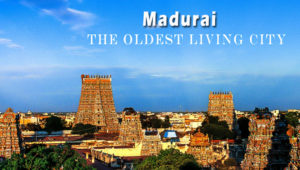

About Madurai

In the Indian state of Tamil Nadu, Madurai is a major city. It is Tamil Nadu’s cultural capital. With the Meenakshi Temple and the Tirumalai Nayak Palace being the most famous, the city has a number of historical monuments. In South Tamil Nadu, Madurai is an important industrial and educational centre. You have to get to the right place if you are in town and you want a credit card. Now you can easily apply for a credit card online with Dialabank.

In the Indian state of Tamil Nadu, Madurai is a major city. It is Tamil Nadu’s cultural capital. With the Meenakshi Temple and the Tirumalai Nayak Palace being the most famous, the city has a number of historical monuments. In South Tamil Nadu, Madurai is an important industrial and educational centre. You have to get to the right place if you are in town and you want a credit card. Now you can easily apply for a credit card online with Dialabank.

Top 5 Banks That Offer Credit Card Madurai

State Bank of India

- SBI Platinum Credit Card: This card provides advantages, as you get a welcome bonus voucher for INR.3000 when you sign up for this card. For investments in supermarkets, international travel, restaurants etc., you can receive reward points.

- SBI Advantage Signature Credit Card: This credit card can be used internationally in ATMs, and this worldwide recognition makes it an ideal source for a frequent traveller to gain international travel privileges.

Axis Bank

- Axis Bank Vistara Credit Card: The Axis Bank Vistara credit card is recognised in different categories for the benefits it provides. The card also offers you 15 per cent on your dining costs, in addition to having air insurance. You will get 1,000 Vistara points upon activation, which can be redeemed.

- Axis Bank Privilege Credit Card: For the regular traveller, the Axis Bank Privilege Credit Card is planned. Among several other advantages, you can receive complimentary lounge access, travel and hotel vouchers. The card provides generous incentives in all categories as well.

HDFC Bank

- HDFC Visa Signature Credit Card: A luxury card that provides the cardholder with profound benefits is the HDFC VISA Signature Credit Card. It provides benefits such as the waiver of fuel surcharges, access to premium airport lounges and insurance cover.

- HDFC Bank Solitaire Credit Card: The HDFC Solitaire Credit Card is tailored for women and comes in all categories with a variety of rewards. Among other incentives, consumers earn shopping coupons, accelerated reward points for dining and grocery shopping.

Bajaj Finserv

- Bajaj Finserv World Prime SuperCard: As a welcome gift and a milestone gain of 10,000 bonus reward points on achieving annual spending of Rs. 1.5 lakh, the Bajaj Finserv World Prime SuperCard provides 12,000 reward points

- The Bajaj Finserv World Plus SuperCard: It provides 20,000 bonus loyalty points as a welcome gift and free admission to the airport lounge 8 times a year, along with unrestricted paid access.

Private Bank

- Private Coral Credit Card: A card from the ‘gemstone set’ of Private Bank is an Private Coral Credit Card. In the Visa and Mastercard versions, these cards can be used. You will benefit from this card’s shopping, travel and movie spending benefits.

- Private Bank Platinum Chip Credit Card: The aim of the Private Bank Platinum Chip Credit Card is to provide customers with an enriching spending experience and versatility in payment. Chip cards are the best for individuals who want a rewarding credit card that also guarantees secure transactions.

Looking for Bank Branches where you can get information on Credit Card Madurai

Bank Name |

Address |

| Corporation Bank Ltd | No. 46, West Masi Street, Near Raymond Shop, West Masi Street, Madurai, Tamil Nadu 625001 |

| Axis Bank | No. 4, Goods Shed Street, Madurai, Tamil Nadu 625001 |

| Indian Overseas Bank | Narayanapuram, Meenakshi Nagar Rd, Madurai, Tamil Nadu |

| State Bank of India | Madurai, Tamil Nadu 625020 |

| Bank of India | Sathamangalam, Madurai, Tamil Nadu |

Why Apply Online or Choose Dialabank for Credit Card Madurai:

- Online minimum documentation available for applications from current customers

- Exact usability of a credit card in a few minutes

- Get Instant E-Approval by Dialabank

How you can get credit cards with Dialabank in Madurai in just three easy steps:

- A fast analysis of eligibility

- Application Total Online, Full

- Within minutes, get Instant E-approval

Which are the credit cards available in Madurai for Customers?

- Cashback Cards

- Premium Cards

- Reward Cards

- Travel Cards

- Entertainment Cards

- Regular Cards

- Fuel Cards

How you can pay for credit cards payments or payment options?

By using the net banking of a specific bank, Auto Pay, via fund transfer, mobile banking, Via Cheque or dropbox, etc., a credit card user in Madurai can easily make payments by those means.

Eligibility Criteria for Credit card Madurai:

- Minimum age of 21 years is needed for Salaried / Self-employed individuals

- Maximum age of 65 years is needed for Salaried / Self-employed individuals

Required Income Criteria for Credit Card Madurai:

A minimum income of Rs.15000 per month is needed or depends on criteria for credit cards; high-end cards require more monthly income & a very good cibil score.

Other Cities Credit Card

| Credit Card Latur | Credit Card Kumbakonam |

| Credit Card Kurnool | Credit Card Kota |

| Credit Card Kottayam | Credit Card Kollam |

| Credit Card Kozhikode | Credit Card Kulti |

FAQs Credit Card Madurai

✅ Can I apply for Credit Card Madurai online?

Certainly, you can very quickly apply for a credit card online. All you have to do is visit the Dialabank website to verify your eligibility and fill out your details with the minimum documents needed in a very simple form.

✅ Can I carry a Credit Card Madurai to avail the EMI facility?

Many credit card issuers offer you attractive terms of repayment at affordable interest rates and stable tenure. It is possible to convert your transactions above Rs. 5,000 to simple EMIs.

✅ What are the choices for Credit Card Madurai bill-paying available?

You can choose from the following options in order to pay your bill:

- Pay your credit card bill via online banking, such as NEFT / RTGS / EPAY / VMT (from other bank accounts)

- Payment by cheques

- Cash deposit/cheque deposit at ATM / Bank during banking hours

✅ Do all Credit Card Madurai require an annual fee and a membership fee?

No, not all cards ask for a yearly charge and/or fee for membership. For basic credit cards, there is usually no annual charge, but cards with an annual fee also have more advantages than zero annual fee cards.

✅ Will my Credit Card Madurai limit rise at a later time?

Credit limits are changed from time to time by the card issuer. This usually takes into account your past payment track record, but your limit can also be downgraded if you missed multiple payments on previous bills.

✅ What is a secured credit card?

A secured credit card is one that is issued against an asset, say, a fixed deposit. This could be a good start for those who are not able to get a standard (unsecured) passport.

✅ What are the Add-On credit cards?

Add-on credit cards are distributed under the main credit card and are addressed to a single account for all transactions requiring the payment of dues. For students living away from their parents, it is useful and even for those who are unable to obtain their own passport.

✅ What is the transfer of Credit Card Madurai balances?

Some credits have the power to transfer unpaid balances, combine debt and repay EMIs into other accounts.