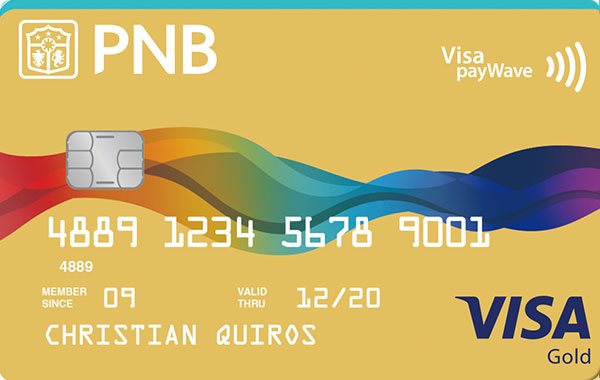

PNB’S Wave n Pay Credit Card Features

Given below are the important features of PNB’S Wave n Pay Credit Card:

-

The transactions made through the contactless card are faster and more secure due to contactless technology.

The transactions made through the contactless card are faster and more secure due to contactless technology. - The contactless transactions amounting to less than Rs. 2,000, the cardholder can use the credit card.

-

The maximum limit for contactless transactions per day is Rs.6,000.

-

Charge slips for transactions up to or below Rs.2,000 will be optional.

-

However, as per RBI guidelines, a charge slip will be given for transactions amounting to more than Rs.2,000.

-

At all Visa-approved merchant terminals, including those not approved for contactless transactions, the PNB’S Wave n Pay Credit Card can be used as a standard card.

PNB’S Wave n Pay Credit Card Eligibility Criteria

Eligibility Criteria |

Details |

| Age | The primary applicant must be at least 18 years old. |

| Nationality | He or she must be a citizen of India or a non-resident Indian. |

| Employment status | The applicant must have a steady source of income. |

| Credit Score | An ideal CIBIL score is a major factor in getting the application approved |

PNB’S Wave n Pay Credit Card Documentation

Identity Proof |

Income Proof |

Address Proof |

|

|

|

Fees and Charges

Type of Fee |

Charge |

|---|---|

| Joining fee | NIL |

| Annual fee | Rs.500 |

| Finance charges | 2.95% per month |

| Cash advance | 2% of the cash withdrawn; Rs.100 at PNB ATMs (higher amount will be taken) |

| Credit limit over usage | 2.5% or Rs.500 |

| Duplicate statement fee | Rs.50 |

| Card replacement fee | Rs.150 |

| Foreign currency transaction | 3.50% |

| Minimum amount due | 5% of the total amount due |

Rewards Points programs

- For every Rs.150 spent on the card, 2 reward points will be given.

PNB’S Wave n Pay Credit Card Limit

- After considering several variables, the credit limit for the PNB’S Wave n Pay Credit Card is allocated by the Bank.

- The credit score of the primary applicant, the credit utilization ratio, repayment patterns of any past or current debts, are some of the factors taken into account by the bank.

How to apply for PNB’S Wave n Pay Credit Card

You can use Dialabank with ease. To get your credit card easily, take the following steps:

- Go first to the Dialabank website.

- For your PNB’S Wave n Pay Credit Card, pick out a credit card.

- For that card, fill in an application form. Properly fill in all the necessary details.

- Check your eligibility and then you can finish the online application if you are eligible.

Other Top Credit Cards by PNB

- PNB RuPay Select Credit Card

- PNB RuPay Platinum Credit Card

- PNB Global Gold Card

- PNB Gold Platinum Credit Card

- PNB Rakshak RuPay Platinum Credit Card

FAQ’s