What is CIBIL in Personal Loan?

A personal loan is a kind of loan provided by a bank to fulfil your personal needs. It comes in the category of medium-term or short-term loans. The time for which the loan is provided is specified before sanctioning the loan. You have to pay back the loan amount with some rate of interest within the prescribed time.

Furthermore, you can return the loan even before the tenure of the loan. This is known as pre-payment. Almost every bank provides you with this facility of pre-payment. But before this process bank puts some checks on the age, income, and credit history (CIBIL). So let us understand what CIBIL in personal loans is.

What is CIBIL?

First of all, it is important to know that CIBIL is India’s first credit information company. The full form of the CIBIL is Credit Information Bureau India Limited. It maintains all the records of the credit cards and the loans of all customers in every banking and non-banking company. In this way, it is easy to keep the records of all the loans and other financial debts of customers.

What is a CIBIL Score?

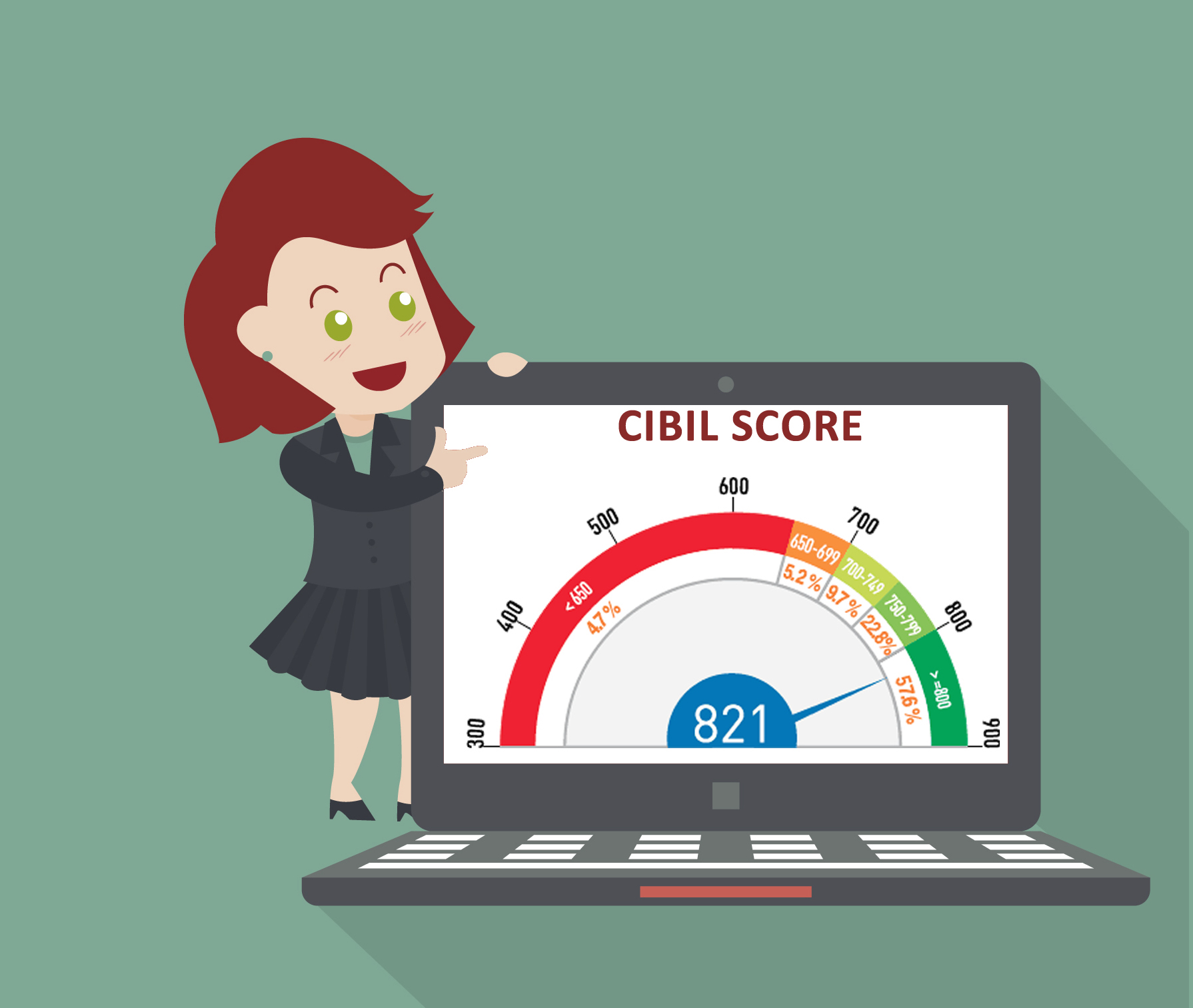

CIBIL score is basically a parameter set by the CIBIL to measure the credit history of the customer. It lies between 300 to 900. The more, the better.

If your CIBIL score is nearer to 900 or greater than 720, you will easily get a personal loan. And if it is less than 620, then it is considered a bad credit score. You will have a problem getting a personal loan then.

How your CIBIL gets bad?

If you have gotten any personal loan and haven’t paid it properly, your CIBIL score can affect you badly. But, on the other hand, if you don’t pay your credit card bills properly, your CIBIL score also gets affected.

Special Note: An individual must examine the whole EMI amount payable to the lender with the Personal loan EMI calculator.