Axis Bank Gold Loan Key Features – Apply Now

| Axis Bank Gold Loan Interest Rate | Starting 7.25% per annum |

| Axis Bank Gold Loan Per Gram | Axis Bank Gold Loan Per Gram Today is ₹ 3,800 to ₹ 4,350 |

| Axis Bank Gold Requirement | Minimum 18 Carat |

| Axis Bank Gold Loan Processing Fee | 1% of the Principal Loan Amount |

| Axis Bank Minimum Loan Amount | 90% LTV on Your Gold Market Price |

| Axis Bank Maximum Loan Amount | Up to Rs. 1 Crore |

| Axis Bank Prepayment Charges | 2%+GST (Within 3 Months), 0 (After 3 months) |

| Axis Bank Repayment Tenure | 6 Months to 36 Months |

| Axis Bank Gold Loan Schemes | Bullet Payment Scheme, EMI Scheme |

Axis Bank issues a Gold Loan per gram rate of ₹ 3,506 to ₹ ₹ 3,800 to ₹ 4,350 .

Introduction to Axis Bank Gold Loan

Axis Bank is one of the reputable names in the private banking sectors. We have retained the trust of our customers and keep them a priority. Axis Bank Gold Loan provides various schemes. It is not necessary to be an Axis Bank customer for availing a GOLD Loan. We have low interest rates and higher tenure periods. Your Gold Loan can get approved within few hours of application. Document verification and Purity Test of Gold are two important steps in Gold Loan approval. While submitting an online application for Gold Loan, our representative will call you and schedule an appointment for a bank visit. At Axis Bank, Gold Loan can get approved in a single bank visit.

Axis Bank Gold Loan Explanation

Axis Bank gold loan can be availed to meet an urgent need for cash by pledging one’s gold ornaments or gold coins as collateral. A Gold loan is one of the quickest and easiest ways of borrowing money and can be availed by any existing customer of the Axis Bank as well as new borrowers. With Axis Bank, you will not only be able to avail the gold loan easily but it will also be at a competitive interest rate.

Axis Bank Gold Loan Details

Loan Purpose – The loan sum can be used to meet immediate financial needs such as higher education, marriage, medical emergencies, or other pressing financial needs.

Quantum of loan– Axis Bank gold loans are available in amounts ranging from Rs. 25,001 to Rs. 25 lakh.

Repayment Period – The repayment period begins at 3 months and will last up to 36 months.

Axis Bank Gold Loan Interest Rate – The interest rate on an Axis Bank gold loan begins at 12.5% per annum. Axis Bank’s gold loan rates are determined by its MCLR.

Axis Bank Gold Loan per Gram – The rate for an Axis Bank gold loan per gram will be communicated at the time of application.

Gold Items – A gold loan will be granted in exchange for gold ornaments and coins. The pledged gold products are stored in a secure location.

| Classification | Charges |

| Processing Fee | 1% + GST |

| Insurance Charges or Valuation fee | Rs 500 + GST |

| Pre-Payment Charges | Nil |

| Foreclosure Charges |

|

| Penalty | 2% p.m on the overdue amount |

GOLD LOAN @ 0.75%*

APPLY NOW

What type of Gold can use to Secure A Gold Loan?

A Gold loan can be secured by gold valuables which can be in form of jewellery, coins, statues, etc. A Bank accepts gold ornaments weighing more than 50 grammes and weighing 18 to 24 carats. The Gold loan is approved on the market value of gold which you are keeping as a mortgage.

Tips To Get Gold Loan From Axis Bank Fast

- Axis Bank accepts both hallmarked and non-hallmarked jewellery in exchange for money. However, you can get the highest gold loan per gram for any hallmark jewellery, because it reduces the chances of under-valuation by the valuer.

- Axis Bank can adjust the price of 22-carat gold for the purity of gold. Therefore, one should also try to borrow against jewellery of higher purity because it fetches the highest amount for a gold loan.

- Axis Bank will calculate the net weight of the jewellery to calculate the amount of loan against the gold you can get. You can always try to choose jewellery that has minimum gems and stones. Most of the banks will reduce the weight of gems and stones from the total weight of the jewellery. But Axis Bank will rely on the report of its gold valuer to calculate the net weight. Higher the weight of gems and stones in jewellery, lower the net weight and value of jewellery which results in a lower amount of jewel loan you can are eligible to get.

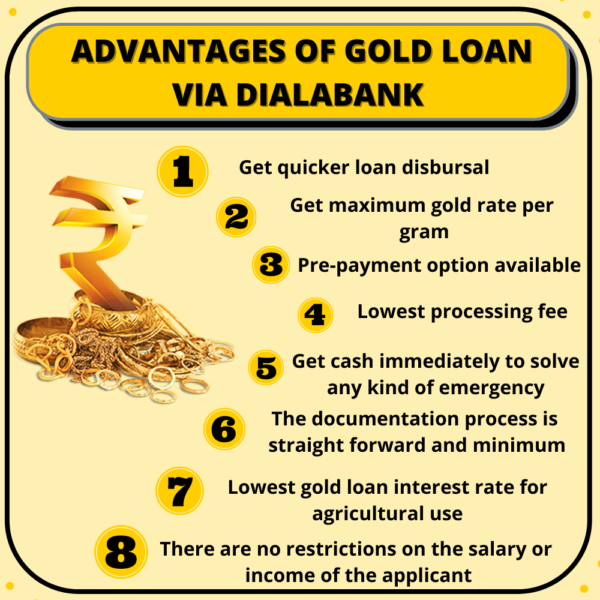

Advantages Of Axis Bank Gold Loan

- You can use a gold loan to fulfil any of your requirements, whether it is related to your business or home, education, or agricultural activities.

- A gold loan is approved very quickly if you are eligible.

- If you have all the documents, your loan is disbursed on the same day.

- There is no need to worry about your credit score, it’s ok if your credit score is not that good. You will still get a gold loan because the CIBIL score is not a requirement for loan approval.

- The Gold Loan Interest Rate is quite low as compared to other loans.

- A gold loan is very easy to apply to. One can easily apply for a gold loan online within 5 minutes. Besides that, before applying for a gold loan, you can get all the information about the rate of interest and EMI’s online.

- There is one more point that if you have gold that you should make use of your gold to overcome your financial problems.

- In a gold loan, your ornaments will be kept in tight security. On the other hand, if you want to put your gold in the locker, you will have to pay the locker charges to the bank. Whereas, the bank won’t charge anything from you as security charges.

- As the bank takes care of the security of your gold but still in case any miss-happening bank will be responsible.

- Axis Bank charges up to 0.50% of the principal amount as Foreclosure charges.

How Much Loans Can I Get Through Axis Bank Gold Loan?

As per the most advanced gold prices, Axis Bank offers a gold loan per gram today of ₹₹ 3,800 to ₹ 4,350 . The highest Axis gold loan rate per gram now is 7.25% per annum for 22-carat jewelry calculated at a maximum LTV of 75% and average gold loan rates of the last 30 days in 2021 are ₹ 5121 of 22 carats.

Axis Bank Gold Loan Per Gram

Axis Bank Gold Loan Per Gram Rate Today – Apr 27 2024

GOLD LOAN @ 0.75%*

APPLY NOW

The bank also charges some additional fees along with the rate of interest in some cases, which are :

- Processing fee – 1% of the loan amount or ₹1000 whichever is higher.

- Documentation charges.

- Gold Valuation charges.

- The bank charges no additional fees for part payment or the foreclosure of the Gold Loan.

Gold Loan Apply Online

This is the best way to avail of a Gold Loan, as the applicant does not have to bother to find the branch; in fact, the branch reaches the customer itself. This means the applicant can avail of the best deal at the comfort of your home. Follow the following steps to do so:

- Hit our online website Dialabank.

- Fill an application form with all the needed areas.

- You will be reverted by our Contact administrator to assist throughout the entire process.

- You will have to present documents to the bank.

- Your loan will be appreciated in just a few minutes.

- Apart from the above process, you can undeviatingly call us at 9878981144.

GOLD LOAN @ 0.75%*

APPLY NOW

Benefits Of Axis Bank Agricultural Jewel Loan Scheme

- Axis Bank does not charge a huge processing fee.

- For 0.30% of the loan amount, a Minimum of ₹ 300 is charged ranging from more than ₹25,000 – less than ₹ 5 lakh.

- 0.28% of the credit sum, subject to at least Rs.1,500 applicable on more than Rs.5 lakh and less than Rs.1 crore.

- Best Interest Rate On Jewel Loan is provided by Axis Bank

Axis Bank Gold Loan Overdraft Scheme

In Axis Bank Gold loan, the loan amount is provided as an overdraft facility. It works as a Credit Card, where the Gold Loan Amount can be spent as per the choice of the borrower. The overall loan amount has a Credit/Loan Limit. In the Axis Bank Gold Loan Overdraft facility, the interest is charged only on the amount that is withdrawn/utilize.

GOLD LOAN @ 0.75%*

APPLY NOW

How Does Axis Bank Gold Loan, Here’s An Example

The suitability of the gold loan is determined based on the purity of gold, LTV, and its weight. Suppose Mr A and his two friends Mr B and Mr C have different gold values for different purity. Mr A has 50 grams of gold per 22-carat purity. Mr B has 60 grams of gold in 20 carats of purity and Mr C has 70 grams of gold in purity or 22 carats. They approached the Axis Bank to get a gold loan. The price used to calculate the suitability of their gold loan according to the high 85% LTV will vary with the purity of the gold and therefore, will lead to the validity of the gold loan.

Applying Through DialaBank Website?

You can apply for Gold Loan by just visiting the Dialabank website and choosing from several loan options. The online process of applying for a Gold Loan is quite an easy and time-saving process. You are provided with several options for checking various bank’s eligibility and Gold Loan EMI Calculator. It’s always wised to compare and take the best deal and we help you with that.

You can apply For a Gold loan by following these simple steps-

Step 1- Visit Dialabank official website and fill in your personal details and basic information related to the loan.

Step 2- A representative from Dialabank will call you shortly and guide you through the Gold Loan process and verify the Gold Loan eligibility factors and requirements for the loan.

Step 3- Our representative will notify you about the eligible lenders for you and about several Gold Loan offers.

Step 4- If you are eligible and willing, our representative will schedule a branch visit with the bank.

Step 5- You should submit the relevant documents and gold jewellery to the branch to be mortgaged. The gold loan lender will determine whether to sanction or deny your loan after the documents are checked and the eligibility conditions are met. If the loan is approved, you will receive a sanction letter outlining the main loan terms, such as the interest rate, processing cost, tenure, and prepayment penalties, etc.

Step 6- The bank will safeguard your Gold as per the RBI guidelines and the approved loan amount will be credited to your bank account in a short while.

GOLD LOAN @ 0.75%*

APPLY NOW

✅ How Does Axis Gold Loan work?

The Axis Bank gold loan is a very simple scheme in which the bank provides you with funds against your gold ornament. The amount depends upon the gold weight. Once the jewellery is valued the loan amount is disbursed instantly.

✅ What is the Axis Bank Gold Loan interest rate?

The Axis Gold Loan Interest Rate is 7.25% per annum

✅ How to check gold loan status in Axis Bank?

You can check your Axis Bank Gold Loan status online by visiting the Bank’s online portal and logging in with your personal details.

✅ How to calculate Axis Bank Gold Loan Rate of Interest?

You can calculate your gold loan interest rate in Axis Bank by subtracting the principal amount from the total amount to be paid.

✅ What is the maximum gold loan amount I can avail of on a gold loan from Axis Bank?

The maximum gold loan amount that you can avail of on a gold loan from Axis Bank is Rs 50 lakh. The bank offers a loan amount of up to 75% of the gold jewellery’s value.

✅ What is the loan tenure of the Axis Bank gold loan?

The loan tenure of your Axis Bank gold loan usually ranges from 6 months to 36 months.

✅ How much processing fee applies to the Axis Bank Gold loan?

A processing fee of up to 1% is applicable on the Axis Bank gold loan.

✅ What are the charges for pre-payment in Axis gold loan?

The charges of pre-payment in Axis Bank gold loan is up to 2% of the outstanding loan amount.

✅ How to renew Axis Gold Loan?

You can renew your Axis Bank Gold Loan by visiting the nearest branch with all your loan documents. The gold submitted will be taken out for a revaluation based on current market gold rates. You will then be required to fill in a renewal form, and once everything is processed, a small renewal fee will be charged, and your loan will be renewed for a new tenure.

✅ How to pay Axis Gold loan interest online?

You can pay the Axis Gold loan interest online using online payment options available like net banking, debit cards, mobile apps, etc.

✅ What if I can’t pay the interest on the Axis Bank Gold loan for 3 months?

If you cannot repay the Axis Gold loan interest amount for 3 months, the bank will charge you with penal interest. In case of continuous defaults, the Bank might even sell your gold ornaments kept as a security for the loan.

✅ How can I apply for an EMI moratorium on the Axis Gold loan?

You can apply for EMI Moratorium on Axis Bank Gold loan online by logging in with your credentials or can also visit the bank personally. You have to submit the moratorium request with the bank a minimum of 5 working days before your EMI payment’s due date.

✅ How to pay Axis Bank Gold loan through credit card?

The Axis Bank Gold loan cannot be repaid through credit cards as per RBI Guidelines.

✅ What is the Overdraft Scheme for Axis Bank Gold Loan?

Axis Bank’s Overdraft Scheme has a Credit/Loan Limit. Axis bank charges interest on the amount withdrawn/utilized.

✅ What is the Axis Bank Gold Loan closure procedure?

The Gold loan will automatically close after the payment is done in full.

✅ What is the Axis Bank customer care number?

9878981144 is the customer care number. You can also call this number for any Axis Bank Gold Loan details.

✅ What are Axis Bank Gold Loan Preclosure charges?

The Bank preclosure charges are 2%+GST (Within 3 Months), 0 (After 3 months).

✅ What is the maximum gold loan tenure?

The maximum gold loan tenure is 36 months.

✅ What are Axis Bank Gold Loan Foreclosure charges?

Axis Bank charges up to 0.50% of the principal amount as Foreclosure charges.

✅ What is the minimum gold loan tenure?

The minimum gold loan tenure is 6 months.

✅ What is Axis Bank Gold Loan Rate Per Gram?

Axis Bank Gold Loan Per Gram Today is ₹ 3,800 to ₹ 4,350

✅ What are the foreclosure charges of the Axis Bank Gold Loan?

Axis Bank charges a borrower up to .50% on the principal amount in case of a Gold Loan Foreclosure.

News About Axis Bank Gold Loan

10 banks offering the lowest gold loan interest rates starting at 7.35%

Axis Bank provides an interest rate of 7.25% per annum with a loan tenure of 6 months to 36 months.

Axis Bank offers EMI deferment on loans for 3 months

Axis Bank has informed that the repayment would resume from June 2020, once the deferment period is over. The private lender has also advised borrowers whose cash flows are not impacted to opt out from the moratorium by sending an email.