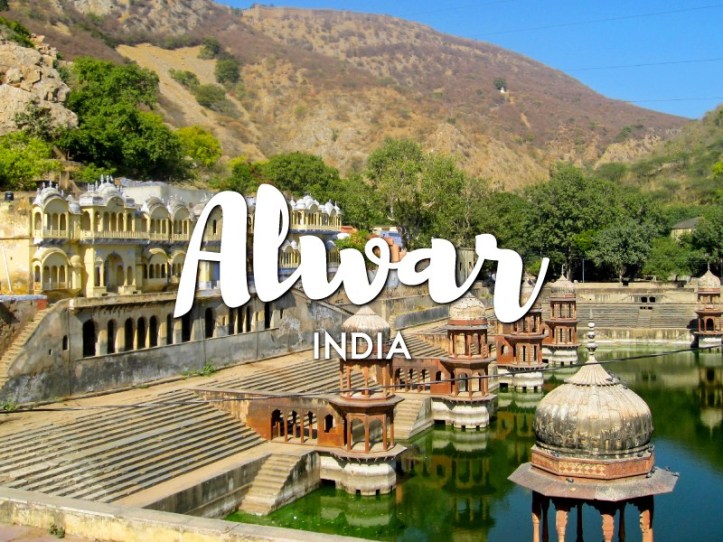

About Alwar

Alwar is a city in the National Capital Region of India, situated 150 km south of Delhi and 150 km north of Jaipur, and is the administrative headquarters of the Alwar District in Rajasthan State. Alwar is a tourism hub with many forts, dams, Havelis and nature reserves, including the Bhangarh Fort, the Sariska Tiger Reserve and Lake Siliserh.

You have reached the right place if you want a credit card in Alwar.

Top 5 Banks That Offer Credit Cards In Alwar

State Bank of India

- SBI Advantage Signature Credit Card: This credit card can be used internationally in ATMs, and this international visibility makes it the ideal source for a frequent traveller to gain international travel privileges.

- Yatra SBI Card: The Yatra SBI Card is suitable for frequent travellers as it offers several travel benefits in order to provide a comfortable and affordable travel experience.

Citibank

- Citibank ® Rewards Card: As the name suggests, this credit card is incredibly rewarding. You can earn up to 10 reward points for every Rs. 125 spent on your card at select partner shops. The best part of it is that the accumulated reward points never expire.

- Citi PremierMiles ® Credit Card: This is a travel-centric credit card from Citi Bank. If a total expenditure of Rs 1,000 is met within the first 60 days of card issuance, users will receive 10,000 miles as a welcome gift.

Axis Bank

- Axis Bank Buzz Credit Card: The Buzz Credit Card was introduced by Axis Bank exclusively for online purchasers. The card gives a Flipkart exclusive discount and extra loyalty points on all online orders.

- Axis Bank Privilege Credit Card: For regular travellers, the Axis Bank Privilege Credit Card is intended. You can get free lounge access, travel and hotel vouchers, among many other benefits. In all categories, the card offers generous rewards too.

Standard Chartered Bank

- Standard Chartered Manhattan Platinum Card: This card is the perfect fit for both shopaholics and frequent flyers. You will get up to 20 per cent off when you rent a car on mylescars.com.

- Standard Chartered Super Value Titanium Card: As the name suggests, the Super Value Titanium Credit Card by SCB gives exciting value back every time you use your card to pay utility bills or when you get a fuel refill in your vehicle.

Bajaj Finserv

- Bajaj Finserv Doctor’s SuperCard: Offers professional compensation insurance of up to Rs. 20 Lakh. 1 loyalty point, 2X reward points on all online spending are given for every Rs.100 spent offline, with the exception of online transactions made on education, insurance, utilities, etc.

- Bajaj Finserv Shop Smart SuperCard: It offers cashback worth Rs. 500 (on spending Rs. 2,000 in the first 30 days & paying to join fees) and also 5 per cent cashback up to Rs. 250 a month on grocery transactions.

Looking for Bank Branches where you can get information on Credit Card Alwar

Bank Name |

Address |

| Kotak Mahindra Bank | Nagli Cir, Sector 7, Alwar, Rajasthan 301001 |

| YES Bank | Scheme No 2, Ground Floor Plot No 29, opposite Private Bank, Lajpat Nagar, Alwar, Rajasthan 301001 |

| Axis Bank | Jai Complex, No 1, Jay Marg, Alwar, Rajasthan 301001 |

| Private Bank | Vijay Mandir Road, B-12, Ground Floor, Arya Nagar, Scheme 1-A, NR Bhagat Singh Circle, Alwar, Rajasthan 301001 |

| HDFC Bank | 2, Bank Bldg, Matsya Ind Area, Alwar, Rajasthan 301030 |

Why Apply Online or Choose Dialabank for Credit Card Alwar:

- Proper availability of a card in a limited period of time

- The least online documentation of applications accessible to current customers

- Get Instant E-Approval by Dialabank.

How you can get credit cards with Dialabank in Alwar in just three easy steps:

- A short overview of qualifications

- Fill in Online Full Application

- Get Instant E-approval in virtually no time

Which are the credit cards available in Alwar for Customers?

- Travel Cards

- Reward Cards

- Regular Cards

- Premium Cards

- Fuel Cards

- Cashback Cards

- Entertainment Cards

How you can pay for credit cards payments or payment options?

Through the net banking of a specific bank, Auto Pay, through fund transfer, mobile banking, through cheque or dropbox, and so on, through these methods, a charge card customer in Alwar may make instalments without much of a stretch.

Eligibility Criteria for Credit card Alwar:

- Minimum age of 21 years is required for salaried or self-employed individuals.

- Maximum age of 65 years is required for salaried or self-employed individuals.

Required Income Criteria for Credit Card Alwar:

It is appropriate or depends on credit card requirements for a minimum income of Rs.15000 per month; high-end cards need more monthly income & a very good cibil score.

FAQs Credit Card Alwar

✅ Can I apply for Credit Card Alwar online?

You can, certainly, legally apply online for a credit card. To confirm your qualification and fill out your data within the forms given in a fair framework, you can only visit the Dialabank site.

✅ Why You Should Have A Credit Card Alwar?

In addition to offering ease of use, for the following reasons, having a credit card is essential:

- Helps hold a nice credit score

- Up to 45 days after the credit interest-free cap

- Online and offline Hassle-free transactions

✅ What are the choices for credit card Alwar bill-paying available?

- Payment by cheques

- Pay by online banking for your credit card bill, such as NEFT / RTGS / EPAY / VMT (from other bank accounts)

- Cash deposit/cheque deposit during banking hours at ATM / Bank

✅ Do all credit card Alwar require an annual fee and a membership fee?

Actually, no, not all of the cards include both an annual membership fee and expenses. There is normally no annual expense for essential credit cards, but cards with an annual payment also offer a greater range of advantages than zero annual charge cards.

✅ Will my credit card Alwar limit rise at a later time?

Credit limits are updated every once and a while by the card’s guarantor. This typically takes into account your prior payment history, but your limit can also be reduced if you missed a few instalments on past bills.

✅ What is a secured credit card?

One that is issued against a fixed asset, a home, a state, is a secured credit card. For individuals who can not get an ordinary (unstable) identity, this may be a positive beginning.

✅ Does credit card Alwar come with specific limitations for cash withdrawal?

At the credit card recognition hour, the cash withdrawal/advance cutoff on your card is pre-set and announced.

✅ What is the transfer of credit card Alwar balances?

The ability to move overdue balances to different accounts, combine obligations and reimburse EMIs for some credit cards is granted.