Kashi Gomti Samyut Gramin Bank Personal Loan Key Features – May 01 2024

| Features | Details |

| Age | 21 to 58 yrs(at loan maturity) |

| CIBIL Score | 750 |

| Kashi Gomti Samyut Gramin Bank Personal Loan Interest Rate | 9.99% p.a. |

| Lowest EMI per lakh | N/A |

| Tenure | 12 to 60 Months |

| Kashi Gomti Samyut Gramin Bank Personal Loan Processing Fee | 1%-2% |

| Prepayment Charges | Decided by bank |

| Part Payment Charges | Decided by bank |

| Minimum Loan Amount | Rs. 5000 |

| Maximum Loan Amount | Up to Rs. 20 Lakh |

Kashi Gomti Samyut Gramin Bank Personal Loan Eligibility Criteria

Personal loan eligibility criteria:

| CIBIL score Criteria | 750 or above |

| Age Criteria | 21 to 58 yrs |

| Min Income Criteria | Rs. 15,000 to Rs 25,000 |

| Occupation Criteria | Salaried/Self-Employed/Pensioner |

Kashi Gomti Samyut Gramin Bank Personal Loan Interest Rate and Charges

Best Personal Loan Interest Rate

| Kashi Gomti Samyut Gramin Bank Personal Loan Interest Rate | 9.99% p.a. |

| Kashi Gomti Samyut Gramin Bank Personal Loan Processing Charges | 1%-2% |

| Prepayment Charges | NIL |

| Stamp Duty | NIL |

| Cheque Bounce Charges | As per Bank |

| Penal Interest | As per Bank |

| Floating Rate of Interest | NIL |

Kashi Gomti Samyut Gramin Bank Personal Loan Documents Required

| Form | Duly filled and signed the application form |

| Proof of Identity | Copy of: > Passport > Driving License > Aadhaar Card > Voter ID Card |

| Proof of Address | Rent Agreement (Min. 1 year of stay) Utility Bills Proof of permanent residence Ration card, Bank Account Statement, Latest Credit Card Statement |

| Proof of Income | ITR: Last two financial years( For self-employed)> Salary Slip: Last 6 months (Salaried Employee)

> Bank Statement: Last 3 months |

Kashi Gomti Samyut Gramin Bank Personal Loan EMI Calculator

EMI Calculator for a personal loan.

Kashi Gomti Samyut Gramin Bank Personal Loan Compared to Other Banks

| Particulars | Kashi Gomti Samyut Gramin Bank | HDFC Bank | Bajaj Finserv | Axis Bank | Citibank | Private Bank |

| Interest Rate | 9.99% | 11.25% to 21.50% | Starting from 12.99% | 15.75% to 24% | Starting from 10.99% | 11.50% to 19.25% |

| Tenure | 12 to 60 Months | 12 to 60 months | 12 to 60 months | 12 to 60 months | 12 to 60 months | 12 to 60 months |

| Loan amount | Up to Rs. 20 lakh | Up to Rs. 40 lakh | Up to Rs. 25 lakh | Rs. 50,000 to Rs. 15 lakh | Up to Rs. 30 lakh | Upto Rs. 20 lakh |

| Processing Fee | 1%-2% | Up to 2.50% of the loan amount | Up to 3.99% of the loan amount | Up to 2% of the loan amount | Up to 3% of the loan amount | Up to 2.25% of the loan amount |

Other Loan Products from Kashi Gomti Samyut Gramin Bank

Why should you apply for Kashi Gomti Samyut Gramin Bank Personal Loan with Dialabank?

- Dialabank is the leading helpline in the country.

- Less Documentation is required for processing

- Fast Approval is our first priority.

You can call at 9878981166 for any query.

How to Calculate EMIs for Kashi Gomti Samyut Gramin Bank Personal Loan?

There is a requirement of the following information to calculate Kashi Gomti Samyut Gramin Bank Personal Loan:

EMI:

- you should provide a Loan of the Amount

- also, the Interest Rate allotted to you

- and Tenure of your loan

Substitute the values in the calculator below and find your monthly EMIs

Kashi Gomti Samyut Gramin Bank Personal Loan Processing Time

- It has fast processing

- you need less paperwork

- A processing fee may vary

Kashi Gomti Samyut Gramin Bank Personal Loan Preclosure Charges

Is your fund ready? Then you can apply for Preclosure. For more details make a call or by visiting the branch.

Types of Different Personal Loan offered by Kashi Gomti Samyut Gramin Bank

Home Loan

Kashi Gomti Samyut Gramin Bank offers personal loan for a home:

- Your minimum age should be 21 yrs

- The maximum Age should be 60 yrs

- Regular Income applicants are a must for the Home Loan

- Earn more than the required monthly income to avoid rejection risk

Personal Loan for Government Employees

Kashi Gomti Samyut Gramin Bank offers personal loans to all the Govt. employees. The loan amount depends on the Company in which you are working.

Education Loan

- Kashi Gomti Samyut Gramin Bank offers Education loans up to Rs 10 lac in India and Rs 20 lac to study in Abroad

- The loan limit should be above Rs 4.00 lac

- Max Loan to study in India is Rs 10 lac

- Max Loan to Study in India is Rs 20 lac

Personal Loan for Pensioners

- A processing charge can be asked from the bank.

- Very Affordable Interest Rate

Personal Loan Balance Transfer

- Personal Loan balance transfer means the borrower transfer the sum to other institutions.

- Low-interest rates.

- Long repayment tenure.

Kashi Gomti Samyut Gramin Bank Personal Loan Top Up

Kashi Gomti Samyut Gramin Bank’s personal loan provides a top-up that means an additional amount on the existing loan.

Types of Kashi Gomti Samyut Gramin Bank Personal Loan

Home Renovation Loan

Whether you need to buy new furniture or give a new look to your home by renovation, Kashi Gomti Samyut Gramin Bank Home Renovation Loan helps you in by providing financial help. The home renovation loan makes one eligible to cover up the cost of the restoration of the house.

Features of the Kashi Gomati Samyut Gramin Bank Home Renovation Loan is as follows :

- Less documentation with easy processing

- This Loan is available for new customers as well as for current customers.

Holiday Loan

A Holiday Loan is there to reconnect you with your planned luxurious vacation. The holiday loan helps you with your funds and lets you enjoy the day-offs without worrying about the expenses.

- Kashi Gomti Samyut Gramin Bank’s Holiday Loan processing is easy with low rates.

- It takes less time in loan disbursal.

Fresher Funding

Kashi Gomti Samyut Gramin Bank provides funds for Freshers. The startups owned by students lacking funds for further progress can opt for fresher funding and give their newly set up business a new direction.

Important characteristics of Fresher Funding are as follows:

- The age of the applicant has to be a minimum of 21

- The rate of interest varies according to the applicant’s background.

NRI Personal Loan

Kashi Gomti Samyut Gramin Bank provides financial help for international students to overcome the financial crisis.

- This loan is given without any security.

- The NRI Applicant and co-applicant Indian borrower need to present satisfactory proof for the Loan.

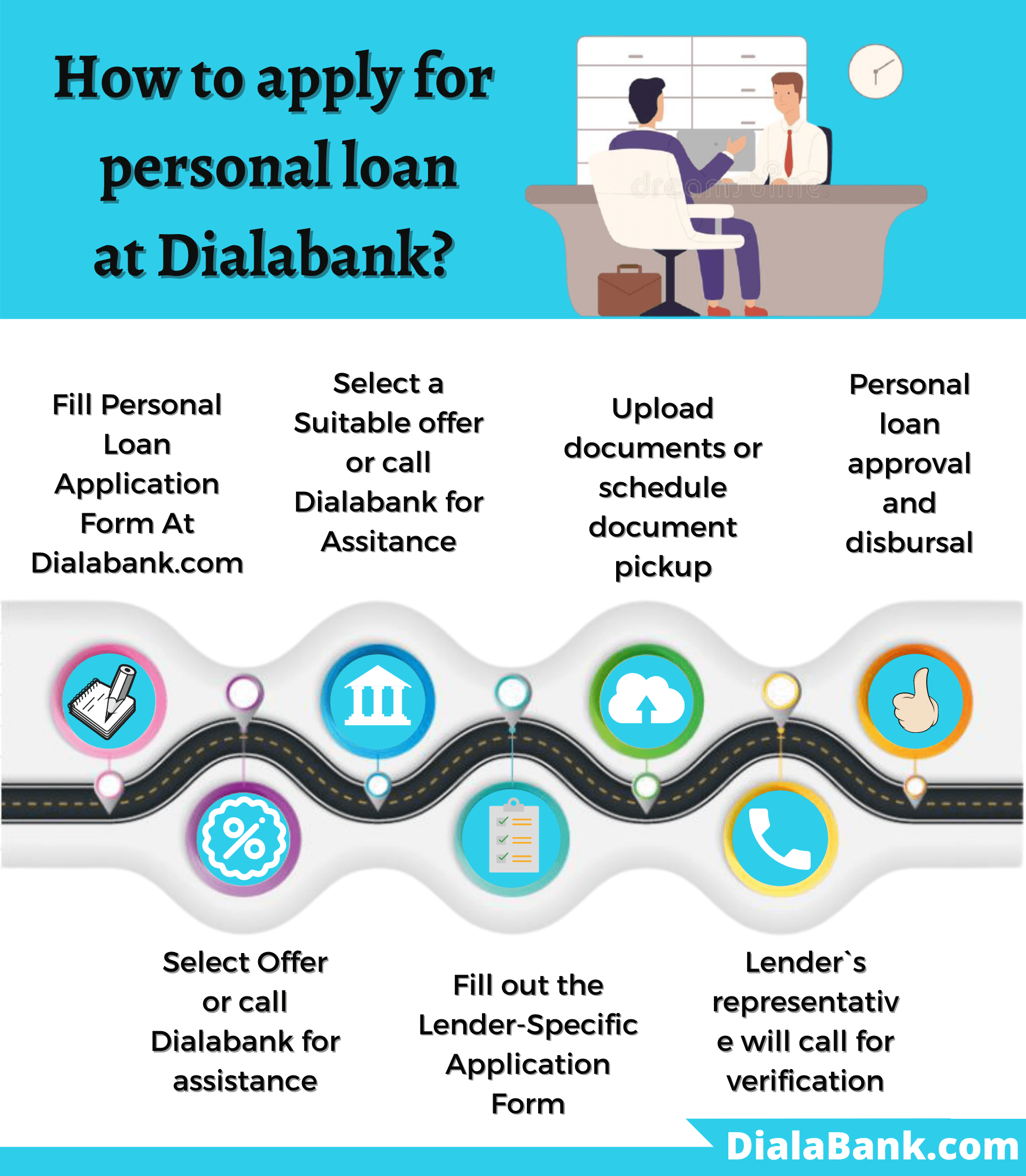

How to Apply Online for Kashi Gomti Samyut Gramin Bank Personal Loan?

To apply for Kashi Gomti Samyut Gramin Bank online by visiting the Kashi Gomti Samyut Gramin Bank’s online portal and fill the form for applying for a personal loan. Other than that you can simply follow the given steps for applying for a Kashi Gomti Samyut Gramin Bank Personal Loan:

- Visit Dialabank.

- Fill the Application form and submit it.

- Our Relationship manager will call you for further process.

- With help of experts, get a customized personal Loans by comparing various loan offers available in the market.

Kashi Gomti Samyut Gramin Bank Personal Loan Verification Process

While applying for Kashi Gomti Samyut Gramin Bank personal loan, make sure to follow the below-mentioned steps :

- After completing your application with Dialabank, the personal loan application is processed by the bank.

- To verify the details, the bank will call you.

- After the telephonic verification, the bank will send for documents.

- After the collection of documents, the next step of verification takes place.

- bank confirms the final interest rate, loan amount, and tenure for the mentioned amount.

- Once the customer confirms everything, the loan amount is disbursed.

Check your Kashi Gomti Samyut Gramin Bank Personal Loan Application Status

You can visit the nearest Bank for offline checking of the status of your Personal Loan Application. To check it online follow the simple steps:

- Visit the site of this bank.

- Check the eligibility.

- Fill the form with your information.

- Our managers will contact you.

How to Login to the Kashi Gomti Samyut Gramin Bank Portal

- Google Kashi Gomti Samyut Gramin Bank Website.

- Log in with your Kashi Gomti Samyut Gramin Backlog in ID and Password.

- Press the login key and get access to the bank portal.

Kashi Gomti Samyut Gramin Bank Personal Loan Statement

- Go to the official website of Kashi Gomti Samyut Gramin Bank.

- Search and click on the “Register New Loan”.

- Fill in all the required details.

- After that click on the submit key.

- Enter the OPT that will direct you to register for Loan Statement.

Kashi Gomti Samyut Gramin Bank Personal Loan Restructuring (COVID-19)

The Kashi Gomti Samyut Gramin Bank took the initiative to reduce the pressure on its borrowers despite the stress of the COVID induced lockdown. The RBI moratorium ending in the month of September was mandated by the bank. Subsequently, it was expected that all borrowers would revert to previous EMI schedules. However, the borrowers were in confusion as to how to repay the outstanding with ongoing financial crunches. Considering the adverse situation, Kashi Gomti Samyut Gramin Bank came up with a new strategy that helps its borrowers authorized by the RBI.

By reducing financial stress, the relief framework is aimed at destroying the creditors. This new framework allows the creditor the right, with some implications, to prolong the loan period by up to 2 years. An additional interest rate on the unpaid balance would be welcomed by the extended waiver and the debt will also be referred to as ‘Restructured’ in the beneficiary’s credit sheet. As a consequence of a comment on the credit score of the borrower, it is also preferable for borrowers to use the machine in the most unfavourable situations, otherwise, the repayment schedules must pick up the threads as before.

Kashi Gomti Samyut Gramin Bank Customer Care

- Branch Visit: By visiting the nearest bank branch for any information on loan approval.

- Via Phone: The customers can get in touch with the bank by giving a call on 9878981166

- Via Chatbox: The chatbox is available for all the queries on the official site.

Benefits of Applying for Personal Loan on Dialabank

- EMI Calculator: Personal loan EMI Calculator helps you to find out the EMI that needs to be paid and gives you foresight of the Loan.

- Convenient Customer Care: The customer can have 24*7 accessibility for their doubts regarding the loans and applications.

- Easy Documentation: Easy documentation makes the loan process accessible and convenient.

Important Aspects

The mentioned below are a few points that should be taken into consideration before you apply for a Personal Loan:

- Holding the debt volume as low as possible is advisable. Although the redemption of a bigger sum is quick and short.

- When applying for a personal loan, the repayment potential of the borrower is of paramount importance such that the loan amount can be used as per the criteria rather than using higher loan amounts due to its simple availability.

- The credit score decides whether the borrower is eligible for the credit in question, so it is recommended that you check the credit score before applying for a loan. The poor credit score only results in a straight denial of the application in most cases.

- For the loan sum you need, go to the bank or institution providing the best in class operation and interest rate. Until settling for one bank, compare and evaluate. The banks provide attractive personal loan interest rates and tenures for the loan volume in the Credit World, so a second glance at the banks would profit you only.

FAQs About Kashi Gomti Samyut Gramin Bank Personal Loan

✅ How to apply for Kashi Gomti Samyut Gramin Bank Personal Loan?

You can apply for a personal loan at the website of Kashi Gomti Samyut Gramin Bank.

✅ What is the Interest Rate for Kashi Gomti Samyut Gramin Bank Personal Loan?

The interest rate for Kashi Gomti Samyut Gramin Bank Personal Loan is 9.99% p.a.

✅ What is the minimum age for getting a Personal Loan from Kashi Gomti Samyut Gramin Bank?

The minimum age to apply for Kashi Gomti Samyut Gramin Bank’s Personal Loan is 21 years.

✅ What is the maximum age for getting a Personal Loan from Kashi Gomti Samyut Gramin Bank?

The maximum age you need for applying for Kashi Gomti Samyut Gramin Bank’s Personal Loan is 60 years

✅ What is the minimum loan amount for Kashi Gomti Samyut Gramin Bank Personal Loan?

The minimum loan amount for Kashi Gomti Samyut Gramin Bank’s Personal Loan can be asked from the bank by calling them or by visiting them personally.

✅ What is the maximum loan amount for Kashi Gomti Samyut Gramin Bank Personal Loan?

The maximum loan amount for Kashi Gomti Samyut Gramin Bank’s Personal Loan is Rs. 20 lakh, but it may vary.

✅ What are the documents required for Kashi Gomti Samyut Gramin Bank Personal Loan?

You need to show your Proof of Identity, Proof of income, and address proof to apply for Kashi Gomti Samyut Gramin Bank’s Personal Loan.

✅ What is the Processing Fee for Kashi Gomti Samyut Gramin Bank Personal Loan?

The processing fee for Kashi Gomti Samyut Gramin Bank’s Personal Loan is 1%-2% of the loan amount.

✅ How to get Kashi Gomti Samyut Gramin Bank Personal Loan for Self Employed?

You must have a good and rigid source of income and your credit history should be good to avoid rejection.

✅ What is the Maximum Loan Tenure for Kashi Gomti Samyut Gramin Bank Personal Loan?

Maximum Loan tenure for Kashi Gomti Samyut Gramin Bank’s Personal Loan is 60 months

✅ What should be the CIBIL Score for Kashi Gomti Samyut Gramin Bank Personal Loan?

A good CIBIL Score has less chance of Rejection. For Kashi Gomti Samyut Gramin Bank’s Personal Loan you must have a 750 or above CIBIL Score.

✅ Do I have a preapproved offer for Kashi Gomti Samyut Gramin Bank Personal Loan?

Information about the preapproved offer for Kashi Gomti Samyut Gramin Bank’s Personal Loan can be extracted from the branch itself.

✅ How to calculate EMI for Kashi Gomti Samyut Gramin Bank Personal Loan?

You can calculate your EMI at any EMI calculator just you have to put the loan amount, Interest rate, and Tenure of the loan.

✅ How to pay Kashi Gomti Samyut Gramin Bank Personal Loan EMI?

All the procedures will be explained once you applied for a personal loan and your application will get approved.

✅ How to close Kashi Gomti Samyut Gramin Bank Personal Loan?

If your funds are ready then you can apply for Preclosure or after all the EMI’s are paid your loan will get closed.

✅ How to check Kashi Gomti Samyut Gramin Bank Personal Loan Status?

To know the status of Kashi Gomti Samyut Gramin Bank’s Personal Loan just call the bank or check on the website i.e provided by the bank.

✅ How to close Kashi Gomti Samyut Gramin Bank Personal Loan Online?

Dialabank is the best option for applying for Kashi Gomti Samyut Gramin Bank’s Personal Loan with less paperwork and ease or visits the official site of the bank and apply for the loan

✅ How to pay Kashi Gomti Samyut Gramin Bank Personal Loan EMI Online?

You can pay EMI for Kashi Gomti Samyut Gramin Bank’s Personal Loan through Netbanking.

✅ How to check Personal Loan Balance in Kashi Gomti Samyut Gramin Bank?

You can call the bank customer care or a timely message will be sent on your registered no.

✅ How to download Kashi Gomti Samyut Gramin Bank Personal Loan Statement?

You can download the statement, from the official website of the Kashi Gomti Samyut Gramin Bank.

✅ How to Top Up Personal Loan in Kashi Gomti Samyut Gramin Bank?

You can Top up the Personal Loan in Kashi Gomti Samyut Gramin Bank by filling a simple form or by visiting the nearest branch.

✅ What happens if I don’t pay my Kashi Gomti Samyut Gramin Bank Personal Loan EMIs?

You may face action against you and also your CIBIL score will get affected. So regular is like safety for the future.

✅ How to find Kashi Gomti Samyut Gramin Bank Personal Loan account number?

After your application gets approved you will be provided with your account number for Kashi Gomti Samyut Gramin Bank’s Personal Loan.

✅ What is the Kashi Gomti Samyut Gramin Bank personal loan closure procedure?

Visit the bank with the complete set of documents (as mentioned above). You may be required to fill a form or write a letter requesting pre-closure of the Personal Loan account. Pay the pre-closure amount. Sign the required documents, if any. Take acknowledgement of the balance amount you have paid.

✅ What is Kashi Gomti Samyut Gramin Bank personal loan maximum tenure?

The maximum tenure of the Kashi Gomti Samyut Gramin Bank personal loan is 60 months.

✅ What is Kashi Gomti Samyut Gramin Bank personal loan minimum tenure?

The minimum tenure of the Kashi Gomti Samyut Gramin Bank personal loan is 12 months.

✅ What is the Kashi Gomti Samyut Gramin Bank personal loan customer care number?

The customer care number of Kashi Gomti Samyut Gramin Bank personal loan is 9878981166.

✅ What are the Kashi Gomti Samyut Gramin Bank Personal Loan pre-closure charges?

Kashi Gomti Samyut Gramin Bank gives you the option of pre-closing your loan after a period of a minimum of 12 months of taking the loan and paying 12 successful EMIs on your mortgage. However, Kashi Gomti Samyut Gramin Bank charges a Prepayment or Pre-closure charge. Refer to the table mentioned above.

Other Banks For Personal Loan

| Meghalaya Rural Bank Personal Loan | |

| Manipur Rural Bank Personal Loan | |

| Mizoram Rural Bank Personal Loan | |

| Maharashtra Gramin Bank Personal Loan |