Allahabad Bank Personal Loan Key Features Apr 26 2024

| Allahabad personal loan Eligibility Criteria | Details |

| Age | 21 – 60 (at loan maturity) |

| CIBIL Score | Minimum 700 or above |

| Allahabad Bank Personal Loan Interest Rate | 9.35% per Annum |

| Lowest EMI per lakh | Rs 2093 |

| Tenure | 12 to 60 months |

| Allahabad Bank Personal Loan Processing Fee | 0.512% of the loan amount onwards |

| Prepayment Charges | NIL |

| Part-Prepayment | N/A |

| Minimum Loan Amount | Rs. 50,000 |

| Maximum Loan Amount | Rs. 20 Lakh |

Allahabad Bank Personal Loan Interest Rates and Charges

| Allahabad Bank Personal Loan Interest Rate | 9.35% per Annum |

| Allahabad Bank Personal Loan Processing Charges | 0.512% of the loan amount onwards |

| Prepayment Charges | 36 months: 2% of loan principal outstanding |

| Stamp Duty | As per state laws |

| Cheque Bounce Charges | As per bank terms |

Allahabad Bank Personal Loan Status

You can check the status of your Allahabad Bank Personal Loan by the following methods –

- You can visit your loan branch and ask the banker for the same.

- Log In to the Allahabad Bank Net banking Portal, Click on loans from the top ribbon and click on Enquire to check the status of your loan.

Allahabad Bank Personal Loan Eligibility Criteria

Personal loan eligibility criteria is given below for your assistance:

| CIBIL Score Criteria | 700 and Above |

| Age Criteria | 21 – 60 years |

| Min Income Criteria | Rs. 20000/month |

| Occupation Criteria | Salaried/Self-employed |

Allahabad Bank Fees and Other Charges

| Category | Details |

| Allahabad Bank Personal Loan Interest Rate | 9.35% per annum |

| Allahabad Bank Personal Loan Processing Fee | 0.512% of the loan amount onwards |

| Min ₹ 1000 and Max ₹ 25000 | |

| Prepayment | No prepayment is allowed until 12 EMIs are paid |

| Pre-closure | No foreclosure is allowed until 12 EMIs are paid |

| Prepayment Charges | 13-24 months: 4% of loan principal outstanding |

| 25-36 months: 3% of loan principal outstanding | |

| >36 months: 2% of loan principal outstanding | |

| Stamp Duty | As per state laws |

| Cheque Bounce Charges | ₹ 550/cheque + GST |

| Floating Rate of Interest | Not Applicable |

| Overdue EMI Interest | 2% p.m.(on overdue amount) |

| Amortization Schedule Charges | ₹ 200 + GST |

Allahabad Bank Personal Loan Documents Required

| Proof of Identity | Passport, Driving License, Aadhar Card, Voter ID Card, |

| Copy of: | |

| > Passport | |

| > Driving License | |

| > Aadhar Card | |

| > Voter ID Card | |

| Proof of Address | Rent Agreement (Min. 1 year of stay) |

| Utility Bills | |

| Passport (Proof of permanent residence) |

Allahabad Bank Personal Loan EMI Calculator

EMI Calculator

Allahabad Bank Personal Loan Compared to Other Banks

| Bank | Interest Rate | Tenure | Loan Amount & Proc Fee |

| Allahabad Bank | 9.35% | 12 to 60 months | Up to Rs. 10 lakh / 1% to 2% of Loan Amount |

| HDFC Bank | 10.50% to 21.50% | 12 to 60 months | Up to Rs. 40 lakh / Up to 2.50% of the loan amount |

| Bajaj Finserv | Starting from 12.99% | 12 to 60 months | Up to Rs. 25 lakh / Up to 3.99% of the loan amount |

| Axis Bank | 7.35% to 24% | 12 to 60 months | Rs. 50,000 to Rs. 15 lakh / Up to 2% of the loan amount |

| Citibank | Starting from 10.50% | 12 to 60 months | Up to Rs. 30 lakh / Up to 3% of the loan amount |

| Private Bank | 10.50% to 19.25% | 12 to 60 months | Up to Rs. 20 lakh / Up to 2.25% of the loan amount |

Other Loan Products from Allahabad Bank

| Allahabad Bank Gold Loan | Allahabad Bank Car Loan | Allahabad Bank Home Loan | Allahabad Bank Business Loan |

| Allahabad Bank TWL | Allahabad Bank LAP | Allahabad Bank Credit Card | Allahabad Bank Education Loan |

Why should you apply for Allahabad Bank Personal Loan with Dialabank?

Dialabank helps you choose the best financial products without any hassle. We make it simple for you to decide what product you should avail of to fulfill your needs.

How to Calculate EMIs for Personal Loan in Allahabad Bank

You can use the EMI calculator given below.

Allahabad Bank Personal Loan Processing Time

A personal loan from Allahabad Bank takes about a week or two to get processed. Borrowers with an existing relationship with the bank can get their loan processed within 48 hours.

Allahabad Bank Personal Loan Preclosure charges

Allahabad Bank provides you with the foreclosure facility on your personal loan without any charges. You can pay back your personal loan when you have the required funds.

Documents Required for Preclosure of Allahabad Bank Personal Loan

Generally, the following documents are required to foreclose your Allahabad Bank personal loan:

- A valid photo identity proof

- Loan Account Statement

- Cheque/ demand draft/ cash to make the payment

Allahabad Bank Personal Loan Foreclosure Benefits

Given below are a few key benefits of foreclosing your Allahabad Bank personal loan:

Foreclosure / Full Prepayment

- Helps you save on the overall interest payout.

- Frees you from the burden of regular loan repayments.

Partial Prepayment

- It enables you to save on the interest component.

- You also have the advantage of either paying a reduced EMI amount or having a shorter loan tenure.

Allahabad Bank Prepayment Facility

The bank also offers prepaid accommodation to help customers pay the full amount or part of it. If you have a balance left over and you meet the conditions below you can pay part of your principal balance to reduce the same. This will also help save interest on accumulated capital. Find out more about the facility below.

Note:

- Prepayment will be allowed subject to the effective payment of the first 12 EMIs.

- Prepayments will be allowed twice the entire loan period.

- Prepayment is allowed only once a year.

- At any time, the advance payment will not exceed 25% of the Principal Outstanding

Prepayments.

Charges:

- 13-24 months – 4% of outstanding loan balance

- 25-36 months – 3% of outstanding loan balance

- Over 36 months – 2% of outstanding loan balance

Allahabad Bank Pre Calculated EMI for Personal Loan

Allahabad Bank Personal Loan for Salaried Employees

Allahabad Bank offers Personal Loan for Salaried Employees at attractive rates of interest. The amount that you get a loan depends on the Company that you work for, The take-home salary of the employee, and the city of residence of the employee. Allahabad Bank offers these loans for a tenure of 12-60 months and provides instant approval along with funds to pre-approved customers.

Allahabad Bank Personal Loan for Self Employed Individuals

Allahabad Bank’s Personal Loan for Self Employees is a loan product offered to self-employed individuals and in need of funds. The bank provides them with attractive rates of interest on their personal loan and tenure of 12-60 months. However, as compared to Salaried Employees, you have to present more documents here as you need to provide the bank with sufficient documents related to your business to prove its continuity as well as your steady income.

Allahabad Bank Personal Loan for TCS Employees

- Exclusive personal loans with a reasonable interest rate of 11.25% p.a.

- EMI for personal loans starts at Rs.2178 per lakh when terms and conditions are met.

- The hassle-free documentation process for TCS employees.

- Pre-approved personal loans for eligible TCS employees.

- Interest rate starting at 11.99% p.a for superbike loans.

- Great offers on home loans with an interest rate of 9.45% p.a and discount interest rate for women at Rs.9.40% p.a.

Allahabad Bank Moratorium Process

The process for setting up your Allahabad Bank loan EMIs is as follows-

- Visit the Allahabad Bank website or use the mobile app

- Click on the link where the suspension period appears

- On the application page, state your registered mobile number, name, email address

- Then enter your birthday and choose the type of loan

- Enter your loan number and state your EMI value

- Then make a decision and choose the right app

- Click on the EMI reversal option that says I agree to pay interest earned on the remaining balance

- Click the ‘Submit’ button

- The bank will review the details and process your application for suspension

- You will be given a reference when successfully completing the process on your registered number and email address

Allahabad Bank Personal Loan Special Pricing

If a customer is looking for INR 15 lakh of the loan amount or more than that below rates would be applicable.

| Loan Amount | IRR | Processing Fee (+GST) |

|---|---|---|

| Loan amount >=15 lakh* | 10.50% | INR 3999 |

*Terms & conditions apply

This offer is not applicable for Top-up/ Enhancement/ Existing loan amount closure.

If a customer is looking for a Balance transfer and a fresh loan of above INR 10 lakh above, the below offer is available.

| NTH | Loan Amount | IRR | Processing Fee (+GST) |

|---|---|---|---|

| >=50000 | Loan amount >=10 lakh* | 10.50% | INR 3999 |

*Terms & conditions apply

- Not applicable on Existing loan closure

- Not applicable for Credit card BT

How to Manage a Personal Loan

Here are the 4 tips that will help you manage your loans:

- Pay On Time: The first step is to avoid late fees and penalties. The best way to do that is by paying your monthly payments on time every month. This also hits the credit score. These are needless and all too common consequences that will work against your financial condition.

If you have just taken a personal loan or are about to, the best way to manage your loan is by making a monthly payment on your loan as soon as you receive the loan. By being a payment ahead of your installment plan you will have a buffer against a missed payment. - Pay More Than Your Minimum: Paying beforehand is a good option for managing your plans but paying a little extra every month keeps you ahead of your loan term and provides you with some other financial bonuses.

Moreover, paying extra on your loan reduces the length of the repayment plan. This will help you clear the debt and allows you to regain your financial independence sooner. It will also reduce the rate of interest you owe and thus, saving you money in the long run.

Paying off your debts faster also leads to an improvement in your credit score. A lower credit score will benefit you in several ways, like dropping down payments and rate of interest. - Consolidate Your Loans: For debtors managing multiple personal loans, consolidation could be the best way to simplify your debt repayment. Debt Consolidation is when you take a large loan to repay all the other loans you have taken. So, instead of paying multiple lenders every month with different rates of interests and needs, one can make a single payment to one provider.

Debt Consolidation is helpful if you can save an interest rate on a new loan that is lower than the average personal loan interest rate of the earlier loans.

The only disadvantage that lies here is that one will likely end up having to reimburse the debt quicker than before. Before consolidating your debt, make sure that you can make the payments on a new loan. This may also help to reimburse large portions of your loans on credit rather than with a single loan, consolidating it into more controllable pieces. - Credit Score: Last but not the least, always keep a close watch on your credit score while reimbursing a personal loan. The credit score plays a major role in finances and has an important relationship with the loans taken out. How you manage your loans is reflected in your credit score. On the other hand, falling behind on your payments will subordinate the credit score. Thus, a higher credit score is important.

Different Personal Loan Offers by Allahabad Bank

Allahabad Bank Marriage Loan

Marriages are one of the costliest events in Indian households. Allahabad Bank has personal loan offers with a low-interest rate and high loan quantum to meet your wedding expenses.

Allahabad Bank Personal Loan for Government Employees

Government employees can apply for an Allahabad Bank personal loan to meet their financial expenses. The bank has personal loan offers to meet your different monetary needs.

Allahabad Bank Personal Loan Offers for Government Employees

| Offers By Government | Number of Companies | Processing Fee(% of the Loan Amount | IRR |

| Miniratna, Navratna, and Maharasthra | 55 | 1.50% | 13.49% |

| 11.49% | |||

| 10.99% | |||

| Pensioner | All | 1.50% | 14.75% |

| Employees from the Railway Department | All | 1.50% | 16.50% |

| 15.00% | |||

| 14.25% | |||

| CISF, CRPF, ITBP, SSB and BSF | All | 1.50% | 14.75% |

State and Central Government Officers:

| Section | Salary | Processing charge | IRR |

| Government Officer Division A (GA) and Division B (GB) | NTH>24k | 2% | 16.75% |

| NTH>35k | 2% | 15% | |

| NTH>50k | 1.75% | 14.75% |

Allahabad Bank Doctor Loan

Doctors and medical professionals can apply for a personal loan from Allahabad Bank and enjoy a range of offers and deals curated to their personal and professional needs.

Allahabad Bank Personal Loan for Pensioners

Government employees can fulfill their post-retirement financial needs by applying for a personal loan with Allahabad Bank. The bank has special offers for all the pensioners with their pension account with the bank.

Allahabad Bank Personal Loan Balance Transfer

Personal Loan Balance Transfer is the process of transferring your existing personal loan with another bank to a new lender for lower rates of interest and better loan terms. You can apply for Allahabad Bank’s personal loan balance transfer to lower your financial burden.

Allahabad Bank Personal Loan Top Up

Allahabad Bank’s personal loan top-up is a facility through which you can avail of additional funds under the same existing personal loan without applying for a fresh loan. Dialabank helps you choose the best personal loan offers available for you.

Allahabad Bank Personal Loan Overdraft Facility

An individual overdraft is a credit office that licenses you to pull out an all-out as and when required. You can similarly repay the got out absolutely at whatever point the condition is ideal. Thusly, it is maybe the most preferred credit decisions that profited from meeting changing individual supporting necessities unbounded.

Apply for an overdraft office as an Allahabad Bank Personal Loan. The adaptable improvement office has all the gigantic features of an unreliable overdraft credit.

Allahabad Bank Home Renovation Loan

For individuals who want to get their home redesigned, Allahabad Bank provides home redesign credit. This individual loan will fund the required repairs or help the applicant purchasing new fittings, appliances, and furniture for their home. Some of the Allahabad Bank Home Renovation Loan’s essential highlights are:

- The Home Improvement Loan’s funding cost from Allahabad Bank starts at as low as 11.25 percent.

- People could be qualified to have their home remodeled for an advance amount of Rs. 20 Lakh

- Allahabad Bank’s home remodels credit needs zero paperwork, rendering the whole advance period free of bother.

- The advance amount is generally credited to the record within 72 hours until the bank prefers your application.

Allahabad Bank Holiday Loan

The Holiday Loan of Allahabad Bank will help you with a minor issue in planning your dream get-away. This individual Allahabad Bank advance will subsidize a variety of expenses related to excursions, including booking travel tickets, hotel facilities, guided tours, and so on The main highlights of the Allahabad Bank Holiday Loan are:

- Holiday loan financing costs start at 11.25 percent p.a.

- You can do a measure of up to Rs 20 Lakh without a lot of a stretch profit, so your dream excursion will not be ruined because of a monetary crunch.

- Streamlined and minimal paperwork ensures the basic and clear financing of your get-away.

- Brisk planning and disbursement of progress that is specifically attributed to your record.

Allahabad Bank Fresher Funding

In either case, a dominant part of insecure individual credits is based on individuals with a customary pay Allahabad Bank’s Fresher Funding is outstanding. This Allahabad Bank credit alternative is intended to assist freshers, such as continuing alumni searching for their first job, for example. Some significant highlights of individual credit from Allahabad Bank Fresher Funding are as follows:

- Amount of credit up to Rs 1.5 lakh

- Candidates must be 21 years of age, at any rate.

- Fresher Funding’s speed of interest depends on the candidate’s profile, the financial record/score, the candidate’s age, and region.

Allahabad Bank NRI Personal Loan

Allahabad Bank provides a person advance specifically for NRIs, recognizing the necessities and dreams of NRIs. An Indian inhabitant should be the primary advance nominee, and a nearby family member must be the co-candidate NRI. The following highlights include the Individual Loan for NRIs.

- Allahabad Bank provides individual NRI advances of up to Rs. 10 lakh with adaptable end-use advances.

- NRI Personal Loan funding costs start at 15.49 percent p.a.

- A residence of as long as three years is included in the credit.

Allahabad Bank Personal Loan Preclosure Online

Allahabad Bank enables a Personal loan borrower to make a pre-closure or a pre-payment of a loan. However, you will be able to prepay your Allahabad Bank Personal Loan only after 12 months after you have procured your loan and after paying 12 EMIs plus the foreclosure charges that may be applicable. If you meet this requirement, you can repay your personal loan before the original due date and close your loan early.

Allahabad Bank Personal Loan Process Steps

Step 1: Determine your requirement

Figure out why you need a Personal Loan and how much you need. For example, you may need a loan to fund your wedding or to renovate your home. And you may need just Rs. 1 lac or Rs. 10 lac.

Step 2: Check loan eligibility

Once you know how much you need, you should check whether you are eligible. You can visit the Allahabad Bank Personal Loan Eligibility Criteria online, to find out how much you can borrow as a Personal Loan. Allahabad Bank offers loans up to Rs. 40 lac.

Step 3: Calculate monthly installments

Use an online EMI tool to calculate your approximate loan repayments every month. You can modify the interest rate and tenure to match your monthly income, like on the Allahabad Bank Personal Loan EMI Calculator. Allahabad Bank offers pocket-friendly EMIs on all its Personal Loans starting at Rs. 2093 per lac * (T&C).

Step 4: Approach the bank

You can apply for a Personal Loan with Allahabad Bank in various ways: Via Net Baning, online on the Allahabad Bank website, at an ATM, or by visiting a branch.

Step 5: Submit documents

Next, find out what documents are required for a Personal Loan. You will usually need income proof (bank statements, salary slips or IT returns), address proof, and ID proof. Hand over copies of your Personal Loan documents at the bank.

Wait for funds to be remitted to your account. Allahabad Bank disburses funds for pre-approved loans to customers in 10 seconds*, and for non-Allahabad Bank customers in 4 hours.

That’s how to get a Personal Loan in 5 easy steps!

Allahabad Bank Personal Loan Prepayment Charges

If you are a salaried applicant, you can pre-pay your Allahabad Bank Personal Loan only after paying 12 equated monthly installments completely.

The pre-payment charges for salaried applicants are as follows:

- 4% of the outstanding principal amount for 13 to 24 months.

- 5% of the outstanding principal amount for 25 to 36 months.

- 2% of the outstanding principal amount for more than 36 months.

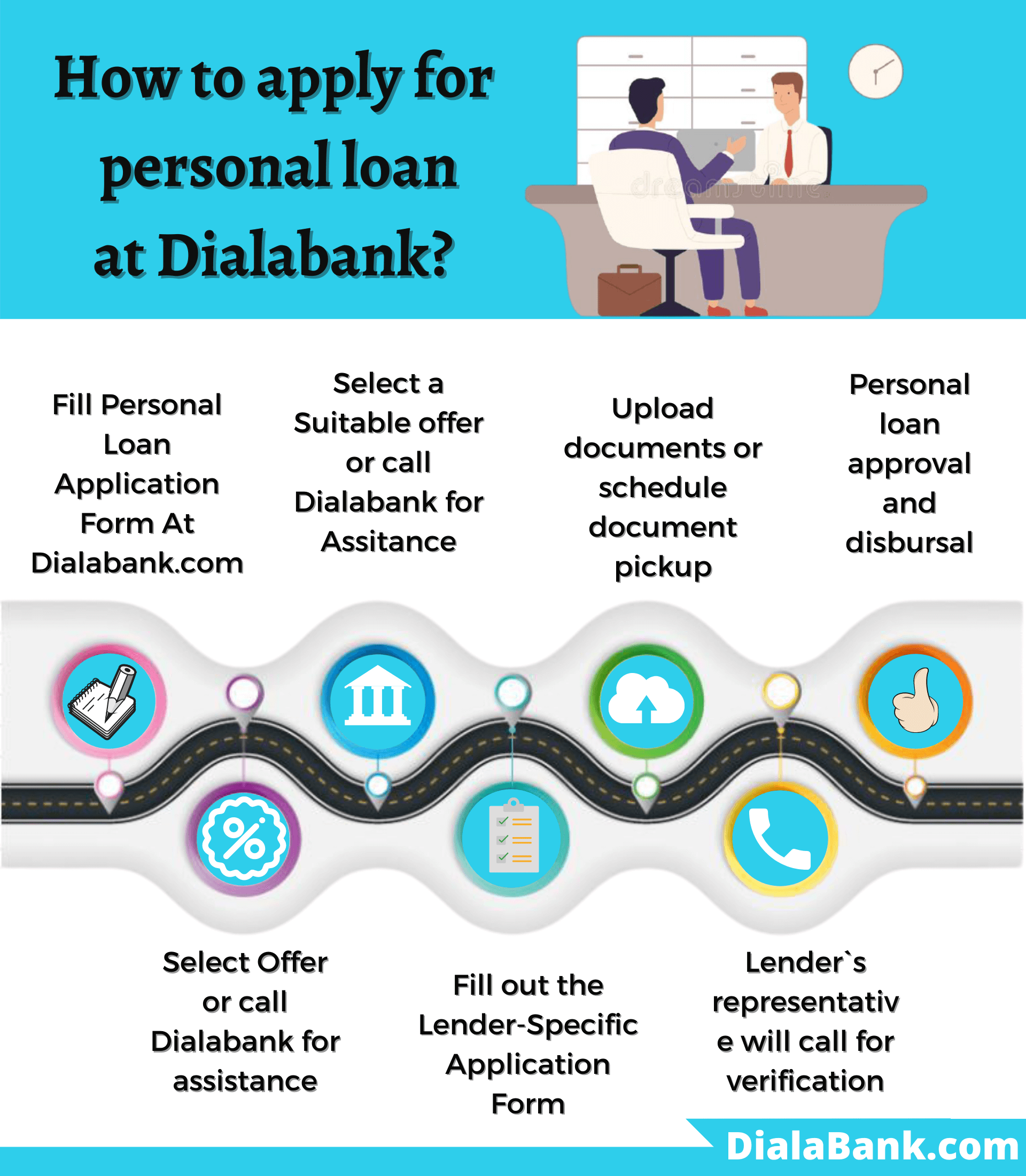

How to apply for Allahabad Bank Personal Loan

- Visit Dialabank

- Fill in your details in the form.

- Our team will then contact you.

- Submit your documents and get instant approval.

The personal loan verification process

The following main measures are included in the verification process for a personal loan:

Step 1: Your preferred lender receives your online loan application after submitting your online application on the Dialabank website / Dialabank App.

Step 2: The lender’s representative will contact you to check the application’s details and arrange for the documentation needed for your loan application to be picked up.

Step 3: The personal loan application is accepted after the records have been obtained and successfully checked.

Stage 4: The loan is disbursed once the borrower signs the loan agreement.

Allahabad Bank Personal Loan Status

To check your Allahabad Bank Personal Loan’s status, you can:

- Visit the bank branch where you applied for the loan directly and provide your loan application information to the loan officer.

- Visit the Allahabad Bank website and work out the details of your loan.

- Send the details of your loan via email to the bank.

- Via the bank’s I-mobile app

- These techniques allow you to monitor your loan status easily.

How to login to the Allahabad Bank Portal

- Check the official website of Allahabad Bank.

- Click on ‘Login’ in the upper right corner of the screen.

- Using your User ID and Password or reported mobile number to log in

How to Check Your Allahabad Bank Loan Statement

By following the means given below, clients can download the bank’s very own credit proclamation:

- Visit the bank’s official site.

- Select ‘Link’ and choose ‘Administration Requests’ from the drop-down list.

- On the following page that opens, click ‘Individual Loan Linked’ under the ‘Advances’ menu.

- First, click on ‘Solicitation for Loan Account Statement’.

- To profit from the bank’s very own credit explanation, log in using your User ID and the hidden word or using your enlisted flexible number and OTP.

Allahabad Bank Personal Loan Restructuring (COVID-19)

Due to the COVID-19 pandemic, the cross-country lockout antagonistically influenced multiple borrowers. A multi-month ban on various term advances was declared to moderate its effect to a particular degree. Allahabad Bank announced the RBI-commanded one-time gain of Allahabad Bank’s individual credit reconstruction after the half-year ban had expired. This instrument is intended to offer relief to those borrowers who cannot repay their usual EMI due to the pandemic’s continuing money-related difficulties.

The Allahabad Bank’s credit target system proposes an additional ban of as long as two years or an extension in the existing reimbursement time period to decrease EMI installments from month to month. As a primary concern, it is imperative that the rebuilding of your Allahabad Bank individual credit will result in additional premium charges well beyond those of the first advance. Consequently, if anything else fails with the intention of not ending up defaulting on your great credit, this relief instrument can only be used.

Allahabad Bank Customer Care

Customers can contact the Allahabad Bank customer care via any of the following means:

- By Phone: You can call Allahabad Bank on 9878981166 (toll-free)

- Callback Request: You can also request a call back by visiting the bank’s website

- Online Chatbot: You can also get your queries answered by the iPal chatbot online

- Branch Visit: You can visit the nearby Allahabad Bank branch to get your queries.

Benefits of Applying for Personal Loan on Dialabank

In applying for a personal advance on the Dialabank platform, there are numerous points of interest. Some of them are provided underneath:

- 24 x 7 Accessibility: Anytime and wherever you can get to the Dialabank platform, and in this way, apply for an individual advance whenever your home or office is relaxed.

- Multiple moneylenders on a solitary stage: Dialabank empowers you to receive individual credit deals on a solitary stage from different scheduled loan specialists and removes the need to visit various bank sites or branches.

- Know EMI in a split second: With the individual advance EMI calculator, you can check the EMIs you would be paying on an individual credit even before applying for one. It will help you acquire the suitable sum that you can without much of a stretch reimburse and have a helpful reimbursement plan.

- Liberated from cost: Additionally, you are not needed to pay any charges when you apply for an individual advance on Dialabank.

How to get the best offer on Allahabad Bank Personal Loan?

You can get the best personal interest rates from Allahabad Bank subject to an assessment of your loan amount, salary, other obligation company you work with, and loan tenure. The following factors determine the personal loan rate of interest you can expect to get from Allahabad:

How does Allahabad Bank Personal Loan work?

Here is the process:

| Maximum Annual Percentage Rate (APR) | 11% to 22.5% |

| A representative example of the total cost of the loan, including all applicable fees |

Here is an illustration of the total cost of the loan:

|

Important Aspects

Some important angles that you should consider when applying for an individual Allahabad Bank credit are given below:

- When applying for a personal advance, it is nice to review your financial evaluation in any situation. A good credit evaluation builds up your credit endorsement chances and can cause you to benefit from an individual advance on better terms.

- It is wise to think about the cost of an individual credit (premium expense and all fair expenditures and charges) provided by various moneylenders on Dialabank.com before deciding on a particular bank.

- Acquire as per the ability to need and reimbursement. Try not to gain just because you’re willing to get a higher number. It just adds to the cost of your advantage and has not many benefits over the long haul.

- Try not to apply for individual advances concurrently with separate moneylenders. This shows that you are ready for credit and raises the number of complicated demands for your credit report, which can have an antagonistic impact on your credit rating.

FAQs About Allahabad Bank Personal Loan

✅ How to Allahabad bank personal loan apply online?

Apply for a personal loan with Allahabad Bank by visiting your nearby Allahabad Bank branch or submitting a simple form with Dialabank. With us, you can get the benefit when you apply from anywhere and approve your personal loan faster.

✅ What is the Interest Rate for Allahabad Bank Personal Loan?

The interest rate charged by Allahabad Bank for a personal loan is 9.35% per annum.

✅ What is the minimum age for getting a Personal Loan from Allahabad Bank?

You must be 21 years old to apply for a personal loan through Allahabad Bank.

✅ What is the maximum age for getting a Personal Loan from Allahabad Bank?

The maximum age for getting a personal loan from Allahabad Bank is 60 years.

✅ What is the minimum loan amount for Allahabad Bank Personal Loan?

You can take a minimum loan amount of Rs. 50,000 from Allahabad Bank for Personal Loan.

✅ What is the maximum loan amount for Allahabad Bank Personal Loan?

You can avail of a maximum loan amount for your personal loan of Rs. 10 lakh from Allahabad Bank.

✅ What are the documents required for Allahabad Bank Personal Loan?

You will require an Aadhaar card/Voter ID, PAN card, salary slips/ITR, and two recently clicked photographs required for a personal loan for Allahabad Bank.

✅ What is the Processing Fee for Allahabad Bank Personal Loan?

The processing fee charged by Allahabad Bank for a personal loan is 1% of the Loan Amount.

✅ How to get Allahabad Bank Personal Loan for Self Employed?

Allahabad Bank offers personal loans for Self Employed to help them financially. You must have the ITR files of the last two financial years.

✅ What is the Maximum Loan Tenure for Allahabad Bank Personal Loan?

The maximum loan tenure duration in Allahabad Bank for a personal loan is 60 months.

✅ What should be the CIBIL Score for Allahabad Bank Personal Loan?

You can avail of a personal loan from Allahabad Bank if you have a CIBIL score of 700 and above.

✅ Do I have a pre-approved offer for Allahabad Bank Personal Loan?

You can examine your pre-approved personal loan offers from Allahabad Bank through Dialabank. You have to fill a form, and the bank will check out the best offer and present it to you.

✅ How to calculate the Allahabad bank personal loan interest rate calculator?

You can calculate your personal loan EMI for Allahabad Bank by using the EMI calculator.

✅ How to pay Allahabad Bank Personal Loan EMI?

Your personal loan EMIs from Allahabad Bank are automatically subtracted from your bank account. You can also use internet banking for the payments of your personal loan.

✅ How to close Allahabad Bank Personal Loan?

If you want to close your personal loan from Allahabad Bank, make sure you have paid the outstanding personal loan amount and receive no dues certificate from the Allahabad bank branch.

✅ How to check Allahabad Bank Personal Loan Status?

You must visit the Allahabad Bank branch to know about your personal loan status. On the other hand, visit Dialabank and fill a form.

✅ How to close Allahabad Bank Personal Loan Online?

The following steps are to be followed for a closing personal loan from Allahabad Bank:

- Visit the net-banking page of Allahabad Bank.

- Login using your details.

- Pay for your personal loan and save the transaction receipt.

✅ How to pay Allahabad Bank Personal Loan EMI Online?

You can pay your personal loan EMI through the net-banking service of Allahabad Bank. Dialabank will compare offers and deals of different banks to opt for the right choice. You have to fill a form, and the bank will work for you.

✅ How to check Personal Loan Balance in Allahabad Bank?

You have to need to contact the customer care number of Allahabad Bank for checking your personal loan balance. If you are searching for low-interest personal loans, visit Dialabank and fill a form for Personal Loan Balance Transfer and the bank will do the best work for you.

✅ How to download Allahabad Bank Personal Loan Statement?

Using the Allahabad bank mobile banking app for downloading your personal loan statement of Allahabad Bank. Also, visit the online portal of Dialabank and fill a form, and know about the personal loan offers for you.

✅ How to Top Up Personal Loan in Allahabad Bank?

If you want to top-up your personal loan from Allahabad bank, you have to visit the bank branch and contact the loan officer. You can fill a simple form with Dialabank to avail of Personal Loan Top Up.

✅ What happens if I don’t pay my Allahabad Bank Personal Loan EMIs?

If you cannot pay your personal loan EMIs, then Allahabad Bank will charge a penal interest. You can transfer your balance using Dialabank to get low-interest personal loans.

✅ How to find the Allahabad Bank Personal Loan account number?

You will require to contact your Allahabad bank loan branch to know your personal loan account number. You may also fill out the form available at Dialabank, and we will do all the work for you.

✅ What is the Allahabad bank personal loan customer care number?

Dial 9878981166 for any query.

✅ What are the Allahabad bank Personal Loan pre-closure charges?

Allahabad Bank provides you with the foreclosure facility on your personal loan without any charges. You can pay back your personal loan when you have the required funds.

✅ What is the Allahabad bank Personal Loan closure procedure?

- Visit the bank with the complete set of documents (as mentioned above).

- You may be required to fill a form or write a letter requesting the Personal Loan account pre-closure.

- Pay the pre-closure amount.

- Sign the required documents, if any.

- Take acknowledgment of the balance amount you have paid.

✅ What are the Allahabad bank’s Personal Loan foreclosure charges?

Allahabad bank lets you foreclose your personal loan with 2% to 4% foreclosure charges.

✅ What is the Allahabad Bank Personal Loan Overdraft Facility?

An individual overdraft is a credit office that licenses you to pull out an all-out as and when required. You can similarly repay the got out absolutely at whatever point the condition is ideal.