J and K Bank Personal Loan Key Features Apr 26 2024

Eligibility Criteria |

Details |

| Age | 21 – 65 (at loan maturity) |

| CIBIL Score | Minimum 750 or above |

| J and K Bank Personal Loan Interest Rate | 10.30% per annum |

| Lowest EMI per lakh | ₹2139 |

| Tenure | 12 to 60 months |

| J and K Bank Personal Loan Processing Fee | For loans up to Rs. 75000.00: Rs 250.00 plus applicable GST. For Loans above Rs. 75001.00: Rs 500.00 plus applicable GST |

| Prepayment Charges | NIL |

| Part Payment Charges | Allowed after 12 Months (2 – 4 %) |

| Minimum Loan Amount | ₹50,000 |

| Maximum Loan Amount | ₹ 1.5 Lakh |

Benefits of J and K bank Personal Loan

- Lesser documents are required- It has very little paperwork. You would just have to provide your KYC and income documents for the verification process.

- Immediate approvals- your loan gets sanctioned quickly and credited to your account within 48 hours.

- High loan amount- the applicant can take up to Rs. 20,00,000 from the bank. The amount borrowed depends on the user’s credit transaction history and the present income. If the applicant matches the eligibility criteria for the loan, they can then take the highest loan amount from it.

- Extremely competitive rates of interest- the interest rates range are at 9.99% per annum. An exceptional credit score would help you get a lower rate of interest.

- Flexibility in loan repayments- you have at least 5 years to pay the loan in monthly instalments. You can choose your own loan period according to your payment capability and income.

J and K Bank Personal Loan Eligibility Criteria

The eligibility criteria may vary between Salaried and Self-Employed. The criteria which determine the eligibility for you to avail your personal loan in J and K bank are :

| CIBIL score | 750 and Above |

| Age | 21-60 years |

| Min Income | Rs 25000/month |

| Occupation | Salaried/Self-employed |

J and K Bank Personal Loan Interest Rate, Fees & Other Charges

|

Category |

Details |

|

Interest Rate |

10.30% per annum |

|

Processing Charges |

1% |

|

Min ₹ 1000 and Max ₹ 25000 |

|

|

Prepayment |

No prepayment is allowed until 12 EMIs are paid |

|

Preclosure |

No foreclosure is allowed until 12 EMIs are paid |

|

Prepayment Charges |

NIL |

|

Stamp Duty |

As per state laws |

|

Cheque Bounce Chgs |

₹ 550/cheque + GST |

|

Floating Rate of Interest |

Not Applicable |

|

Overdue EMI Interest |

2% p.m.(on overdue amount) |

|

Amortisation Schedule Chgs |

Rs 200 + GST |

More About: Interest Rates on Personal Loan

J and K Bank Personal Loan Documents Required

The bank does not exactly mention the documents required to apply for each type of personal loan, some of the essential documents needed are: identity proof – Aadhar card, voter ID card, PAN card, passport, driving license, etc; address proof – latest utility bill (electricity/telephone bill), bank passbook, Aadhar card, etc; income proof- latest salary slips, bank account statement, profit and loss statement, income tax return, etc.; a personal loan application form -should be filled properly and signed and 2 recent passport-sized colour photographs.

Personal Loan EMI Calculator for J and K Bank

Click here to know more about- EMI Calculator

J and K Bank Personal Loan Comparison with Other Banks

| Bank | Interest Rate | Tenure | Loan Amount & Proc Fee |

| HDFC Bank | 10.50% to 21.50% | 12 to 60 months | Up to Rs. 40 lakh / Up to 2.50% of the loan amount |

| Bajaj Finserv | Starting from 12.99% | 12 to 60 months | Up to Rs. 25 lakh / Up to 3.99% of the loan amount |

| Axis Bank | 7.35% to 24% | 12 to 60 months | Rs. 50,000 to Rs. 15 lakh / Up to 2% of the loan amount |

| Citibank | Starting from 10.50% | 12 to 60 months | Up to Rs. 30 lakh / Up to 3% of the loan amount |

| Private Bank | 10.50% to 19.25% | 12 to 60 months | Up to Rs. 20 lakh / Up to 2.25% of the loan amount |

Other Loan Products from J and K Bank

| J and K Bank Car Loan |

| J and K Bank Gold Loan |

| J and K Bank Credit Card |

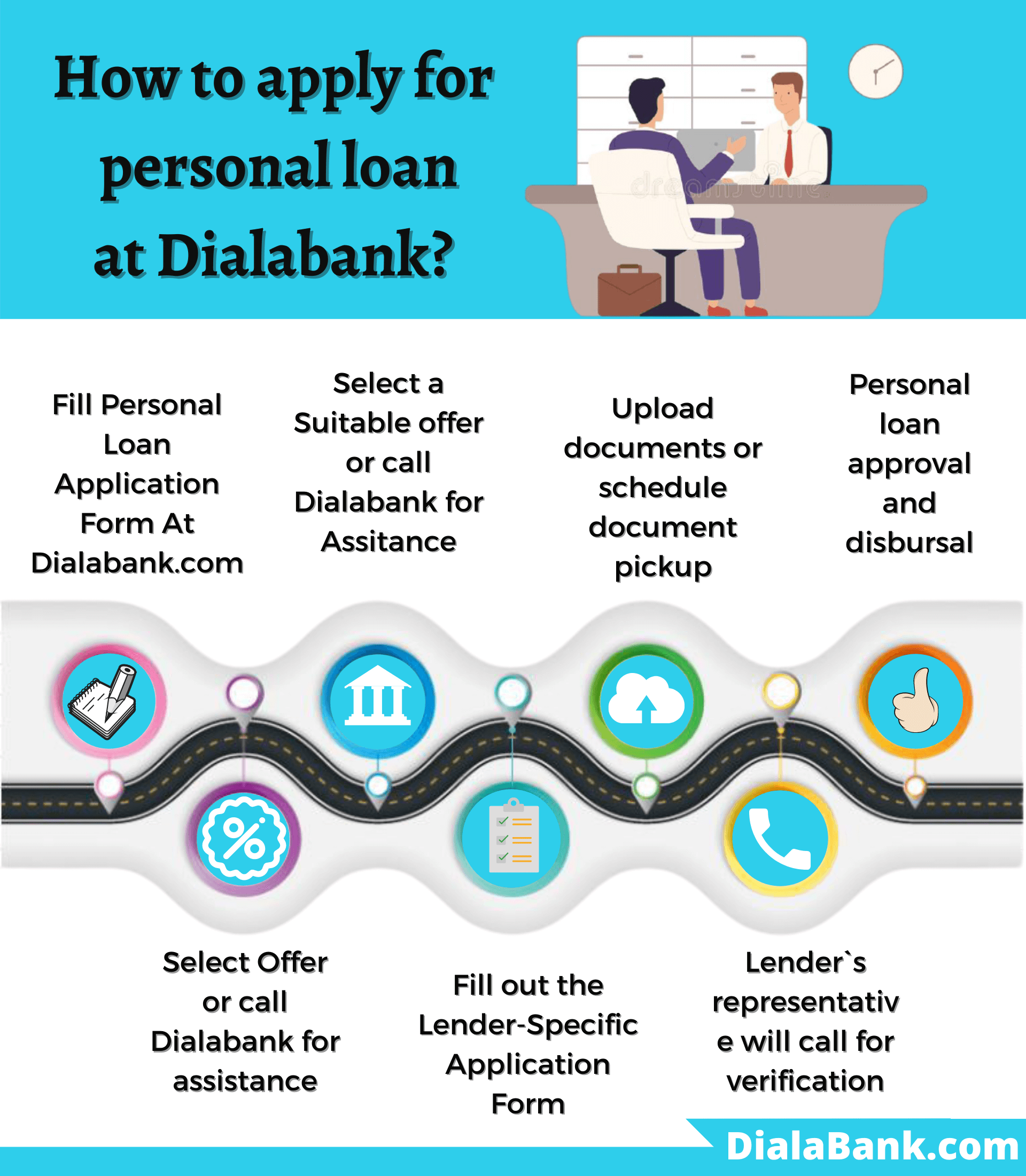

Why should you apply for a J and K Bank Personal Loan with Dialabank?

Dialabank assists you in choosing the best option of banks by giving you the up to date market comparison of various other banks so that you can make the right decision. At Dialabank we have already guided thousands of applicants to take the loan that they need without any hassle and look forward to doing so. Apply today to get the special deals and discounts on J and K bank personal loans.

You can contact us on 9878981166 to get a J and K personal loan.

How to Calculate EMIs for J and K Bank Personal Loan

You can calculate the EMIs on your personal loan, you need to fill in the basic information about the loan: such as the amount of the loan, rate of interest and the loan period.

You just need to enter the values to find the exact amount that you would have to pay every month.

J and K Bank Personal Loan Processing Time

J and K Bank almost always take 2 weeks or 15 days when it comes to the processing of personal loan applications. Nevertheless, J and K Bank sanction your loan in a few hours to a maximum of 1-3 days to its already existing account holders.

J and K Bank Personal Loan Preclosure charges

J and K give you the choice of pre-closing your personal loan after a period of a minimum time period of 12 months of taking the loan and paying successful EMIs on your personal loan. However, there are no pre-closure charges for charged for closing your loan.

Pre Calculated EMI for J and K Bank Personal Loan

| Loan principal @ interest | Tenure | ||||

| 1 year | 2 years | 3 years | 4 years | 5 years | |

| 2.5 lakh @ 11.25% | Rs. 22,125 | Rs. 11,681 | Rs. 8,214 | Rs. 6,492 | Rs. 5,467 |

| 5lakh @ 12% | Rs. 44,424 | Rs. 23,536 | Rs. 16,607 | Rs. 13,166 | Rs. 11,122 |

| 10 lakh @ 12.5% | Rs. 89,082 | Rs. 47,307 | Rs. 33,453 | Rs. 26,579 | Rs. 22,497 |

Different Offers for J and K Bank Personal Loan

J and K have a variety of personal loan categories. Those are consumer loans, scholiast/Saral finance, scholiast/Saral finance scheme for pensioners, solar lighting and photovoltaic finance, laptop/PC finance, and scooty finance girls/ ladies.

J and K Bank Personal- Consumer Loan

J and K offer this personal loan for government employees, semi-government, civic bodies, and self-employed with assured income.

Saholiat/Saral Finance

This is the personal loan offered to permanent employees of central /state government, public sector undertakings, autonomous bodies, and organizations.

Saholiat/Saral Finance scheme for pensioners

Central and state government pensioners withdrawing their allowance through the bank.

Solar Lighting and Photo Voltaic Finance

It is for the confirmed employees of the government and semi-government undertakings, autonomous bodies, and public sector undertakings. It could also be for permanent employees of reputed organizations or private companies with at least 2 years of alliance with the current employer. It is also for self-employed individuals or business professionals with the running of their company/organization for 2 years.

Laptop/PC Finance

This is for the teachers who fall under the Rehabber-a-Taleem, officials who fall under the Rehabber-a- Zeerat under the J & K government. Pensioners who are both state/central withdrawing their monthly salaries/pension through the bank. Professionals, self-employed individuals with proprietorship concerns. Regular students of recognized schools, colleges, and universities. Permanent employees of the government. Employees of reputed organizations and contractual government employees.

Scooty Finance for Girls/Ladies

The age of the applicant/co-applicant at the time of loan maturity should be 58 years or more at the age of retirement, whichever is higher for employees and 65 years for others. The borrower should have been in their current employment for at least 1 year or must have a business standing for at least 2 years. The applicant should be an Indian citizen and should also have a valid driving license.

How to Apply Online for J and K Bank Personal Loan?

You can avail of a J and K personal loan online by visiting the J and Ks online website and filling the form required to apply for a personal loan or you can just follow the few steps to apply for a J and K personal loan:

Visit our website —> Fill the form online and submit it —> Wait for a call from one of your relationship managers related to the field —> Get customized service to get the personal loan by comparing between other features of banks and choosing the one which is most suitable to your preferences.

J and K Bank Personal Loan Status

You can monitor the status of your J and K bank personal loan by the following measures:

- You could also visit the nearest loan branch and ask the bankers also for the same.

- Log In to the bank’s net banking portal, click on the loans from the top icon and click on enquire to check the status of your personal loan.

- Search for ‘personal loan status’ on google, click on the first link which will direct you to the loan status tracker webpage of J and K bank and fill in the needed information to monitor the status of your loan.

FAQs About J and K Bank Personal Loan

✅ What is J and K Personal Loan?

Personal loans with less documentation become trouble-free as no collateral security is needed. J and K offer personal loans to its already pre-existing customers in just 10 seconds and can take a maximum of 4 hours for the new customers.

The interest rates are at 10.30% per annum and the loan amount can be used by the applicant for any financial need from higher studies or a vacation to using the money for daily expenses.

✅ What is the procedure of a Personal Loan in J and K Bank?

The process to get a personal loan with J and K bank is completely trouble-free. You can apply for a personal loan in J and K bank by visiting the nearest branch with your personal documents, through a J and K bank ATM, or by using the J and K bank’s loan assist app. You can also contact us and apply with Dialabank for simple and customized assistance.

The steps are:

- Calculation of loan amount required as per your need

- Checking your loan eligibility online or by visiting the branch

- Approaching the bank via your preferred method (online or offline)

- Submitting the required documents with the banker,

- Disbursal of loan amount once your application and documents have been verified and approved.

✅ How much EMI on J and K Personal Loan?

EMI is the money that you would have to pay every month to repay your personal loan. The EMI on J and K Bank personal loans largely depends on the amount borrowed, the rate of interest to be paid, and the time period of the loan. It could be calculated simply using the EMI calculator on our website.

✅ How much CIBIL score is required for J and K’s personal loan?

CIBIL score is a 3 digit summary of your credit transaction history which determines if you’re eligible for a personal loan. J and K would want you to have a CIBIL score with a minimum of 700 being the lower limit. You can escalate your CIBIL score by paying off your EMIs and credit card bills on time.

✅ Minimum credit score needed for J and K bank personal loan?

J and K Bank needs you to have a minimum score of 750 to be eligible for a personal loan.

✅ How to calculate J and K’s personal loan EMI?

EMI on personal loan can be calculated using the formula, E = P x R x [(1+R)^N] / [(1+R)^N-1] where,

P= Principal or your loan amount,

R= Rate of interest, and

N= Loan Tenure.

You can calculate the amount that you would have to pay online at Dialabank’s website which is free and compare it with other offers from different banks and financial institutions.

✅ What can I use J and K bank personal loans for?

There are multiple uses for a number of reasons which range from small bill payments and daily expenditure to a medical emergency and bigger expenses such as debt unification, wedding, etc. You can fulfil your financial needs with a personal loan by applying on our digital platform.

✅ How to prepay J and K bank personal loans?

Steps to prepay your J and K bank personal loan:

- Collect the required documents (PAN, Id proof, and any other loan documents)

- Visit your loan branch and ask for the balance and any pre-closure charges or penalties.

- You will be prompted to fill a form requesting the prepayment of the loan.

- Pay the prepayment amount (cash up to Rs.49000, Cheque, or DD) and take its acknowledgement.

- Your loan will be closed as soon as the bank receives the fund.

✅ How to repay J and K bank personal loans?

You have the choice to repay your J and K personal loan either by sending a standing instruction to your bank account to pay the EMI, online payment through other modes or through post-dated cheques.

✅ How to repay J and K bank personal loans online?

You can pay your personal loan EMI online in just 5 steps:

- Visit the payments page on J and K Bank’s website.

- Click on ‘PAY ONLINE’ and enter your ‘Loan No.’ and ‘Date of Birth’.

- Select your net banker from the drop-down menu and click on PAY.

- You will be securely redirected to the bank payment interface of your chosen net banking option.

- Complete the payment and you will receive an online transaction confirmation. You can also pay your J and K Bank personal loan on Paytm.

✅ What are the J and K Bank Personal Loan closure procedures?

- Just go to the bank with the documents.

- Write a letter for pre-closure of the J and K Personal loan account.

- Pay the pre-closure charges as per J and K Bank Personal Loan.

✅ What are J and K Bank Personal Loan preclosure charges?

J and K Bank Personal Loan preclosure charges are Nil.

✅ What is the J and K Bank Personal Loan overdraft scheme?

For simplifying the process and providing you with a hassle-free service while processing an overdraft scheme at J and K Bank Personal Loan is provided, it gives you an online way to get your own overdraft, also known as Smartdraft – Overdraft Against Salary. You do not need to visit bank branches and go through a boring process. Just log in to J and K Bank online banking portal and from there you can fill out a simple form and get an overdraft under your name.

✅ What is the J and K Bank Personal Loan maximum tenure?

J and K Bank Personal loan maximum tenure is 60 months.

✅ What is J and K Bank Personal Loan minimum tenure?

J and K Bank Personal Loan minimum tenure is 12 months.

✅ What is the J and K Bank Personal Loan customer care number?

The customers get in touch with the bank via call on 9878981166.

Other Banks For Personal Loan

| Meghalaya Rural Bank Personal Loan | |

| Manipur Rural Bank Personal Loan | |

| Mizoram Rural Bank Personal Loan | |

| Maharashtra Gramin Bank Personal Loan |