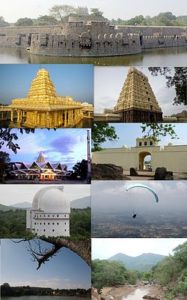

About Vellore

Vellore city is situated in the Indian state of Tamil Nadu. Vellore has a population of over 423,425 where Tamil is the majorly used language.

Vellore Fort is a remarkable monument in the city which has historical significance and the Jalakanteshwara temple.

Vellore is the nationwide famous leather hub that produces major leather products in India. In this prosperous city, credit services are of utmost importance as the financial requirements have now accelerated. Credit Card Vellore helps meet all the financial requirements of the dwellers of Vellore.

Top 5 Banks that offer Credit Card in Vellore

Citi Bank:

- Citi Prestige Credit Card: This credit card welcomes all kinds of travel and premium privileges to the credit cardholders. The key highlight of the credit card is that the users get an unlimited pass to lounge service and memberships. From hotel bookings to travel tickets everything is covered under its reward program.

Axis Bank:

- Axis Flipkart Credit Card: It is an amazing co-branded credit card by Axis Bank and Flipkart. This card brings infinite cashback on every online purchase this is specially designed for those customers who frequently shop from Flipkart and other partner websites to enjoy bonuses and cashback on every purchase.

Standard Chartered Bank:

- Standard Chartered Platinum Rewards Credit Card: This is excellent for meeting monthly requirements like fuels, grocery, dining, etc. The cost of the credit card is not so high you just have to pay a decent annual fee to get access to the reward services.

- Standard Chartered Super Value Titanium Credit Card: With the help of this credit card the card user can easily pay utility bills, electricity bills, telecom bill payments. It is the perfect blend of reward and cashback benefits.

Punjab National Bank:

- PNB Global Platinum Credit Card: This is a special credit card that offers you deals on every spends and this card provides a number of perks to the card users such as, insurance coverage and passport and visa support before any air travel. And the reward point offered on every spend.

RBL Bank:

- RBL Maxima Card: The bonus point worth Rs. 8,000 are provided to the user’s credit account after successful payment of the annual fee within the first 30 days from the day of issuance of the credit card. Free movie tickets, free access to the domestic air lounge, and much more are provided to the user of the credit card.

Looking for Bank Branches where you can get information on Credit Card in Vellore

Bank Name |

Bank Address |

| Private Bank | No. 19a, officer’s line, Sasthri Nagar, Krishna Nagar, Saduperi, Vellore |

| Indian Bank | VIT University, Vellore, Tamil Nadu |

Why Apply Online or Choose Dialabank for Credit Cards in Vellore

- The entire process of a Credit Card is very easy to grasp.

- The entire credit card information is present on the site along with the bank’s details.

- The application gets instantly approved.

How you can get credit cards with Dialabank in Vellore in just three easy steps:

- Visit the Dialabank website and get an instant eligibility comparison.

- Now fill the application form with accurate personal details.

- Submit the application and you’ll be updated.

Which are the credit cards available in Vellore for Customers?

- Fuel Cards

- Charge Cards

- Premium Cards

- Regular Cards

- Travel cards

- Shopping Cards

- Reward Cards

- Entertainment Cards

How you can pay for credit card payments or payment options?

- NEFT/RTGS

- Autopay

- Via Cheque at dropbox

- Net Banking from any bank account

Eligibility Criteria for Credit Card Vellore

- Income: The applicant must have a monthly income of Rs. 15,000.

- Age Criteria: The minimum age of the applicant must be 21 years and a max. of 65 years.

- Occupation: Either salaried-employee or self-employed.

- Cibil Score: An excellent Cibil score is mandatory for credit card approval.

Required Income Criteria for Credit Cards in Vellore:

- The Credit Card Vellore applicant must earn an amount of Rs. 15,000 p.m. for credit card approval. However, there are some premium and high-end credit cards that demand a higher monthly income. Cibil score in all respect needs to be kept in mind.

FAQs for Credit Card Vellore

✅ Is it important to possess an excellent Cibil score for Credit Card Vellore?

Yes, the Cibil score mandatorily needs to be excellent as a weak Cibil score only gets the application rejected for Credit Card Vellore.

✅ What are the added benefits of availing of a Credit Card Vellore?

Credit cards welcome many exclusive privileges to the users whether travel benefits or cashback perks on shopping. The credit cards are designed in a manner that covers every need of the users through discounts, reward points, and cashback.

✅ How much should the applicant earn on monthly basis for Credit Card Vellore?

The criteria for income for Credit Card approval states that the applicant must earn a minimum of Rs. 15,000 on monthly basis to get qualified for credit card approval.

✅ What are the steps for the availing of credit Card Vellore?

- Visit the Dialabank website and get an instant eligibility comparison.

- Now fill the application form with accurate personal details.

- Submit the application and you’ll be updated.

✅ What are the different types of credit cards available for approval in Vellore?

- Travel cards

- Fuel Cards

- Shopping Cards

- Premium Cards

- Entertainment Cards

- Charge Cards

- Regular Cards

- Reward Cards

✅ What all modes of payment are available in Vellore?

- Via Cheque at dropbox

- NEFT/RTGS

- Net Banking from any bank account

- Autopay

✅ What must be the least age of an aspirant for Credit Card Vellore?

The applicant for Credit Card should be no less than 21 years of age for qualifying for the credit card eligibility criteria.

✅ Who should I reach out to for seeking solutions to credit card-related doubts?

The credit card users and applicants who report any issue regarding service and product with Dialabank the customer-relation managers immediately respond to the customers with effective solutions.

| Credit Card Tadipatri | Credit Card Surat |

| Credit Card Thanjavur | Credit Card Thiruvananthapuram |

| Credit Card Tenali | Credit Card Thane |

| Credit Card Tirupati | Credit Card Tinsukia |