Indian Overseas Bank Personal Loan Key Features May 16 2024

| Indian Overseas Bank personal loan eligibility calculator | Details |

| Age | 21 – 60 (at loan maturity) |

| CIBIL score | Minimum 750 or above |

| Indian Overseas Bank Personal Loan Interest Rate | 10..40% per annum |

| Lowest EMI per lakh | Rs 1873 |

| Tenure | 12 to 72 months |

| Indian Overseas Bank Personal Loan Processing Fee | Up to 0.50% of the loan amount + taxes |

| Prepayment Charges | NIL |

| Part Payment Charges | Allowed after 12 Months (2 – 4 %) |

| Minimum Loan Amount | ₹50,000 |

| Maximum Loan Amount | ₹ 15 Lakh |

Indian Overseas Bank Personal Loan Interest Rates and Charges

| Indian Overseas Bank Personal Loan Interest Rate | 10.40% per Annum |

| Indian Overseas Bank Personal Loan Processing Charges | Up to 0.50% of the loan amount + taxes |

| Prepayment Charges | 36 months: 2% of loan principal outstanding |

| Stamp Duty | As per state laws |

| Cheque Bounce Charges | As per bank terms |

Indian Overseas Bank Personal Loan Status

You can check the status of your Indian Overseas Bank Personal Loan by the following methods –

- You can visit your loan branch and ask the banker for the same.

- Log In to the Indian Overseas Bank Net banking Portal, Click on loans from the top ribbon and click on Enquire to check the status of your loan.

Indian Overseas Bank Personal Loan Eligibility

There are some Eligibility Criteria regulated by the bank to provide an Indian Overseas Bank Personal Loan. You need to qualify the Indian Overseas Bank personal loan eligibility criteria if you want finance to meet your requirement. As Indian Overseas Bank Personal Loan is an unsecured loan, the eligibility criteria differ for both salaried and self-employed applicants. Given below are the conditions that you need to full fill.

| CIBIL score | 750 and Above |

| Age | 21-60 years |

| Min Income | Rs 18000/month |

| Occupation | Salaried/Self-employed |

Indian overseas bank personal loan Fees and Other Charges

Indian Overseas Bank’s loan interest rate could be higher than other loaning schemes, and this is due to the fact they there is no collateral that banks can take as a security against the loan amount. On the other hand, Indian Overseas Bank provides personal loans at a starting interest rate of 10.40% annually. As a result, you don’t have to worry about the vast amount that needs to be paid monthly.

The tenure period of a personal loan starts from 12 months (1 year) to 60 months (5 years). In addition to this, you can pay the Indian Overseas Bank Personal Loan amount before the tenure ends and save a couple of bucks by using a foreclosure scheme. The foreclosure charges range from 2-3% of the total loan amount.

| Category | Details |

| Indian Overseas Bank personal loan interest rate 2021 | 10.40% per annum |

| Processing Charges | Up to 0.50% of the loan amount + taxes |

| Min ₹ 1000 and Max ₹ 25000 | |

| Prepayment | NIL |

| Preclosure | No foreclosure is allowed until 12 EMIs are paid |

| Prepayment Charges | 13-24 months: 4% of loan principal outstanding |

| 25-36 months: 3% of loan principal outstanding | |

| >36 months: 2% of loan principal outstanding | |

| Stamp Duty | As per state laws |

| Cheque Bounce Chgs | ₹ 550/chq + GST |

| Floating Rate of Interest | Not Applicable |

| Overdue EMI Interest | 2% p.m.(on overdue amount) |

| Amortisation Schedule Chgs | Rs 200 + GST |

Indian Overseas Bank personal loan documents required

| Form | Duly filled application form |

| Proof of Identity | Copy of: Passport Driving License Aadhar Card Voter ID Card |

| Proof of Address | Rent Agreement (Min. 1 year of stay) Utility Bills Passport (Proof of permanent residence) Ration card |

| Proof of Income | ITR: Last two Assessment years Salary Slip: Last 6 months Bank Statement: Last 3 months |

Personal loan EMI calculator for Indian Overseas Bank

Indian Overseas Bank Personal Loan Compared to Other Banks

| Bank | Interest Rate | Tenure | Loan Amount & Proc Fee |

| Indian Overseas Bank | 10.40% | 12 to 60 months | Up to Rs. 10 lakh / 1% to 2% of Loan Amount |

| HDFC Bank | 10.50% to 21.50% | 12 to 60 months | Up to Rs. 40 lakh / Up to 2.50% of the loan amount |

| Bajaj Finserv | Starting from 12.99% | 12 to 60 months | Up to Rs. 25 lakh / Up to 3.99% of the loan amount |

| Axis Bank | 7.35% to 24% | 12 to 60 months | Rs. 50,000 to Rs. 15 lakh / Up to 2% of the loan amount |

| Citibank | Starting from 10.50% | 12 to 60 months | Up to Rs. 30 lakh / Up to 3% of the loan amount |

| Private Bank | 10.50% to 19.25% | 12 to 60 months | Up to Rs. 20 lakh / Up to 2.25% of the loan amount |

Why should you apply for Indian Overseas Bank Personal Loan with Dialabank?

Dialabank helps you choose the best financial products without any hassle. We make it simple for you to decide what product you should avail of to fulfil your needs.

How to Calculate EMIs for Personal Loan in Indian Overseas Bank

You can use the EMI calculator given below.

Indian Overseas Bank Personal Loan Processing Time

A personal loan from Indian Overseas Bank takes about a week or two to get processed. Borrowers with an existing relationship with the bank can get their loan processed within 48 hours.

Indian Overseas Bank Personal Loan pre-closure charges

Indian Overseas Bank provides you with the foreclosure facility on your personal loan without any charges. You can pay back your personal loan when you have the required funds.

Documents Required for Preclosure of Indian Overseas Bank Personal Loan

Generally, the following documents are required to foreclose your Indian Overseas Bank personal loan:

- A valid photo identity proof

- Loan Account Statement

- Cheque/ demand draft/ cash to make the payment

Indian Overseas Bank Personal Loan Foreclosure Benefits

Given below are a few key benefits of foreclosing your Indian Overseas Bank personal loan:

Foreclosure / Full Prepayment

- Helps you save on the overall interest payout.

- Frees you from the burden of regular loan repayments.

Partial Prepayment

- It enables you to save on the interest component.

- You also have the advantage of either paying a reduced EMI amount or having a shorter loan tenure.

Indian Overseas Bank Prepayment Facility

The bank also offers prepaid accommodation to help customers pay the full amount or part of it. If you have a balance left over and you meet the conditions below you can pay part of your principal balance to reduce the same. This will also help save interest on accumulated capital. Find out more about the facility below.

Note:

- Prepayment will be allowed subject to the effective payment of the first 12 EMIs.

- Prepayments will be allowed twice the entire loan period.

- Prepayment is allowed only once a year.

- At any time, the advance payment will not exceed 25% of the Principal Outstanding

Prepayments.

Charges:

- 13-24 months – 4% of outstanding loan balance

- 25-36 months – 3% of outstanding loan balance

- Over 36 months – 2% of outstanding loan balance

Pre Calculated EMI for Indian Overseas Bank Personal Loan

| Loan principal @ interest | Tenure | ||||

| 1 year | 2 years | 3 years | 4 years | 5 years | |

| 5 lakh @ 11% | Rs. 44,190 | Rs. 23,303 | Rs. 16,369 | Rs. 12,922 | Rs. 10,871 |

| 7 lakh @ 11.25 % | Rs. 61,948 | Rs. 32,706 | Rs. 23,000 | Rs. 18,176 | Rs. 15,307 |

| 10 lakh @ 12% | Rs. 88,848 | Rs. 47,073 | Rs. 33,214 | Rs. 26,333 | Rs. 22,244 |

Indian Overseas Bank Personal Loan for Salaried Employees

Indian Overseas Bank offers Personal Loan for Salaried Employees at attractive rates of interest. The amount that you get a loan depends on the Company that you work for, The take-home salary of the employee, and the city of residence of the employee. Indian Overseas Bank offers these loans for a tenure of 12-60 months and provides instant approval along with funds to pre-approved customers.

Indian Overseas Bank Personal Loan for Self Employed Individuals

Indian Overseas Bank’s Personal Loan for Self Employees is a loan product offered to self-employed individuals and in need of funds. The bank provides them with attractive rates of interest on their loan and tenure of 12-60 months. However, as compared to Salaried Employees, you have to present more documents here as you need to provide the bank with sufficient documents related to your business to prove its continuity as well as your steady income.

Indian Overseas Bank Personal Loan for TCS Employees

- Exclusive personal loans with a reasonable interest rate of 11.25% p.a.

- EMI for personal loans starts at Rs.2178 per lakh when terms and conditions are met.

- The hassle-free documentation process for TCS employees.

- Pre-approved personal loans for eligible TCS employees.

- Interest rate starting at 11.99% p.a for superbike loans.

- Great offers on home loans with an interest rate of 9.45% p.a and discount interest rate for women at Rs.9.40% p.a.

Indian Overseas Bank Moratorium Process

The process for setting up your Indian Overseas Bank loan EMIs is as follows-

- Visit the Indian Overseas Bank website or use the mobile app

- Click on the link where the suspension period appears

- On the application page, state your registered mobile number, name, email address

- Then enter your date of birth and choose the type of loan

- Enter your loan number and state your EMI value

- Then make a decision and choose the right app

- Click on the EMI reversal option that says I agree to pay interest earned on the remaining balance

- Click the ‘Submit’ button

- The bank will review the details and process your application for suspension

- You will be given a reference when successfully completing the process on your registered number and email address

Indian Overseas Bank Personal Loan Special Pricing

If a customer is looking for INR 15 lakh of the loan amount or more than that below rates would be applicable.

| Loan Amount | IRR | Processing Fee (+GST) |

|---|---|---|

| Loan amount >=15 lakh* | 10.50% | INR 3999 |

*Terms & conditions apply

This offer is not applicable for Top-up/ Enhancement/ Existing loan amount closure.

If a customer is looking for a Balance transfer and a fresh loan of above INR 10 lakh above, the below offer is available.

| NTH | Loan Amount | IRR | Processing Fee (+GST) |

|---|---|---|---|

| >=50000 | Loan amount >=10 lakh* | 10.50% | INR 3999 |

*Terms & conditions apply

- Not applicable on Existing loan closure

- Not applicable for Credit card BT

How to Manage Personal Loan

Here are the 4 tips that will help you manage your loans:

- Pay On Time: The first step is to avoid late fees and penalties. The best way to do that is by paying your monthly payments on time every month. This also hits the credit score. These are needless and all too common consequences that will work against your financial condition.

If you have just taken a personal loan or are about to, the best way to manage your loan is by making a monthly payment on your loan as soon as you receive the loan. By being a payment ahead of your installment plan you will have a buffer against a missed payment. - Pay More Than Your Minimum: Paying beforehand is a good option for managing your plans but paying a little extra every month keeps you ahead of your loan term and provides you with some other financial bonuses.

Moreover, paying extra on your loan reduces the length of the repayment plan. This will help you clear the debt and allows you to regain your financial independence sooner. It will also reduce the rate of interest you owe and thus, saving you money in the long run.

Paying off your debts faster also leads to an improvement in your credit score. A lower credit score will benefit you in several ways, like dropping down payments and rates of interest. - Consolidate Your Loans: For debtors managing multiple personal loans, consolidation could be the best way to simplify your debt repayment. Debt Consolidation is when you take a large loan to repay all the other loans you have taken. So, instead of paying multiple lenders every month with different rates of interest and needs, one can make a single payment to one provider.

Debt Consolidation is helpful if you can save an interest rate on a new loan that is lower than the average interest rate of the earlier loans.

The only disadvantage that lies here is that one will likely end up having to reimburse the debt quicker than before. Before consolidating your debt, make sure that you can make the payments on a new loan. This may also help to reimburse large portions of your loans on credit rather than with a single loan, consolidating it into more controllable pieces. - Credit Score: Last but not the least, always keep a close watch on your credit score while reimbursing a personal loan. The credit score plays a major role in finances and has an important relationship with the loans taken out. How you manage your loans is reflected in your credit score. On the other hand, falling behind on your payments will subordinate the credit score. Thus, a higher credit score is important.

Different Personal Loan offers by Indian Overseas Bank

Indian Overseas Bank Doctor Loan

Doctors and medical professionals can apply for a personal loan from Indian Overseas Bank and enjoy a range of offers and deals curated to their personal and professional needs.

Indian Overseas Bank Marriage Loan

Marriages are one of the costliest events in Indian households. Indian Overseas Bank has personal loan offers with a low-interest rate and high loan quantum to meet your wedding expenses.

Indian Overseas Bank Personal Loan for Government Employees

Government employees can apply for an Indian Overseas Bank personal loan to meet their financial expenses. The bank has personal loan offers to meet your different monetary needs.

Indian Overseas Bank Personal Loan Offers for Government Employees

| Offers By Government | Number of Companies | Processing Fee(% of the Loan Amount | IRR |

| Miniratna, Navratna, and Maharasthra | 55 | 1.50% | 13.49% |

| 11.49% | |||

| 10.99% | |||

| Pensioner | All | 1.50% | 14.75% |

| Employees from the Railway Department | All | 1.50% | 16.50% |

| 15.00% | |||

| 14.25% | |||

| CISF, CRPF, ITBP, SSB and BSF | All | 1.50% | 14.75% |

State and Central Government Officers:

| Section | Salary | Processing charge | IRR |

| Government Officer Division A (GA) and Division B (GB) | NTH>24k | 2% | 16.75% |

| NTH>35k | 2% | 15% | |

| NTH>50k | 1.75% | 14.75% |

Indian Overseas Bank Personal Loan for Pensioners

Government employees can fulfill their post-retirement financial needs by applying for a personal loan with Indian Overseas Bank. The bank has special offers for all the pensioners with their pension account with the bank.

Indian Overseas Bank Personal Loan Balance Transfer

Personal Loan Balance Transfer is the process of transferring your existing personal loan with another bank to a new lender for lower rates of interest and better loan terms. You can apply for Indian Overseas Bank’s loan balance transfer to lower your financial burden.

Indian Overseas Bank Personal Loan Top Up

Indian Overseas Bank’s loan top-up is a facility through which you can avail of additional funds under the same existing personal loan without applying for a fresh loan. Dialabank helps you choose the best personal loan offers available for you.

Indian Overseas Bank Personal Loan Overdraft Facility

An individual overdraft is a credit office that licenses you to pull out an all-out as and when required. You can similarly repay the got out absolutely at whatever point the condition is ideal. Thusly, it is maybe the most preferred credit decisions that profited to meet changing individual supporting necessities unbounded.

Apply for an overdraft office as an Indian Overseas Bank Personal Loan. The adaptable improvement office has all the gigantic features of an unreliable overdraft credit.

Indian Overseas Bank Home Renovation Loan

For customers who plan to have their house renovated, Indian Overseas Bank provides home improvement loans. This personal loan will finance critical repairs or assist the borrower in bringing into their home new appliances, fixtures, and furniture. Four of the Indian Overseas Bank Home Renovation Loan’s key features are:

- For Indian Overseas Bank, the home improvement loan interest rate starts at as low as 11.25 percent.

- For a credit amount of up to Rs. 20 Lakh, individuals can apply to renovate their house.

- Indian Overseas Bank’s home improvement loan includes minimal paperwork that makes the whole loan process hassle-free.

- Usually, after the bank accepts the application, the loan amount is credited to the account within 72 hours.

Indian Overseas Bank Holiday Loan

With minimal disruption, the Indian Overseas Bank Holiday Loan will help you plan for your dream trip. This Indian Overseas Bank personal loan would cover a variety of holiday expenses, including booking a flight ticket, lodging at a hotel, guided tours, etc. The Indian Overseas Bank vacation loan’s key features are:

- The holiday loan interest rates start at 11.25 percent p.a.

- A sum of up to Rs 20 Lakh can be easily used so that your dream holiday will not be ruined by a financial crisis.

- Simplified and Minimal paperwork helps efficiently and effectively finance your holiday.

- Fast processing and credit disbursement, which is credited directly to your account.

Indian Overseas Bank Fresher Funding

For individuals with a daily income, often unsecured personal loans are targeted, but the Fresher Funding of Indian Overseas Bank is different. This Indian Overseas Bank loan option is intended to assist beginners, i.e. recent graduates who are pursuing their first job. The following are some main features of the Indian Overseas Bank Fresher Funding personal loan:

- Amount of borrowings of up to Rs 1.5 lakh

- The nominee should have been at least 21 years of age.

- The interest rate for Fresher Funding depends on the loan borrower’s profile, applicant’s credit history/score, age and venue.

Indian Overseas Bank NRI Personal Loan

Indian Overseas Bank offers an exclusive loan to NRIs only, understanding the hopes and dreams of NRIs. An Indian citizen must be the primary loan candidate and the co-applicant NRI must be a related relative. The following features include Personal Loan for NRIs

- Indian Overseas Bank makes private loans available with flexible end-use NRIs of up to Rs. 10 lakh.

- NRI Personal Loans’ interest rates start at 15.49 percent p.a.

- The loan is for a period of up to 36 months.

Indian Overseas Bank Personal Loan Preclosure Online

Indian Overseas Bank enables a Personal loan borrower to make a pre-closure or a pre-payment of a loan. However, you will be able to prepay your Indian Overseas Bank Personal Loan only after 12 months after you have procured your loan and after paying 12 EMIs plus the foreclosure charges that may be applicable. If you meet this requirement, you can repay your personal loan before the original due date and close your loan early.

Indian Overseas Bank Personal Loan Process Steps

Step 1: Determine your requirement

Figure out why you need a Personal Loan and how much you need. For example, you may need a loan to fund your wedding or to renovate your home. And you may need just Rs. 1 lac or Rs. 10 lac.

Step 2: Check loan eligibility

Once you know how much you need, you should check whether you are eligible. You can visit the Indian Overseas Bank Personal Loan Eligibility Criteria online, to find out how much you can borrow as a Personal Loan. Indian Overseas Bank offers loans up to Rs. 40 lac.

Step 3: Calculate monthly installments

Use an online EMI tool to calculate your approximate loan repayments every month. You can modify the interest rate and tenure to match your monthly income, like on the Indian Overseas Bank Personal Loan EMI Calculator. Indian Overseas Bank offers pocket-friendly EMIs on all its Personal Loans starting at Rs.1873 per lac * (T&C).

Step 4: Approach the bank

You can apply for a Personal Loan with Indian Overseas Bank in various ways: Via Net Banking, online on the Indian Overseas Bank website, at an ATM, or by visiting a branch.

Step 5: Submit documents

Next, find out what documents are required for a Personal Loan. You will usually need income proof (bank statements, salary slips or IT returns), address proof, and ID proof. Hand over copies of your Personal Loan documents at the bank.

Wait for funds to be remitted to your account. Indian Overseas Bank disburses funds for pre-approved loans to customers in 10 seconds*, and for non-Indian Overseas Bank customers in 4 hours.

That’s how to get a Personal Loan in 5 easy steps!

Indian Overseas Bank Personal Loan Prepayment Charges

If you are a salaried applicant, you can pre-pay your Indian Overseas Bank Personal Loan only after paying 12 equated monthly installments completely.

The pre-payment charges for salaried applicants are as follows:

- 4% of the outstanding principal amount for 13 to 24 months.

- 5% of the outstanding principal amount for 25 to 36 months.

- 2% of the outstanding principal amount for more than 36 months.

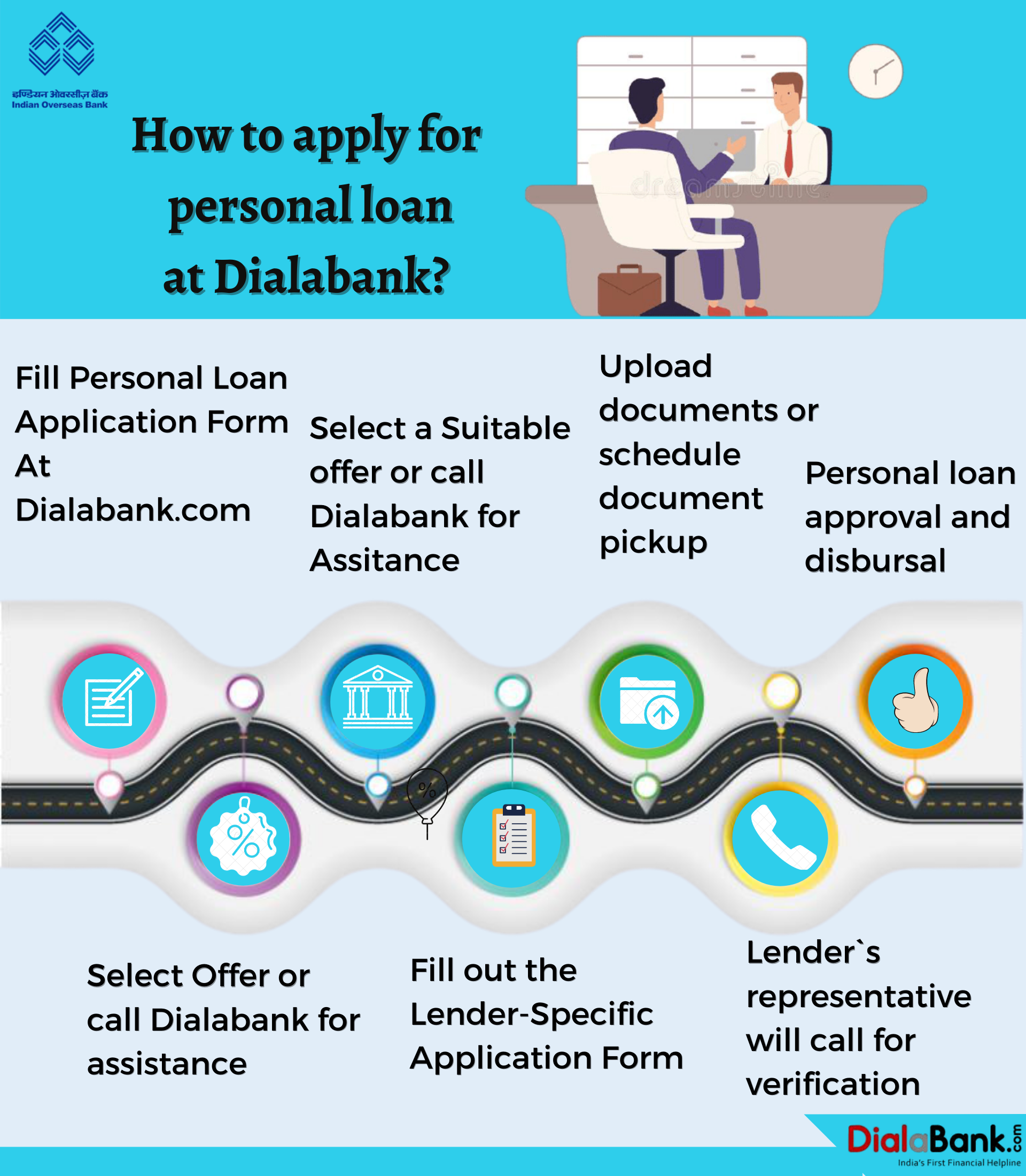

Indian Overseas Bank Personal Loan Apply Online

- Firstly, you need to visit our website Dialabank.

- Once you reach there, all you need to do is fill the personal loan form with your necessary details along with your phone number.

- It is required that you provide your working phone number as our Relationship manager will call you.

- Now once you are done with this all, you need to sit back and relax one of our RM will soon be in touch with you.

- Our Relationship Manager will provide you with information about different loaning schemes available in your area.

- Also, we make sure you’ll get the best in the market loan to value ratio and lowest interest rates.

- Likewise, with our help, your loan gets sanctioned in less than 48 hours.

- For more information, feel free to call us at Indian overseas bank personal loan contact number 9878981166 anytime we are always delighted to hear from you.

Personal Loan Verification Process

- You will receive a phone call from the lender’s representative for verification and arranging document pickup after your application form is forwarded to the lender via Dialabank.

- If the records are checked, you will receive another call from the agent concerning the final loan bid.

- If you comply with the terms and conditions, the loan will be disbursed within a few working days to your account.

Check your Indian Overseas Bank Personal Loan Status Online

- Proceed to the Loan Application Status page on the Indian Overseas Bank’s Official Website

- Enter essential credentials such as loan application no, registered mobile no, etc. to view your refreshed Indian Overseas Bank personal loan application

How to Login to Indian Overseas Bank Portal

- Go to the Online Banking Site of the Indian Overseas Bank

- Enter your Password’ and ‘Username ID’

- In the Start In the area, select ‘Accounts’ and then click ‘Login’ to finish the online banking login.

How to check Indian Overseas Bank Personal Loan Statement?

- On the Indian Overseas Bank website.

- Go to the Download e-Statement page from the ‘Service Type’ column select ‘Download Loan Statement’, then select ‘Next’.

- “Fill out information such as Loan Account Number, PAN, Verified Mobile, etc. on the following page and click “Next” to view/download your Personal Loan Statement from the Indian Overseas Bank.

Indian Overseas Bank Personal Loan Restructuring (COVID-19)

A 6-month moratorium on numerous term loans was reported to minimize the effects of the COVID-19 pandemic to a great extent. After the 6-month moratorium was completed, Indian Overseas Bank declared an RBI-mandated one-time gain from the restructuring of Indian Overseas Bank’s personal loan. This system is structured to provide continued relief to borrowers who are still unable to begin repayment of their daily EMI due to the continuing financial hardship of the pandemic.

An additional moratorium of up to 2 years or an extension to the current repayment period to mitigate monthly EMI payments is needed for the loan settlement procedure initiated by Indian Overseas Bank. It should be observed that the restructuring of the personal loan of Indian Overseas Bank would give rise to additional interest rates in excess of those of the original loan. This relief mechanism should therefore be used only as a last resort.

Indian Overseas Bank Customer Care

- You can phone on 9878981166

- Send your complaint online on the Dialabank website.

Benefits of Applying for Personal Loan at Dialabank

- Several lenders are available: You can search personal loan deals from 30+ lenders on a single platform and save time and effort. Also, anytime, anywhere, you can access Dialabank

- Knowledge of your eligibility: You can understand whether you are eligible to apply for a loan from a specific lender along with the maximum amount of loan you are eligible for through Dialabank.

- Check EMI: You can check EMI during the tenure by using Dialabank’s Personal Loan EMI Calculator and can lend a loan sum according to your repayment ability.

- End-to-end assistance: You get end-to-end assistance from the dedicated customer service team of Dialabankar on your personal loan.

How to get the best offer on Indian Overseas Bank Personal Loan?

You can get the best personal interest rates from Indian Overseas Bank subject to an assessment of your loan amount, salary, other obligation company you work with, and loan tenure. The following factors determine the personal loan rate of interest you can expect to get from Indian Overseas:

How does Indian Overseas Bank Personal Loan work, Here is the process

| Maximum Annual Percentage Rate (APR) | 11% to 22.5% |

| A representative example of the total cost of the loan, including all applicable fees |

Here is an illustration of the total cost of the loan: Total amount borrowed: ₹ 1,00,000 Time period: 12 Months to 60 Months Indian Overseas Bank Personal Loan Interest Rate: 10.50% to 22.00% Processing Fee payable to Upto ₹ 2,500 Fee payable to MyLoanCare: NIL Total Monthly Cost – From ₹ 2,149 for 60 Months ₹ 1,00,000 loan at 10.50% (lowest rate, longest time period) to ₹ 9,359 for 12 Months ₹ 1,00,000 loan at 22.00% (highest rate, shortest time period). This is inclusive of principal repayment. Annual Percentage Rate (APR) of charge including all applicable fees: 11% to 22.5% Total cost payable over loan tenure: ₹ 8,278 for 12 Months loan to ₹ 31,463 for 60 Months loan |

Important Aspects

- Checking your credit score as a good credit score would allow you to use a personal loan more easily and at low-interest rates.

- Make sure you meet the personal loan eligibility requirements and verify that before submitting your loan application, you have all the necessary documentation

- To boost your chances of acceptance for a personal loan, reduce unpaid debt to the lowest amount possible.

- You have to use the Dialabank Personal Loan EMI Calculator to review the EMI and borrow just what you need, not overly.

FAQs About Indian Overseas Bank Personal Loan

✅ What is Indian Overseas Bank Personal Loan?

Indian Overseas Bank Personal Loan is an unsecured loan that can be used to meet your daily financial needs. You can use a Personal Loan to finance all your expenses from a vacation to a medical emergency.

✅ How does Indian Overseas Bank Personal Loan work?

Personal Loans from Indian Overseas Bank is unsecured, and thus you are not required to submit any security with the bank. The rate of interest is usually high as compared to secured loans, but if you have the right CIBIL score banks may offer you lower rates of interest. The repayment of Personal Loans can be made in monthly instalments called EMIs.

✅ What is the Personal Loan rate of interest in Indian Overseas Bank?

The personal loan rate of interest in Indian Overseas Bank starts at 10.40% per annum. You can compare rates of interest of different Banking and Non-Banking Financial Companies on Dialabank and apply for the Personal Loan that best caters to your needs.

✅ How can I get an Indian Overseas Bank Personal Loan?

You can get an Indian Overseas Bank Personal Loan by visiting your branch with your documents and contacting your banker regarding Personal Loans. Once the banker verifies your documents and approves your application, you will get the fund in your bank account.

✅ How to apply for a Personal Loan in Indian Overseas Bank?

Apply for a Personal Loan with Indian Overseas Bank by contacting the nearest branch in person with your documents. You may also contact Dialabank and compare the Personal Loan offers of different banks to choose the one that suits you the best.

✅ Why Indian Overseas Bank personal loan online apply?

Indian Overseas Bank Personal Loan can be used for several financial needs such as a wedding, payment of bills, daily expenses, etc. Being unsecured, you can are not required to submit any alternative security to avail of emergency wholesome funds with a Personal Loan. Indian Overseas Bank offers extremely competitive rates and trouble-free processing of your loan.

✅ How much EMI on Indian Overseas Bank Personal Loan?

The Personal Loan EMI for your own loan varies based on your loan amount, loan tenure, and rate of interest. You can use Dialabank’s EMI calculator to calculate your estimated EMIs within seconds.

✅ How much CIBIL score required for Indian Overseas Bank Personal Loan?

Indian Overseas Bank requires you to have a CIBIL score over 700.

✅ Minimum credit score needed for Indian Overseas Bank Personal Loan?

Indian Overseas Bank requires a minimum credit score of 700 for their Loan products.

✅ How to calculate Indian Overseas Bank Personal Loan EMI?

An Indian Overseas Bank personal loan calculator or EMI calculator can be used to calculate your Personal Loan EMIs using just the three parameters; loan amount, loan tenure, and rate of interest.

✅ What can I use Indian Overseas Bank Personal Loan for?

It can be used to finance a wedding, an event, a vacation, or pay for your daily expenses, medical bills, etc. A Personal Loan can also be used to finance all your needs and financial emergencies.

✅ Can I prepay Indian Overseas Bank Personal Loan?

Yes, you can prepay your Indian Overseas Bank’s Personal Loan by visiting the branch and applying for foreclosure with your loan officer. A prepayment fee may be charged, and your loan will be closed once all the payments are cleared.

✅ How to prepay Indian Overseas Bank Personal Loan?

Prepayment of your Indian Overseas Bank Personal Loan can be done by visiting your loan branch with your loan documents. You will have to pay the entire outstanding amount along with any foreclosure charge as shall be applied by the bank.

✅ How to repay Indian Overseas Bank Personal Loan?

Indian Overseas Bank’s Personal Loan can be quickly repaid in monthly instalments that comprise of your principal loan amount and interest.

✅ What documents are needed for Indian Overseas Bank Personal Loan?

Your KYC documents(Aadhar Card, PAN Card, etc.) and Income proof(Bank Statement, Salary Slips, ITR files) are the only documents that are needed for your Personal Loan from Indian Overseas Bank. Any other material, as asked by the bank should be duly submitted.

✅ How to check Indian Overseas Bank Personal Loan status?

If you wish to check your loan status, you can visit your loan branch in person or you can contact the customer care number to know the status of your loan.

✅ How to get Indian Overseas Bank’s loan top-up?

Top up is the additional loan amount that can be taken from the existing bank of your recent loan or at the time of balance transfer from your new bank. Indian Overseas Bank lets you avail of this facility if you have paid at least about 9 EMIs without any cheque bounces. You can get a minimum top-up of ₹50,000 and a maximum of your already sanctioned loan amount. You can check the online portal of Indian Overseas Bank for more offers or contact Dialabank for any financial help.

✅ What happens if I don’t pay my Indian Overseas Bank’s Personal Loan EMIs?

There will be a penal interest charged as applicable and would even face legal actions if defaulting continues.

✅ How to find Indian Overseas Bank’s Personal Loan account number?

To get your loan account number you can contact the loan officer at the bank branch or by contacting the customer care number of Indian Overseas Bank.

✅ What is the Indian overseas bank personal loan customer care number?

Contact at 9878981166 for any queries.

✅ What are the Indian Overseas Bank Personal Loan pre-closure charges?

Indian Overseas Bank provides you with a foreclosure facility on your loan without any charges. You can pay back your personal loan when you have the required funds.

✅ What is the Indian Overseas Bank Personal Loan closure procedure?

- Visit the bank with the complete set of documents (as mentioned above).

- You may be required to fill a form or write a letter requesting pre-closure of the Personal Loan account.

- Pay the pre-closure amount.

- Sign the required documents, if any.

- Take acknowledgment of the balance amount you have paid.

✅ What are the Indian Overseas Bank’s Personal Loan foreclosure charges?

Indian Overseas Bank lets you foreclose your personal loan with 2% to 4% foreclosure charges.

✅ What is the Indian Overseas Bank Personal Loan Overdraft Facility?

An individual overdraft is a credit office that licenses you to pull out an all-out as and when required. You can similarly repay the got out absolutely at whatever point the condition is ideal.

✅ What is the Maximum Loan Tenure for Indian Overseas Bank Personal Loan?

The maximum tenure duration for a personal loan from Indian Overseas Bank is 12-84 months.