Key Features of Axis Bank Personal Loan Apr 26 2024

| Axis Bank Personal Loan at a Glance | |

| Interest Rate | 10.49% per annum |

| Lowest EMI per lakh | ₹2177 for a tenure of 60 months |

| Tenure | 12 to 36 months (Can be extended) |

| Processing Fee | 1% + GST |

| Prepayment Charges |

5% for 0 to 12 months 4% for 13 to 24 months 3% for 25 to 36 months 2% for greater than 36 months |

Rate of Interest

Today, Axis Bank personal loan interest rates are in the range of 10.50% to 22.00%, with the lowest rates offered to the existing customers of the bank with a strong CIBIL Score and those working with reputed corporate with a stable employment history. Axis Bank also runs special schemes for defence, armed forces, and government employees. The personal loan interest rate for government employees and defence personnel is different from private salaried employees.

Loan Status

Now stay updated with the status of your loan. Simply just enter the required details and keep track of it at any stage. Just by entering the Applicant Name, Proposal Number, or mobile number, you will simply stay updated with your loan status.

Loan Eligibility

There are some criteria that the applicant needs to fulfill to avail of Axis Personal Loan such as credit rating, monthly income, your previously availed loans, repayment capability, etc. There are two categories of applicants: salaried and self-employed.

| CIBIL score Criteria | 750 and Above |

| Age Criteria | 21-60 years |

| Min Income Criteria | Rs 25000/month |

| Income Criteria | Salaried/Self-employed |

Loan Interest Rates, Fees, and Charges

| Interest Rate | 10.49% per annum |

| Repayment Instruction | Rs. 500 + GST |

| Penal Interest | 24% per annum |

| Duplicate Statement Issuance Charges | Rs. 250/set |

| CICs Report Issuance Charges | Rs. 50/ instance + GST |

| Repayment Instruction/ Instrument Return Charges | Rs.500/- per instance of dishonour of cheque /SI/ECS/NACH debit instruction + GST as applicable |

| Swap Charges (Cheque/ Instrument) | Rs. 500/- per instance + GST as applicable |

| Penal Interest | 24% per annum, i.e. 2% per month on the overdue installment. |

| Duplicate statement issuance charges | Rs.250/- per instance per set + GST as applicable. |

| Duplicate Amortization schedule issuance charges | Rs.250/- per instance per set + GST as applicable. |

| Re-Issuance of a photocopy of loan agreement/documents | Rs.250/- per instance per set + GST as applicable. |

| Credit Information Companies (CICs) Report Issuance Charges | Rs. 50/- per instance per set + GST as applicable |

| Duplicate NOC | Rs. 500/- per instance per set + GST as applicable. |

| Stamp Duty Charges | As per the State Stamp Act |

Documents Required

Documentation for personal Loans may vary according to the profiles. Before issuing a loan, the banks ensure the repayment capacity of the borrower. The Axis Personal Loan documents will be different for salaried and self-employed applicants. Before applying for a personal loan, check your eligibility and documentation. Apply now and get quick approval.

| Form | Duly filled application form |

| Proof of Identity | Copy of: |

| > Passport | |

| > Driving License | |

| > Aadhar Card | |

| > Voter ID Card | |

| Proof of Address | Rent Agreement (Min. 1 year of stay) |

| Utility Bills | |

| Passport (Proof of permanent residence) | |

| Ration card | |

| Proof of Income | > ITR: Last two Assessment years |

| > Salary Slip: Last 6 months | |

| > Bank Statement: Last 3 months |

Personal Loan EMI Calculator

Loan Comparison with Other Banks

| Bank | Interest Rate | Tenure | Loan Amount & Proc Fee |

| Axis Bank | 9.99% | 12 to 60 months | Up to Rs. 15lakh / 1% to 2% of Loan Amount |

| HDFC Bank | 11.25% to 21.50% | 12 to 60 months | Up to Rs. 40 lakh / Up to 2.50% of the loan amount |

| Bajaj Finserv | Starting from 12.99% | 12 to 60 months | Up to Rs. 25 lakh / Up to 3.99% of the loan amount |

| Citibank | Starting from 10.99% | 12 to 60 months | Up to Rs. 30 lakh / Up to 3% of the loan amount |

| Private Bank | 11.50% to 19.25% | 12 to 60 months | Up to Rs. 20 lakh / Up to 2.25% of the loan amount |

Why should you apply for the Axis Bank Personal Loan with Dialabank?

Dialabank helps you choose the option of banks by providing you with the updated market comparison of different banks to make the right choice. We at Dialabank have already helped thousands of people to get the loan they need without any issue, and we look forward to continuing in doing so. Apply with us today to get the offers and special deals on Axis Bank Personal Loan.

Call us at 9878981166 to avail of Axis Bank Personal Loan.

How to Calculate EMIs

You can calculate the EMIs on your loan; you just require the basic information concerning the loan –

- Loan Amount

- Interest Rate

- Tenure of Loan

Simply put these values in the calculator below to find the exact amount payable each month.

Processing Time

Axis Bank usually takes two weeks or 15 days when it comes to the Processing of Personal Loan Applications. However, Axis Bank approves the loan in just a few hours to a maximum of 1-3 days to its pre-approved already existing account holders.

Pre-closure Charges

Axis Bank gives you the option of pre-closing your Personal Loan after a minimum of 12 months of taking the loan and paying 12 successful EMIs on your Personal Loan. However, Axis Bank charges a Prepayment or Pre-closure charge.

Documents Required for Pre-closure

Generally, the following documents are required to foreclose your Axis Bank personal loan:

- A valid photo identity proof

- Loan Account Statement

- Cheque/demand draft/cash to make the payment

Foreclosure Benefits

Given below are a few key benefits of foreclosing your Axis Bank personal loan:

Foreclosure / Full Prepayment

- Helps you save on the overall interest payout.

- Frees you from the burden of regular loan repayments.

Partial Prepayment

- It enables you to save on the interest component.

- You also have the advantage of either paying a reduced EMI amount or having a shorter loan tenure.

Prepayment Facility

Axis Bank also offers the prepayment facility to help the customers pay off the entire outstanding or a part of it. If you have a surplus amount of money in hand and meeting the below criteria then you can pay a part of your principal outstanding amount to reduce the same. This will also help in saving interest accrued on the principal amount. Know more about this facility below.

- Prepayment will be allowed subject to the successful payment of the first 12 EMIs

- Prepayment will be allowed a maximum of twice during the entire tenure of the loan

- Prepayment is allowed only once a year

- At any point in time, the prepayment will not exceed 25% of Principal Outstanding

Charges to be paid on Prepayment

- 13-24 Months – 4% of the outstanding loan balance

- 25-36 Months – 3% of the outstanding loan balance

- More than 36 Months – 2% of the outstanding loan balance

Pre Calculated EMI

| Rate | 5 Yrs | 4 Yrs | 3 Yrs |

| 9.99% | 2149 | 2560 | 3250 |

| 11.00% | 2174 | 2584 | 3273 |

| 11.50% | 2199 | 2608 | 3297 |

| 12.00% | 2224 | 2633 | 3321 |

| 12.50% | 2249 | 2658 | 3345 |

| 13.00% | 2275 | 2682 | 3369 |

| 13.50% | 2300 | 2707 | 3393 |

| 14.00% | 2326 | 2732 | 3417 |

| 14.50% | 2352 | 2757 | 3442 |

| 15.00% | 2378 | 2783 | 3466 |

*Note – All EMIs are calculated for a Loan Amount of Rs. 1 Lakh.

Loan for Salaried Employees

Axis Bank offers Personal Loan for Salaried Employees at attractive rates of interest. The amount that you get a loan depends on the Company that you work for, The take-home salary of the employee, and the city of residence of the employee. Axis Bank offers these loans for a tenure of 12-60 months and provides instant approval along with funds to pre-approved customers.

Loan for Self Employed Individuals

Axis Bank’s Personal Loan for Self Employees is a loan product offered to self-employed individuals and in need of funds. The bank provides them with attractive rates of interest on their personal loan and tenure of 12-60 months. However, as compared to Salaried Employees, you have to present more documents here as you need to provide the bank with sufficient documents related to your business to prove its continuity as well as your steady income.

Loan for TCS Employees

- Exclusive personal loans with a reasonable interest rate of 11.25% p.a.

- EMI for personal loans starts at Rs.2178 per lakh when terms and conditions are met.

- The hassle-free documentation process for TCS employees.

- Pre-approved personal loans for eligible TCS employees.

- Personal loan interest rate starting at 11.99% p.a for superbike loans.

- Great offers on home loans with an interest rate of 9.45% p.a and discount interest rate for women at Rs.9.40% p.a.

Moratorium Process

The process to stop your loan EMIs at Axis Bank is as follows-

- Visit the Axis Bank website or use the mobile app

- Click on the link where the option of moratorium period is popping out

- On the application page, mention your registered mobile number, name, email address

- After that enter your date of birth and select the type of loan

- Enter your loan number and mention your EMI amount

- Then make a decision and choose a suitable service

- Click on the EMI deferment option that says I agree to pay the accrued interest on the outstanding balance

- Click on the ‘Submit’ button

- The bank will check the details thoroughly and process your moratorium request

- You’ll be given a reference upon the successful completion of the process. on your registered mobile number and email address

However, if you don’t want to defer EMI, you must click on the second option after the deferment option. This will ensure EMI payments as scheduled with no extra interest charged on it. Select the defer option if your answer is yes otherwise your EMI debited as it was doing in the past

Axis Bank representatives can also get in touch with you via WhatsApp or call regarding the moratorium process.

Axis Bank Personal Loan Special Pricing

If a customer is looking for INR 15 lakh of the loan amount or more than that below rates would be applicable.

| Loan Amount | IRR | Processing Fee (+GST) |

|---|---|---|

| Loan amount >=15 lakh* | 10.50% | INR 3999 |

*Terms & conditions apply

This offer is not applicable for Top-up/ Enhancement/ Existing loan amount closure.

If a customer is looking for a Balance transfer and a fresh loan of above INR 10 lakh above, the below offer is available.

| NTH | Loan Amount | IRR | Processing Fee (+GST) |

|---|---|---|---|

| >=50000 | Loan amount >=10 lakh* | 10.50% | INR 3999 |

*Terms & conditions apply

- Not applicable on Existing loan closure

- Not applicable for Credit card BT

How to Manage Personal Loan

Here are the 4 tips that will help you manage your loans:

1. Pay On-Time – The first step is to avoid late fees and penalties. The best way to do that is by paying your monthly payments on time every month. This also hits the credit score. These are needless and all too common consequences that will work against your financial condition.

If you have just taken a personal loan or are about to, the best way to manage your loan is by making a monthly payment on your loan as soon as you receive the loan. By being a payment ahead of your installment plan you will have a buffer against a missed payment.

2. Pay More Than Your Minimum – Paying beforehand is a good option for managing your plans but paying a little extra every month keeps you ahead of your loan term and provides you with some other financial bonuses.

Moreover, paying extra on your loan reduces the length of the repayment plan. This will help you clear the debt and allows you to regain your financial independence sooner. It will also reduce the rate of interest you owe and thus, saving you money in the long run.

Paying off your debts faster also leads to an improvement in your credit score. A lower credit score will benefit you in several ways, like dropping down payments and rate of interest.

3. Consolidate Your Loans – For debtors managing multiple personal loans, consolidation could be the best way to simplify your debt repayment. Debt Consolidation is when you take a large loan to repay all the other loans you have taken. So, instead of paying multiple lenders every month with different rates of interest and needs, one can make a single payment to one provider.

Debt Consolidation is helpful if you can save an interest rate on a new loan that is lower than the average interest rate of the earlier loans.

The only disadvantage that lies here is that one will likely end up having to reimburse the debt quicker than before. Before consolidating your debt, make sure that you can make the payments on a new loan. This may also help to reimburse large portions of your loans on credit rather than with a single loan, consolidating it into more controllable pieces.

4. Credit Score – Last but not least, always keep a close watch on your credit score while reimbursing a personal loan. The credit score plays a major role in finances and has an important relationship with the loans taken out. How you manage your loans is reflected in your credit score. On the other hand, falling behind on your payments will subordinate the credit score. Thus, a higher credit score is important.

Different Loan offers

Doctor Loan

Axis Bank offers special Personal Loan to Doctors who require funds. Bank gives them loans ranging from Rs. 50000 to Rs. 50 lakhs for a tenure of 12-60 months at interest rates starting from 11.25%. There are certain eligibility criteria’s for availing of this loan:

- The credit score should be at least 650.

- Age should be 25-65 years.

- Medical Experience – More than 4 years (as a doctor).

Marriage Loan

Axis Bank offers Personal Loan for Marriage to solve people who are facing a shortage of funds for their or their close one’s marriage. There is no restriction on using this loan amount and can be used for anything from wedding banquets to makeup or stylists, etc. You get these amounts quickly within seconds if you are a pre-approved customer with the bank or as quickly as 4 hours in some cases. The bank charges an attractive interest rate and gives you the option of choosing the loan tenure.

Loan for Government Employees

To fulfill the individual requirements of all the public authority workers, Axis Bank is here. The moneylender offers individual credit to the representatives of public area endeavours, including Central, State, and Local Bodies. The base net month to month pay of a worker should be INR 15,000/20,000 to profit the greatest advance measure up to INR 40 Lakh. The individual advance offered by the Axis bank accompanies a residency of 5 years alongside a handling expense of 1.50% of the advance sum.

Axis Bank Personal Loan Offers for Government Employees:

| Offers By Government | Number of Companies | Processing Fee(% of the Loan Amount | IRR |

| Miniratna, Navratna, and Maharasthra | 55 | 1.50% | 13.49% 11.49% 10.99% |

| Pensioner | All | 1.50% | 14.75% |

| Employees from the Railway Department | All | 1.50% | 16.50% 15.00% 14.25% |

| CISF, CRPF, ITBP, SSB and BSF | All | 1.50% | 14.75% |

State and Central Government Officers:

| Section | Salary | Processing charge | IRR |

| Government Officer Division A (GA) and Division B (GB) | NTH>24k | 2% | 16.75% |

| NTH>35k | 2% | 15% | |

| NTH>50k | 1.75% | 14.75% |

Loan for Pensioners

Axis Bank offers special plans for Pensioners looking out for Personal Loan. They provide good funding at attractive rates of interest to pensioners. Some of the features of Axis Bank Personal Loan for Pensioners are listed below:

- Minimum Pension Amount – 25000+

- Maximum age – 65 years at loan maturity

- 50% of extra income (FD interest rental income, etc.) can be counted as Actual Income

- Axis Bank Personal Loan Interest Rate – 9.99%

- Tenure – a minimum of 12 months

Loan Balance Transfer

Personal Loan Balance Transfer refers to a process where you shift your personal loan from one lending institution to another. In this, your new bank pays off your previous loan and gives you the loan. You get many benefits if you do this, but you may have to pay the foreclosure charges associated with that loan along with the Processing fee on your new loan. Some of the benefits are listed below:

- Lower Interest Rate

- Extended Tenure for the Repayment

- You may also get additional features associated with your loan, such as no processing fee, etc., based on your CIBIL score.

Loan Top Up

Top up facility on your loan is the additional amount you borrow from the bank on your existing loan. Axis Bank lets you avail of this facility if you have paid at least 9 regular EMIs without any hindrances in payment. You can get a top-up of a minimum of Rs. 50,000 and a maximum of your already sanctioned loan amount.

Loan Overdraft Scheme

Axis Bank Personal Loan Offers an Overdraft Scheme. With this, you are provided a loan amount as an overdraft facility. It works like a Credit Card, where you can spend your Personal Loan Amount as you want anytime anywhere. The overall loan amount will have a Credit/Loan Limit. In the Axis Personal Loan Overdraft facility, the bank charges interest only on the amount you withdraw/utilize

Home Renovation Loan

Home renovation now tops the priority list for most borrowers, but funds become an obstacle in the process. Axis Bank Home Renovation Loan is introduced to get your home refurbished whether it is repainting or tiling Axis Bank loan covers it all. The key highlights of the Axis Bank home renovation loan are as follows:

- The home renovation loan schemes and policies include basic documentation and no-complexity.

- The Axis Bank Home loan is available for both existing and new customers.

- This individual unsecured loan is available at least an interest rate of 8.00% p.a.

- The loan processing fee is charged at a favourable rate of 0.50% along with added tax.

Holiday Loan

A holiday loan is nothing but a credit taken against your travelling expenses and lodging services required to add to your get-away. You can check the characteristic features of the holiday loan to approve funds for your exotic dream vacation simply:

- Axis Bank assures instant disbursal of the loan advance for your holiday fun.

- The processing fee is charged at a minimal rate.

- The interest rate applicable to the Holiday Loan is 11.25% and so on.

Axis Bank Fresher Funding

Axis Bank has accelerated in the world of credit which now has introduced a new category of Axis Bank Freshers Funding. This special type of loan is accessible to those applicants who are graduates and newly minted professional employees who are seeking funds to establish a stable future. The following are the key features that the Freshers Funding exhibit:

- A favourable credit sum is provided to the applicants.

- The candidate must be 21 years of age or more.

- The interest rate charges are dependent on the applicant’s profile.

Loan for NRI

For many valid reasons, people tend to move out, including education, medical facility, job, etc. For such candidates, financial expenses become an obstacle; such emergency personal expenses are looked after by the special loan category called Axis Bank NRI Personal Loan. The important features of the individual loan are as given below:

- Highly competitive rates and flexible repayment tenures for the applicant.

- No collateral or security is demanded or the advance disbursement.

- The document proof must be attached for both the Indian resident (primary borrower) and the NRI candidate (co-applicant).

Loan Pre-Closure Online

Axis Bank allows the borrowers to pre-pay their personal loan after the completion of a specific time period at some additional foreclosure charges. However, there are a few Axis personal loan pre-closure criteria that you need to meet to close the account.

- Pre-closure of your Axis Bank personal loan will be allowed any time during the entire loan tenure after at least 1 installment is paid by the borrower.

- For pre-paying or pre-closing your Axis Bank personal loan, you will have to repay the total outstanding amount along with all other applicable charges

- You have to pay 5% of the loan amount that is outstanding after the payment of the EMIs along with taxes before closing your personal loan as pre-closure charges.

Loan Process Steps

Step 1: Determine your requirement.

Figure out why you need a Personal Loan and how much you need. For example, you may need a loan to fund your wedding or to renovate your home. And you may need just Rs. 1 lac or Rs. 10 lac.

Step 2: Check loan eligibility

Once you know how much you need, you should check whether you are eligible. You can visit the Axis Bank Personal Loan Eligibility Criteria online, to find out how much you can borrow as a Personal Loan. Axis Bank offers loans up to Rs. 40 lac.

Step 3: Calculate monthly installments –

Use an online EMI tool to calculate your approximate loan repayments every month. You can modify the interest rate and tenure to match your monthly income, like on the Axis Bank Personal Loan EMI Calculator. Axis Bank offers pocket-friendly EMIs on all its Personal Loans starting at Rs. 2149 per lac * (T&C).

Step 4: Approach the bank –

You can apply for a Personal Loan with Axis Bank in various ways: Via Net Banking, online on the Axis Bank website, at an ATM, or by visiting a branch.

Step 5: Submit documents -.

Next, find out what documents are required for a Personal Loan. You will usually need income proof (bank statements, salary slips or IT returns), address proof, and ID proof. Hand over copies of your Personal Loan documents at the bank.

Wait for funds to be remitted to your account. Axis Bank disburses funds for pre-approved loans to customers in 10 seconds*, and for non-Axis Bank customers in 4 hours*.

That’s how to get a Personal Loan in 5 easy steps!

Prepayment Charges

If you are a salaried applicant, you can pre-pay your Axis Bank Personal Loan only after paying 12 equated monthly installments completely.

The pre-payment charges for salaried applicants are as follows:

- 4% of the outstanding principal amount for 13 to 24 months.

- 5% of the outstanding principal amount for 25 to 36 months.

- 2% of the outstanding principal amount for more than 36 months.

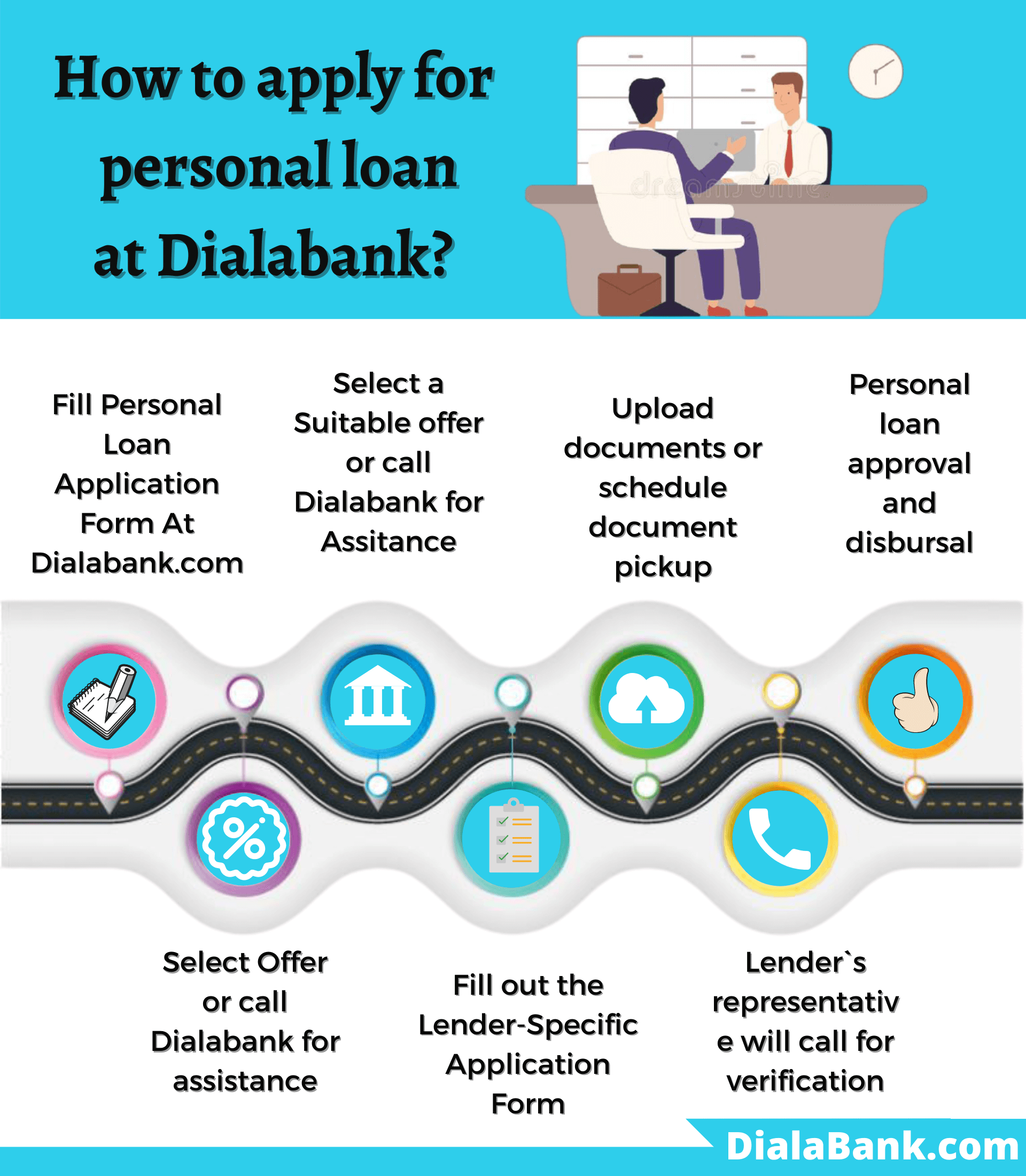

How to Apply Online for Axis Bank Personal Loan?

Apply for Axis Bank Personal Loan online by visiting the Axis Bank’s online website and filling the loan form for applying for a personal loan, Dialabank guarantees to provide you with the best financial services from major banks of the country. To be a part of this journey, you had to follow the steps given below:

-

- Go to the website of Dialabank.

- Go to the personal loan section.

- In the personal loan section, you can apply either as a self-employed individual or a salaried individual.

- Once, you fill in all the important details about yourself, submit the form.

- After form submission, you will have to wait for our representative to call you.

- Eventually, our representative will guide you through the process of the loan.

- You get a loan at an affordable interest rate without moving here and there.

- To know more, you can call on 9878981166.

Axis Bank Personal Loan verification process

Coming up next are fundamental strides of the individual credit confirmation measure after online accommodation of your advance application on Dialabank.

Step1. Dialabank will advance your advance application to your picked loan specialist and commonly within 48 hours, and you will get a call from the moneylender’s delegate.

Step2. The imminent bank will plan a pickup of your KYC, pay, and so on records or give a choice to transfer them on the web. These archives will be utilized to confirm your application.

Step3. When the moneylender’s confirmation is finished, and your advance is affirmed, you will get another call to check the advance offer and request your consent for disbursal.

Step4. After credit endorsement and a good check, the advance is typically dispensed within 48 hours.

Note: The previously mentioned turnaround time for individual advance check/disbursal may differ dependent on the moneylender’s inner prerequisites just as other measures.

Check your Axis Bank PL application Status Online

The cycle to check your application status incorporates the accompanying advances:

- Visit the official site of Axis bank, Click on ‘Items’ and select ‘Individual Loans’.

- On the following page that opens in the future, click on ‘Additional’ and select ‘Check Loan Application Status’.

- Next, you can check your application status by entering subtleties like your mobile number, date of birth and by either entering the OTP that you get on your versatile number or through your application number.

How to login to the Axis Bank Portal

- Visit the official site of Axis Bank.

- On the upper right corner of the page, click on ‘Login’.

- Login utilizing your User ID and Password or your enrolled versatile number.

How to Check Your Loan Statement

Clients can download the bank’s very own credit explanation by following the means given underneath:

- Visit the official site of the bank.

- Click on ‘Connect’ and select ‘Administration Requests’ starting from the drop list.

- On the following page that opens, under the ‘Advances’ menu, select ‘Individual Loan Related’.

- Next, click on ‘Solicitation for Statement of Loan Account’.

- Login utilizing your User ID and secret phrase or utilizing your enlisted versatile number and OTP to benefit the bank’s very own advance assertion.

Personal Loan Restructuring in Axis Bank(COVID-19)

The cross country lockdown because of the COVID-19 pandemic has affected numerous borrowers unfavourably and to alleviate its effect to a specific degree a multi-month ban on other term credits was reported. After the finish of the half-year ban, Axis Bank had declared the RBI-ordered one-time advantage of Axis Bank individual credit rebuilding.

This component is intended to give proceeded with alleviation to those borrowers who are as yet incapable of beginning reimbursement of their normal EMI due ongoing money related difficulty coming about because of the pandemic.

The credit goal instrument presented by Axis Bank offers an extra ban of as long as two years or augmentation on the current reimbursement time frame to lessen the month to month EMI installments. It is essential to tolerate at the top of the priority list that rebuilding of your Axis Bank personal advance will bring about extra premium charges well beyond that material to the first credit.

Subsequently, this help instrument should just be utilized if all else fails, so you don’t wind up defaulting on your great credit.

Axis Bank Customer Care Contact

Clients can contact the Axis Bank customer care via any of the following means:

- By Phone: You can call Axis Bank on 9878981166 (toll-free)

- Callback Request: You can also request a call back by visiting the bank’s website

- Online Chatbot: You can also get your inquiries clarified by the iPal chatbot online

- Branch Visit: You can visit the nearby Axis Bank branch to get your queries

Benefits of Applying for Personal Loan on Dialabank

There are different points of interest in applying for individual credit on the Dialabank site. Some of them are given underneath:

24 x 7 Accessibility: You can get to the Dialabank site whenever and anyplace and consequently, apply for an individual credit whenever from the solace of your home or office.

Various moneylenders on a solitary stage: Dialabank empowers you to get to individual advance proposals from numerous planned loan specialists on a solitary stage and along these lines takes out the need to visit different bank sites or branches.

Know EMI right away: With the individual credit EMI adding machine on Dialabank, you can check the EMIs you would be paying on a personal advance even before you apply for one. It will assist you in obtaining the proper sum that you can undoubtedly reimburse and have a good reimbursement plan.

Liberated from cost: Additionally, you are not needed to pay any charges when you apply for an individual credit on Dialabank.

How to get the best offer on Axis Bank Personal Loan?

You can get the best personal interest rates from Axis Bank subject to an assessment of your loan amount, salary, other obligation company you work with, and loan tenure. The following factors determine the personal loan rate of interest you can expect to get from Axis Bank:

How does the Personal Loan process work in Axis Bank?

Here is the process:

| Maximum Annual Percentage Rate (APR) | 11% to 22.5% |

| A representative example of the total cost of the loan, including all applicable fees |

Here is an illustration of the total cost of the loan:

Total amount borrowed: ₹ 1,00,000 Time period: 12 Months to 60 Months Axis Bank Personal Loan Interest Rate: 10.50% to 22.00% Processing Fee payable to Upto ₹ 2,500 Fee payable to MyLoanCare: NIL Total Monthly Cost – From ₹ 2,149 for 60 Months ₹ 1,00,000 loan at 10.50% (lowest rate, longest time period) to ₹ 9,359 for 12 Months ₹ 1,00,000 loan at 22.00% (highest rate, shortest time period). This is inclusive of principal repayment. Annual Percentage Rate (APR) of charge including all applicable fees: 11% to 22.5% Total cost payable over loan tenure: ₹ 8,278 for 12 Months loan to ₹ 31,463 for 60 Months loan |

Important Aspects

Given beneath are some significant perspectives that you should consider while applying for an individual credit with Axis Bank:

- While applying for a personal advance, it is in every case great to check your credit assessment. A decent credit assessment expands the odds of endorsement of your credit and can empower you to profit an individual advance on more great terms.

- Before finishing upon a specific bank, it is prudent to look at the expense of an individual advance (premium expense and all the pertinent expenses and charges) offered by different moneylenders on Dialabank.

- Get as indicated by your need and reimbursement capacity. Try not to acquire just because you are qualified to obtain a higher sum. It will just add to your advantage cost and not have many advantages over the long haul.

- Try not to apply for individual advances with different banks simultaneously. It shows you to be eager for credit and expands the number of demanding requests for your credit report, which may unfavourably influence your credit assessment.

FAQs About Axis Bank Personal Loan

✅ How to apply for Axis Bank Personal Loan?

You can apply for a personal loan with Axis Bank by visiting the nearest branch of Axis Bank or by a simple form submission with Dialabank. You get the benefit to apply from anywhere and get quick online approval with Dialabank.

✅ What is the Interest Rate for Axis Bank Personal Loan?

Axis Bank’s interest rate is 10.49% per annum for its personal loan products.

✅ What is the minimum age for getting a Personal Loan from Axis Bank?

You should be 21 years old to apply for a personal loan with Axis Bank.

✅ What is the maximum age for getting a Personal Loan from Axis Bank?

The maximum age for availing of a personal loan from Axis Bank is 60 years.

✅ What is the minimum loan amount for Axis Bank Personal Loan?

The minimum loan amount for a personal loan from Axis Bank is Rs 50000.

✅ What is the maximum loan amount for Axis Bank Personal Loan?

You can take a maximum loan amount of Rs. 15 lakhs from Axis Bank under the personal loan scheme.

✅ What are the documents required for Axis Bank Personal Loan?

Aadhaar card/Voter ID, PAN card, salary slips of last 6 months/ITR files of the last two years, and two recently clicked photographs are required for a personal loan from Axis Bank.

✅ What is the Processing Fee for Axis Bank Personal Loan?

Axis Bank charges a processing fee of 1% of the loan amount plus GST for the personal loan.

✅ How to get Axis Bank Personal Loan for Self Employed?

Axis Bank provides special offers for self-employed borrowers to aid them financially. You must have the ITR files of the last two years as your income proof.

✅ What is the Maximum Loan Tenure for Axis Bank Personal Loan?

The maximum loan tenure period for a personal loan from Axis Bank is 60 months.

✅ What should be the CIBIL Score for Axis Bank Personal Loan?

You should have a CIBIL score of 750 or above for availing of a personal loan from Axis Bank.

✅ Do I have a preapproved offer for Axis Bank Personal Loan?

You can examine your preapproved personal loan offers from Axis Bank with Dialabank. You have to fill the form, and we will examine all the offers for you and get back to you to help you choose the best one.

✅ How to calculate EMI for Axis Bank Personal Loan?

You can use the EMI calculator accessible at Dialabank’s website to calculate your personal loan EMIs from Axis Bank.

✅ How to pay Axis Bank Personal Loan EMI?

Your personal loan EMIs from Axis Bank are automatically subtracted from your bank account every month. You can also use the net-banking services of Axis Bank for the payments of your personal loan.

✅ How to close Axis Bank Personal Loan?

You will pay all the outstanding personal loan amount and then contact the branch of Axis Bank to collect your no dues certificate.

✅ How to Check Axis Bank Personal Loan Status?

You will require the visit to the Axis Bank branch to check the status of your personal loan. On the other hand, you can visit Dialabank and fill a simple form to let us do the hard work for you.

✅ How to close Axis Bank Personal Loan Online?

Closing of personal loan from Axis Bank includes the following steps:

- Visit the net-banking page of Axis Bank.

- Log in by filling in your details.

- Pay for your personal loan amount and save the transaction receipt.

✅ How to pay Axis Bank Personal Loan EMI Online?

Your personal loan EMI can be paid using the net-banking facility of Axis Bank. Dialabank lets you compare offers and deals from different banks to choose the best, to get a low-EMI personal loan. All you have to do is fill a simple form, and we will do the rest for you.

✅ How to check Personal Loan Balance in Axis Bank?

To check out the personal loan balance in Axis Bank, you will contact the customer care number of Axis Bank. If you are in search of low-interest personal loans, you can visit Dialabank and fill a simple form for Personal Loan Balance Transfer, and we will do the work for you.

✅ How to download Axis Bank Personal Loan Statement?

The personal loan statement of Axis Bank can be downloaded through the mobile banking app of Axis Bank. also, visit the online platform of Dialabank and fill a form to compare and check about all the offers that we have for you.

✅ How to Top Up Personal Loan in Axis Bank?

You will have to visit the bank branch and contact the loan officer if you require a top-up on your personal loan from Axis Bank. You can also fill a simple form with Dialabank at Personal Loan Top Up and leave the rest to us.

✅ What happens if I don’t pay my Axis Bank Personal Loan EMIs?

Axis Bank charges a penal interest if you don’t pay your personal loan EMIs. Also, apply for a balance transfer through Dialabank to avail of low-interest personal loans.

✅ How to find the Axis Bank Personal Loan account number?

You will require to contact your loan branch of Axis Bank to check your personal loan account number. You may also fill out the form available at Dialabank and let us do all the work for you.

✅ What is the Axis Bank Personal Loan overdraft scheme?

For simplifying the process and providing you with a hassle-free service while processing an overdraft scheme at Axis Bank Personal Loan is provided, it gives you an online way to get your own overdraft, also known as Smartdraft – Overdraft Against Salary. You do not need to visit bank branches and go through a boring process. Just log in to the Axis Bank online banking portal and from there you can fill out a simple form and get an overdraft under your name.

✅ What are the Axis Bank Personal Loan pre-closure charges?

Axis Bank Personal Loan pre-closure charges are Nil.

✅ What is the Axis Bank Personal Loan maximum tenure?

The Axis Personal loan maximum tenure is 36 months.

✅ What is the Axis Bank Personal Loan minimum tenure?

The Axis Bank Personal Loan minimum tenure is 12 months.

✅ What is the Axis Bank Personal Loan customer care number?

You can call Axis Bank on 9878981166.