Chaitanya Godavari Grameena Bank Personal Loan Key Features Apr 26 2024

| Eligibility Criteria | Details |

| Age | 21 – 58 Years |

| CIBIL score | 600 or above |

| Chaitanya Godavari Grameena Bank Personal Loan Interest Rate | 9.99% per annum |

| Lowest EMI per lakh | Rs. 2149 |

| Tenure | 12 to 60 months |

| Chaitanya Godavari Grameena Personal Loan Processing Fee | 1% to 2% |

| Prepayment Charges | NIL |

| Part Payment Charges | NIL |

| Minimum Loan Amount | Rs. 50,000 |

| Maximum Loan Amount | Rs. 10 Lakhs |

Chaitanya Godavari Grameena Bank Personal Loan Eligibility Criteria

Personal Loan Eligibility criteria are as follows :

| CIBIL score | 600 or above |

| Age | 21 to 58 years |

| Min Income | Rs. 20,000 |

| Occupation | Salaried/Self-Employed |

Chaitanya Godavari Grameena Bank Personal Loan Fees and Other Charges

| Chaitanya Godavari Grameena Bank Personal Loan Interest Rate | 9.99% per annum |

| Chaitanya Godavari Grameena Bank Personal Loan Processing Charges | 1% to 2% |

| Prepayment Charges | NIL |

| Stamp Duty | As per state law |

| Cheque Bounce Charges | Rs. 100 |

| Penal Interest | As per bank terms |

| Floating Rate of Interest | Not Applicable |

Chaitanya Godavari Grameena Bank Personal Loan Documents Required

| Form | Duly filled application form |

| Proof of Identity | Copy of: > Passport > Driving License > Aadhar Card > Voter ID Card |

| Proof of Address | Rent Agreement (Min. 1 year of stay) Utility Bills Passport (Proof of permanent residence) Ration card |

| Proof of Income | > ITR: Last two Assessment years > Salary Slip: Last 6 months > Bank Statement: Last 3 months |

Chaitanya Godavari Grameena Bank Personal Loan EMI Calculator

Chaitanya Godavari Grameena Bank Personal Loan Compared to Other Banks

| Particulars | Interest Rate | Tenure | Loan amount |

Processing Fee

|

| Chaitanya Godavari Grameena Bank | 9.99% | 12 to 60 months | Up to Rs. 10 lakh |

0.50% of the loan amount

|

| HDFC Bank | 11.25% to 21.50% | 12 to 60 months | Up to Rs. 40 lakh |

Up to 2.50% of the loan amount

|

| Bajaj Finserv | Starting from 12.99% | 12 to 60 months | Up to Rs. 25 lakh |

Up to 3.99% of the loan amount

|

| Axis Bank | 15.75% to 24% | 12 to 60 months | Up to Rs. 15 lakh |

Up to 2% of the loan amount

|

| Citibank | Starting from 10.99% | 12 to 60 months | Up to Rs. 30 lakh |

Up to 3% of the loan amount

|

| Private Bank | 11.50% to 19.25% | 12 to 60 months | Up to Rs. 20 lakh |

Up to 2.25% of the loan amount

|

Other Loan Products from Chaitanya Godavari Grameena Bank

| Gold Loan | Car Loan | Home Loan | Business Loan |

| TWL | LAP | Credit Card | Education Loan |

Why should you apply for Chaitanya Godavari Grameena Bank Personal Loan with Dialabank?

- Dialabank brings you financial products as per your needs.

- We are India’s first financial helpline and are always just a click away.

- We provide personalized assistance.

How to Calculate EMIs for Chaitanya Godavari Grameena Bank Personal Loan

Calculate your EMI using the calculator given below:

Chaitanya Godavari Grameena Bank Personal Loan Processing Time

A personal loan from Chaitanya Godavari Grameena Bank takes about a week to process. All the documents and details of a borrower are to be verified because personal loans are unsecured.

Chaitanya Godavari Grameena Bank Personal Loan Preclosure Charges

If you want to pay all your loan amount before the end of your tenure, you can do so. Chaitanya Godavari Grameena Bank does not charge you any extra fee for it.

Chaitanya Godavari Grameena Bank Personal Loan Overdraft Facility

An individual overdraft is a credit office that licenses you to pull out an all-out as and when required. You can in like way repay the got out absolutely at whatever point the condition is ideal. From this time forward, it is potentially the most preferred credit decisions that profited to meet changing individual supporting necessities unbounded.

Apply for an overdraft office as a Chaitanya Godavari Grameena Bank Personal Loan. The versatile improvement office has all the gigantic features of a feeble overdraft credit.

Pre Calculated EMI for Personal Loan

Types of Chaitanya Godavari Grameena Bank Personal Loan

Chaitanya Godavari Grameena Bank Marriage Loan

Weddings are celebrated events in India but cause monetary problems. You can apply for a personal loan from Chaitanya Godavari Grameena Bank to cover your marriage costs and save yourself from financial burden.

Chaitanya Godavari Grameena Bank Personal Loan for Government Employees

If you are a central or state public sector employee, you receive special treatment and offers from the bank for your personal loan requirements.

Chaitanya Godavari Grameena Bank Doctor Loan

Medical professionals with a valid degree and 4 years of experience can apply for a personal loan to meet their financial needs, be it personal or professional. You will get interest rates and offers curated to your needs.

Chaitanya Godavari Grameena Bank Personal Loan for Pensioners

Government employees, once they retire, may face some financial problems and need a loan. Chaitanya Godavari Grameena Bank provides special offers for such individuals through their personal loans for pensioners scheme.

Chaitanya Godavari Grameena Bank Personal Loan Balance Transfer

If your current personal loan has high interest rates and hefty EMIs, you can apply for a personal loan balance transfer and get better deals and rates.

Chaitanya Godavari Grameena Bank Personal Loan Top Up

Sometimes, we feel the need for extra money and apply for a fresh loan. But, now you can apply for a top-up loan on your existing personal loan and get extra funds at the same rate.

Home Renovation Loan

Chaitanya Godavari Grameena Bank offers home update credit for people wishing to have their homes overhauled. This individual credit will back the major fixes or award the borrower to purchase new home fittings, machines, and furniture. A few features of the Chaitanya Godavari Grameena Bank Home Renovation Loan are:

- The financing cost of a Bank Home Improvement Loan begins at as low as 11.25%.

- Individuals will be in peril for an advanced degree of Rs. 20 Lakhh to have their home changed.

- The credit of Chaitanya Godavari Grameena Bank’s home recreates needs zero documentation, gaining the whole ground time frame liberated from the inconvenience.

- When in doubt, the improvement entire is credited to the record within 72 hours before the bank favours the comfort.

Holiday Loan

The Chaitanya Godavari Grameena Bank’s Holiday Loan will assist you with a minor issue while arranging your fantasy move away. The principal features of the Baroda UP Holiday Loan are This individual Chaitanya Godavari Grameena Bank advance will keep up a degree of excursion related costs, including booking travel tickets, standing working environments, guided visits, etc

- Financing costs for occasion drives start at 11.25 percent p.a.

- Without a ton of stretch upheld position, you can do a degree of up to Rs 20 Lakh.

- The brisk and away from of your move away is ensured by made and unimportant work.

- Anxious progression outline and apportioning that is fast credited to your record.

Fresher Funding

Chaitanya Godavari Grameena Bank’s Fresher Funding is basic for an overall piece of uncertain individual credits subject to people with a standard remuneration. This option rather than Chaitanya Godavari Grameena Bank credit is proposed to help freshers, for example, proceeding with graduated class, for instance searching for their first work. Coming up next are some sensible features of Chaitanya Godavari Grameena Fresher Funding’s individual credit:

- Credit degree of up to Rs 1.5 lakh

- Competitors must, at any rate, be 21 years of age.

- The movement of interest for Fresher Funding relies upon the up-and-comer’s profile, the monetary record/score, age of the competitor, and locale.

NRI Personal Loan

For NRIs, Chaitanya Godavari Grameena Bank equips an individual with progression, understanding the necessities and dreams of NRIs. The fundamental advancement picked one should be an Indian tenant, and the co-competitor NRI must be close to a relative. The Individual Loan for NRIs contains the going with features.

- Individual NRI advances of up to Rs. 10 lakh with adaptable end-use pushes are given up by Chaitanya Godavari Grameena Bank.

- The expense of NRI Personal Loan financing begins at 15.49 percent p.a.

- The credit requires a residency of up to three years.

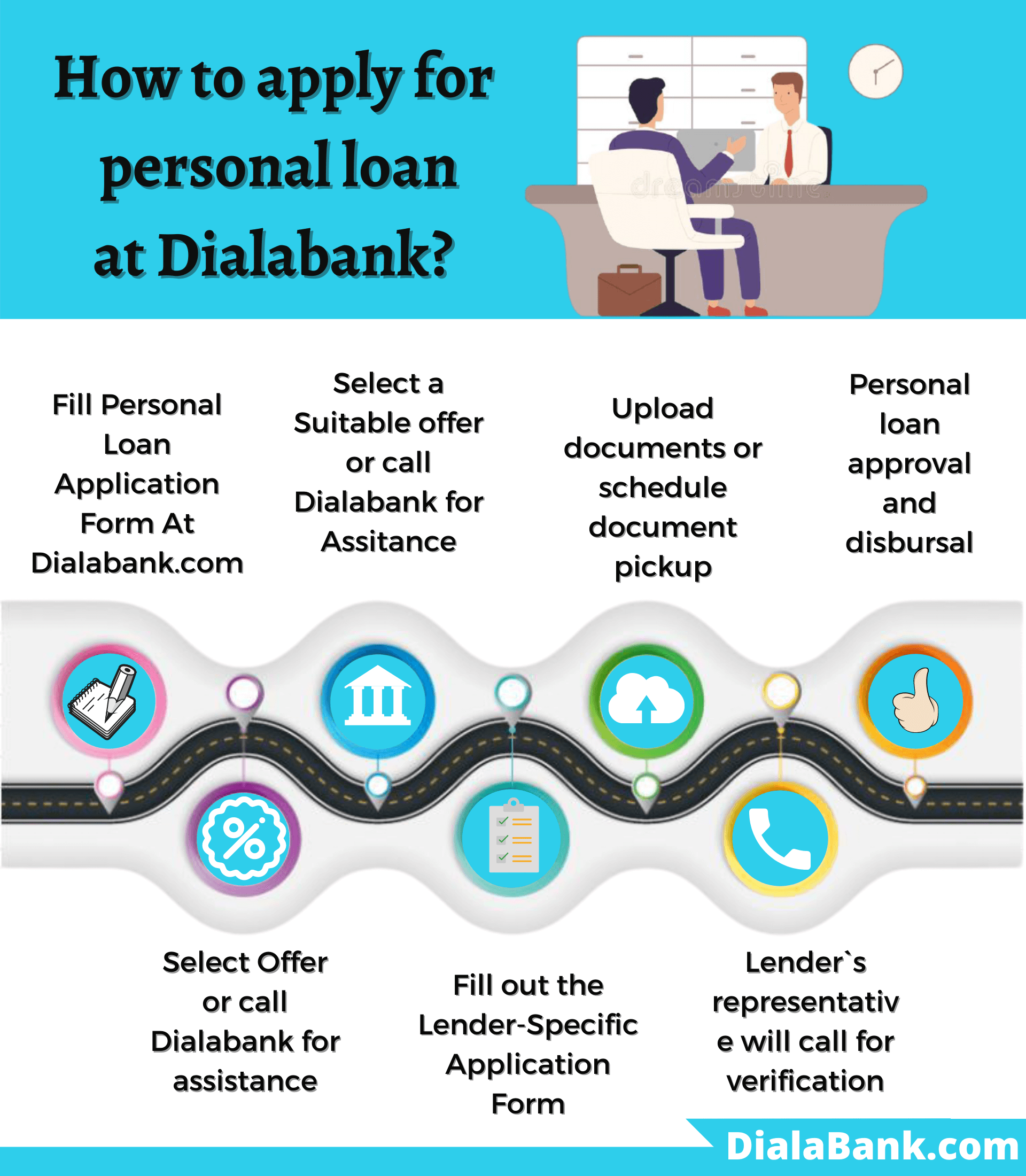

How to Apply Online for Chaitanya Godavari Grameena Bank Personal Loan?

The offline process to apply for Chaitanya Godavari Grameena Bank Personal Loan might be time-consuming but the online process is pretty simple. Given below are the steps that should be followed:

- Visit Dialabank

- Also, you can visit the Chaitanya Godavari Grameena Bank Personal Loan page on Dialabank.

- After visiting the page, you can see whether you are eligible, you have documents, or which scheme is best for you.

- Register your details in a single online form.

- Once you’re through it, you will get a call from us.

- We will provide you with further assistance.

- To know further, dial 9878981166

Personal Loan Verification Process

The Chaitanya Godavari Grameena Bank follows the below-mentioned steps for loan verification:

Step 1 The Bank goes through Dialabank Application and moves forward.

Step 2 First step of verification is completed by calling the applicant.

Step 3 Post the conversation with the customer, the bank collects the documents.

Step 4 Documents help in deciding the Loan tenure, interest rates, and amount.

Step 5 After the agreement of the customer, the loan is disbursed.

Chaitanya Godavari Grameena Bank Personal Loan Status

- Visit the site of this bank.

- Check the qualification.

- Fill the structure with your data.

- Our supervisors will reach you.

How to login into the Chaitanya Godavari Grameena Bank Portal

- Check the official website of Chaitanya Godavari Grameena Bank.

- Click on ‘Login’ in the upper right corner of the screen.

- Using your User ID and Password or reported mobile number to log in

How to Check Your Loan Statement

Clients can download the bank’s very own credit proclamation by following the means given below:

- Visit the official site of the bank.

- Select ‘Associate’ and starting from the drop list, pick ‘Organization Requests’.

- On the accompanying page that opens, under the ‘Advances’ menu, click’ Individual Loan Related.’

- Tap on ‘Solicitation for Loan Account Statement’ first.

- Sign in utilizing your User ID and the mystery word or utilizing your enrolled adaptable number and OTP to profit by the bank’s own personal credit explanation.

Chaitanya Godavari Grameena Bank Personal Loan Restructuring (COVID-19)

All through country lockdown, absurdly influenced a few borrowers by morals of the COVID-19 pandemic, and a multi-month repudiating on various term drives was communicated to control its impact on a particular degree. Chaitanya Godavari Grameena Bank explained the RBI-guided one-time advantage by the individual credit addition of Chaitanya Godavari Grameena Bank after the half-year boycott had wrapped up. This instrument is relied upon to offer help to those borrowers who, considering the pushing cash related challenges of the pandemic, are not yet set up to start reimbursement of their standard EMI.

The credit target plan of Chaitanya Godavari Grameena Bank proposes an extra boycott of up to two years or progress of the current repayment term diminish EMI separates from month to month. As a critical concern, it is basic that the recovery of your individual progress from Chaitanya Godavari Grameena Bank will accomplish extra shocking charges far past those of the standard improvement. In like manner, if whatever else fizzles with the craving for not winding up defaulting on your remarkable credit, you can fundamentally utilize this help instrument.

Chaitanya Godavari Grameena Bank Customer Care

Customers can contact Chaitanya Godavari Grameena Bank customer care via any of the following means:

- By Phone: You can call Chaitanya Godavari Grameena Bank on 9878981166 (toll-free)

- Callback Request: You can also request a call back by visiting the bank’s website

- Online Chatbot: You can also get your queries answered by the iPal chatbot online

- Branch Visit: You can visit the nearby Chaitanya Godavari Grameena Bank branch to get your queries.

Benefits of Applying for Personal Loan on Dialabank

There are several points of concern when applying for a personal advance on the Dialabank website. Underneath some of them are provided:

- 24 x 7 Availability: At whatever point and anyplace you can get to the site of Dialabank, and thusly, when your home or office is agreeable, apply for individual development.

- Multiple moneylenders: com engages you to get singular credit offers from different planned advance experts on a single stage and along these lines wipes out the need to visit distinctive bank locales or branches.

- Check EMI: On the EMI calculator, you can check the EMIs you would be paying on an individual credit even before you apply for one. It will help you with getting the reasonable total that you can without a very remarkable stretch repay and have a supportive repayment plan.

- Cost Free Analysis: Additionally, you are not supposed to pay any charges when you apply for an individual advance on Dialabank.

Important Aspects

Below are some critical points you ought to consider while applying for an individual Chaitanya Godavari Grameena Bank credit:

- It is ideal to check your cash related appraisal in any condition while applying for individual new development. The odds of your credit keep up are worked by a solid credit assessment and can permit you to profit by an individual development on a better agreement.

- Before picking a particular bank, it is keen to consider the expense of an individual credit (premium cost and every single reasonable cost and charge) offered by various moneylenders on Dialabank.com.

- Secure as appeared by the need and repayment limit. Make the huge advances not to win since you’re set up to get a higher entirety. It just adds to the cost of your upheld position and has a reasonably couple of central bright lights as time goes on.

- Make the chief advances not to apply at the same time with different moneylenders for singular advances. This shows that you are ready for credit and extends the extent of complex credit report rules, which can incredibly influence your FICO score.

FAQs About Chaitanya Godavari Grameena Bank Personal Loan

How to apply for Chaitanya Godavari Grameena Bank Personal Loan?

How to apply for Chaitanya Godavari Grameena Bank Personal Loan?

You can apply for a personal loan at Chaitanya Godavari Grameena Bank by visiting the nearest branch or by applying online on the official website. Also, you have a better option i.e Dialabank.

What is the Interest Rate for Chaitanya Godavari Grameena Bank Personal Loan?

What is the Interest Rate for Chaitanya Godavari Grameena Bank Personal Loan?

Chaitanya Godavari Grameena Bank charges an interest rate starting from 9.99% per annum on all personal loan products.

What is the minimum age for getting a Personal Loan from Chaitanya Godavari Grameena Bank?

What is the minimum age for getting a Personal Loan from Chaitanya Godavari Grameena Bank?

The criteria for the applicant’s minimum age is set for 21 years.

What is the maximum age for getting a Personal Loan from Chaitanya Godavari Grameena Bank?

What is the maximum age for getting a Personal Loan from Chaitanya Godavari Grameena Bank?

The maximum age you are required to apply for a personal loan is 60 years.

What is the minimum loan amount for Chaitanya Godavari Grameena Bank Personal Loan?

What is the minimum loan amount for Chaitanya Godavari Grameena Bank Personal Loan?

The minimum loan amount for the personal loan provided by Chaitanya Godavari Grameena Bank is Rs. 50,000

What are the documents required for Chaitanya Godavari Grameena Bank Personal Loan?

What are the documents required for Chaitanya Godavari Grameena Bank Personal Loan?

You need to show your Aadhaar card or Voter ID, PAN card, salary slips or ITR, and two recently clicked photographs to start the process to avail of the personal loan at Chaitanya Godavari Grameena Bank.

What is the Processing Fee for Chaitanya Godavari Grameena Bank Personal Loan?

What is the Processing Fee for Chaitanya Godavari Grameena Bank Personal Loan?

Chaitanya Godavari Grameena Bank charges 1% to 2% of the loan amount as a processing fee.

How to get Chaitanya Godavari Grameena Bank Personal Loan for Self Employed?

How to get Chaitanya Godavari Grameena Bank Personal Loan for Self Employed?

Chaitanya Godavari Grameena Bank provides special offers to Self Employed applicants. All you need to show is ITR files of the last three years as your income proof.

What is the Maximum Loan Tenure for Chaitanya Godavari Grameena Bank Personal Loan?

What is the Maximum Loan Tenure for Chaitanya Godavari Grameena Bank Personal Loan?

The maximum loan tenure for a Personal Loan from Chaitanya Godavari Grameena Bank is 60 months.

What should be the CIBIL Score for Chaitanya Godavari Grameena Bank Personal Loan?

What should be the CIBIL Score for Chaitanya Godavari Grameena Bank Personal Loan?

You must have a CIBIL score of at least 750 or above to avoid the risk of rejection.

Do I have a preapproved offer for Chaitanya Godavari Grameena Bank Personal Loan?

Do I have a preapproved offer for Chaitanya Godavari Grameena Bank Personal Loan?

To know the preapproved offer for the personal loan from Chaitanya Godavari Grameena Bank you can contact Dialabank to know each detail.

How to calculate EMI for Chaitanya Godavari Grameena Bank Personal Loan?

How to calculate EMI for Chaitanya Godavari Grameena Bank Personal Loan?

You can use the EMI calculator to calculate the EMI of Chaitanya Godavari Grameena Bank. It is available on the website of Dialabank.

How to pay Chaitanya Godavari Grameena Bank Personal Loan EMI?

How to pay Chaitanya Godavari Grameena Bank Personal Loan EMI?

Your EMI’s for the personal loan will get automatically deducted from your Bank account every month. You can also use net banking.

How to close Chaitanya Godavari Grameena Bank Personal Loan?

How to close Chaitanya Godavari Grameena Bank Personal Loan?

If your funds are ready then you can apply for Preclosure or after all the EMI’s are paid your loan will get closed.

How to check Chaitanya Godavari Grameena Bank Personal Loan Status?

How to check Chaitanya Godavari Grameena Bank Personal Loan Status?

To know the status of a Personal Loan you need to call the bank or check on the official website i.e provided by the bank.

How to close Chaitanya Godavari Grameena Bank Personal Loan Online?

How to close Chaitanya Godavari Grameena Bank Personal Loan Online?

Dialabank is the best option for applying for a Personal Loan with less paperwork and ease or visit the official site of the bank apply for the loan

✅ How to pay Chaitanya Godavari Grameena Bank Personal Loan EMI Online?

You have multiple options to pay the EMI of a personal loan:

- Net banking

- UPI

- Automatic deduction from your bank account.

How to check Personal Loan Balance in Chaitanya Godavari Grameena Bank?

How to check Personal Loan Balance in Chaitanya Godavari Grameena Bank?

To check the personal loan balance in Chaitanya Godavari Grameena Bank, you will need to contact the customer care number of Chaitanya Godavari Grameena Bank. If you are looking for low-interest personal loans, you can visit Dialabank and fill a simple form for Personal Loan Balance Transfer, and we will do the hard work for you

How to download Chaitanya Godavari Grameena Bank Personal Loan Statement?

How to download Chaitanya Godavari Grameena Bank Personal Loan Statement?

From the official website of the Chaitanya Godavari Grameena Bank, you can also download the statement from the Dialabank account.

How to Top Up Personal Loan in Chaitanya Godavari Grameena Bank?

How to Top Up Personal Loan in Chaitanya Godavari Grameena Bank?

Chaitanya Godavari Grameena Bank allows you to do the top-up of the existing loan rather than opening the new one. You can also contact the Dialabank for this facility

What happens if I don’t pay my Chaitanya Godavari Grameena Bank Personal Loan EMIs?

What happens if I don’t pay my Chaitanya Godavari Grameena Bank Personal Loan EMIs?

Chaitanya Godavari Grameena Bank charges penal interest on your outstanding loan amount if the EMI amount is not paid. Penal Interest can be asked from the bank.

✅ How to find Chaitanya Godavari Grameena Bank Personal Loan account number?

After your application gets approved you will be provided with your account number for Personal Loan.

✅ What relaxation scheme and moratorium Chaitanya Grameena Bank provides about Personal Loan due to COVID 19?

By RBI guidelines, 6 monthly moratoria are provided by Chaitanya Grameena Bank.

✅ What is the Chaitanya Godavari Grameena Bank personal loan customer care number?

Contact 9878981166 for any queries.

✅ What are the Chaitanya Godavari Grameena Bank Personal Loan pre-closure charges?

If you want to pay all your loan amount before the end of your tenure, you can do so. Chaitanya Godavari Grameena Bank does not charge you any extra fee for it.

✅ What is the Chaitanya Godavari Grameena Bank personal loan closure procedure?

- Visit the bank with the complete set of documents (as mentioned above).

- You may be required to fill a form or write a letter requesting pre-closure of the Personal Loan account.

- Pay the pre-closure amount.

- Sign the required documents, if any.

- Take acknowledgement of the balance amount you have paid.

✅ What is the Chaitanya Godavari Grameena Bank Personal Loan Overdraft Facility?

An individual overdraft is a credit office that licenses you to pull out an all-out as and when required. You can in like way repay the got out absolutely at whatever point the condition is ideal. From this time forward, it is potentially the most preferred credit decisions that profited to meet changing individual supporting necessities unbounded.

Other Banks For Personal Loan

| Karnataka Vikas Grameena Bank Personal Loan | |

| Jharkhand Gramin Bank Personal Loan | |

| Kashi Gomti Samyut Gramin Bank Personal Loan | |

| Jana Small Finance Bank Personal Loan |