Sarva UP Gramin Bank Personal Loan Key Features – Apr 27 2024

| Eligibility Criteria | Details |

| Age | 21-58yrs (at loan maturity) |

| CIBIL Score | 750 |

| Sarva UP Gramin Bank Personal Loan Interest Rate | 9.99% p.a. |

| Lowest EMI per lakh | NIL |

| Tenure | 12 to 60 months |

| Sarva UP Gramin Bank Personal Loan Processing Fee | 1%-2% |

| Prepayment Charges | NIL |

| Part Payment Charges | NIL |

| Minimum Loan Amount | Rs. 50,000 |

| Maximum Loan Amount | Rs. 25 lakh |

Sarva UP Gramin Bank Personal Loan Eligibility Criteria

Eligibility criteria for a personal loan:

| CIBIL score criteria | 750 and above |

| Age criteria | 21-58 yrs(at loan maturity) |

| Min Income criteria | Rs. 7,000 per month |

| Occupation criteria | Salaried/Self-Employed |

Sarva UP Gramin Bank Personal Loan Interest Rate and Charges

Lowest Personal Loan Interest Rate

| Sarva UP Gramin Bank Personal Loan Interest Rate | 9.99% p.a. |

| Sarva UP Gramin Bank Personal Loan Processing Charges | 1%-2% |

| Prepayment Charges | NIL |

| Stamp Duty | NIL |

| Cheque Bounce Charges | NIL |

| Penal Interest | NIL |

| Floating Rate of Interest | NIL |

Sarva UP Gramin Bank Personal Loan Documents Required

| Form | Duly filled application form |

| Proof of Identity | Copy of: > Passport > Driving License > Aadhar Card > Voter ID Card |

| Proof of Address | Rent Agreement (Min. 1 year of stay) Utility Bills Passport (Proof of permanent residence) Ration card |

| Proof of Income | > ITR: Last two Assessment years > Salary Slip: Last 6 months > Bank Statement: Last 3 months |

Sarva UP Gramin Bank Personal Loan EMI Calculator

EMI Calculator for a personal loan.

Sarva UP Gramin Bank Personal Loan Compared to Other Banks

| Particulars | Sarva UP Gramin Bank | HDFC Bank | Bajaj Finserv | Axis Bank | Citibank | Private Bank |

| Interest Rate | 9.99% | 11.25% to 21.50% | Starting from 12.99% | 15.75% to 24% | Starting from 10.99% | 11.50% to 19.25% |

| Tenure | 12 to 60 months | 12 to 60 months | 12 to 60 months | 12 to 60 months | 12 to 60 months | 12 to 60 months |

| Loan amount | Up to Rs. 25 lakh | Up to Rs. 40 lakh | Up to Rs. 25 lakh | Rs. 50,000 to Rs. 15 lakh | Up to Rs. 30 lakh | Up to Rs. 20 lakh |

| Processing Fee | 1%-2% | Up to 2.50% of the loan amount | Up to 3.99% of the loan amount | Up to 2% of the loan amount | Up to 3% of the loan amount | Up to 2.25% of the loan amount |

Other Loan Products from Sarva UP Gramin Bank

Why should you apply for Sarva UP Gramin Bank Personal Loan with Dialabank?

Dialabank provides the best and fast services all over the country. It has truthful and responsible operators which will guide you throughout the processing of the best personal loan. If you apply for Sarva UP Gramin Bank Personal Loan with Dialabank, your personal loan processing will be faster.

How to Calculate EMIs for Sarva UP Gramin Bank Personal Loan

The information required for the calculation of your Sarva UP Gramin Bank’s Personal Loan EMI are the following:

- Loan Amount

- Rate of Interest

- Tenure

Put these values in the calculator below and find your monthly EMIs

Sarva UP Gramin Bank Personal Loan Processing Time

Sarva UP Gramin Bank’s Personal Loan Processing Time refers to the time for the procedure of the loan application approval. This bank will take 2 days for the loan application approval.

Sarva UP Gramin Bank Personal Loan Preclosure Charges

Sarva UP Gramin Bank’s Personal Loan Preclosure is the repayment of the loan amount before time. Preclosure will help you in reducing the personal loan interest rate.

Pre Calculated EMI for Personal Loan

| Rate | 5 Yrs | 4 Yrs | 3 Yrs |

| 9.99% | 2149 | 2560 | 3250 |

| 11.00% | 2174 | 2584 | 3273 |

| 11.50% | 2199 | 2608 | 3297 |

| 12.00% | 2224 | 2633 | 3321 |

| 12.50% | 2249 | 2658 | 3345 |

| 13.00% | 2275 | 2682 | 3369 |

| 13.50% | 2300 | 2707 | 3393 |

| 14.00% | 2326 | 2732 | 3417 |

| 14.50% | 2352 | 2757 | 3442 |

| 15.00% | 2378 | 2783 | 3466 |

Different Offers For Sarva UP Gramin Bank Personal Loan

Sarva UP Gramin Bank Home Loan

- Sarva UP Gramin Bank proffers home loans.

- It offers home loans to the Indians as well as for a fully documented NRI.

- Earning of an applicant is more than the required monthly income.

Sarva UP Gramin Bank Personal Loan for Government Employees

- Sarva UP Gramin Bank offers a personal loan for Government Employees.

- The loan amount depends on the company’s name and fame.

Sarva UP Gramin Bank Education Loan

- Sarva UP Gramin Bank offers Education Loan.

- For Indian colleges, the loan amount provided is Rs. 10 lakh.

- For studies Abroad, the loan amount provided is Rs. 20 lakh.

Sarva UP Gramin Bank Personal Loan for Car

- Sarva UP Gramin Bank offers car loans.

- The maximum no. of EMIs that are allowed for a new car is 84.

- The maximum number of EMIs that are allowed for a used car is up to 60.

Sarva UP Gramin Bank Personal Loan Balance Transfer

Sarva UP Gramin Bank’s Personal Loan Balance Transfer is the sending of the loan amount from one bank to another. A balance transfer is helpful for the reduction of the interest rate.

Sarva UP Gramin Bank Personal Loan Top Up

Sarva UP Gramin Bank’s Personal Loan Top Up is the supplementary amount added to your existing loan amount.

Sarva UP Gramin Bank Home Renovation Loan

For most borrowers, home improvement now tops the priority list, but funds are becoming a barrier in the process. If it’s repainting or tiling the Sarva UP Gramin Bank loan, the Sarva UP Gramin Bank Home Improvement Loan is launched to have the home refurbished. The below are the main highlights of the Sarva UP Gramin Bank home improvement loan:

- The home renovation loan schemes and policies embrace basic documentation and no-complexity.

- The Sarva UP Gramin Bank loan is out there for each existing and new customer.

Sarva UP Gramin Bank Holiday Loan

A Holiday Loan covers the plans of the exotic international vacation without much pressure from the financial crisis.

- Sarva UP Gramin Bank avails quick disbursal of the loan in advance for your vacation.

- The processing fee is the lowest.

Sarva UP Gramin Bank Fresher Funding

The subsequent are the key options that the Sarva UP Gramin Bank Freshers Funding exhibit:

- A satisfactory Loan amount is given.

- The candidate must be 21 years of age or more.

- The interest rate charges are variable according to the applicant’s profile.

Sarva UP Gramin Bank NRI Personal Loan

For many valid reasons, people tend to move out which often include education, medical facility, job, etc. For such candidates financial expenses become an obstacle, such emergency personal expenses are looked after by the special loan category that is Sarva UP Gramin Bank NRI Personal Loan. The important features of the individual loan are as given below:

- Highly competitive rates and flexible repayment tenures for the applicant.

- No collateral or security is demanded or the advance disbursement.

- The document proof is required to be attached for both the Indian resident (primary borrower) and the NRI candidate (co-applicant).

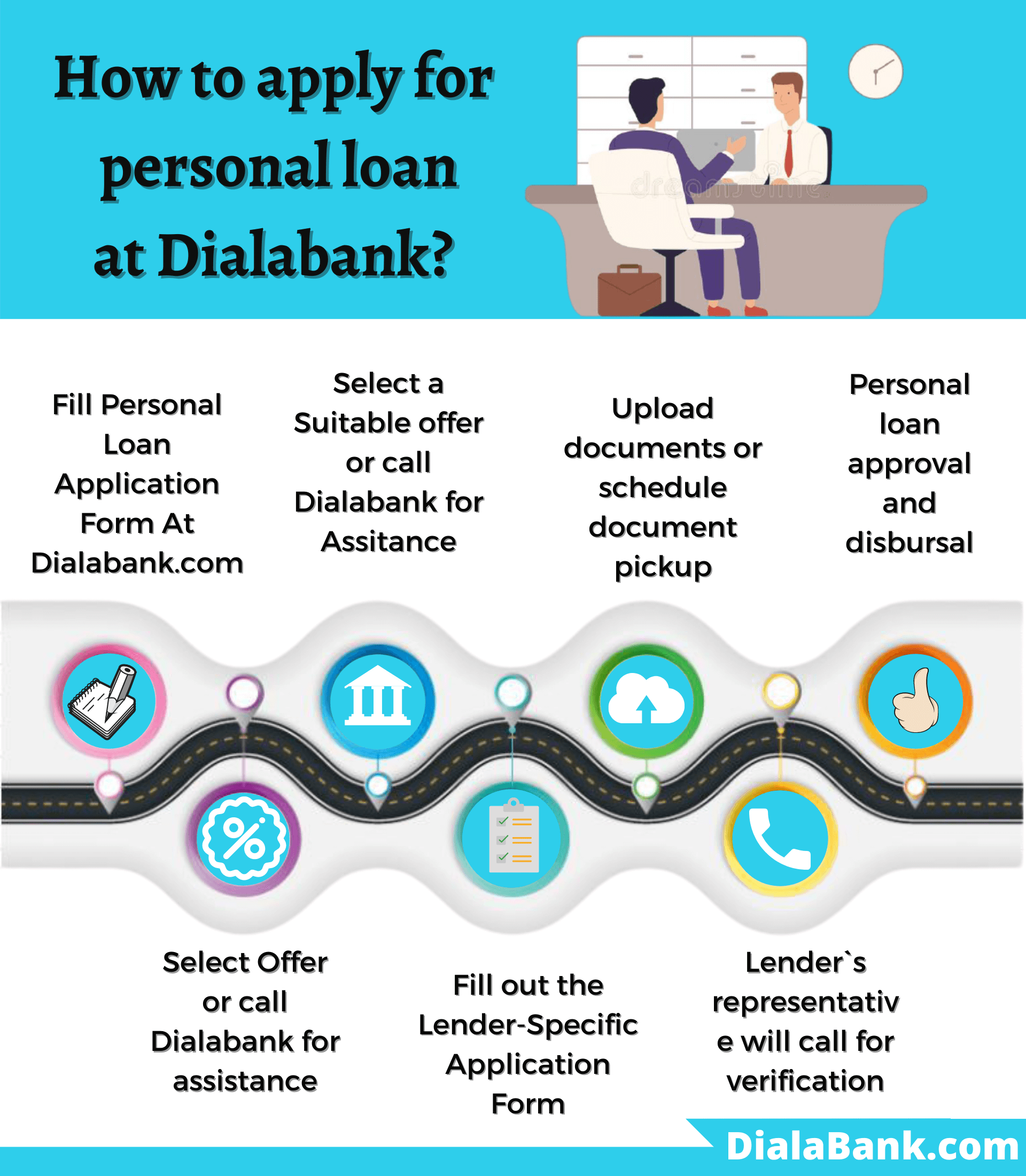

How to Apply Online for Sarva UP Gramin Bank Personal Loan with Dialabank?

You can apply for Sarva UP Gramin Bank’s Personal Loan online by visiting the Sarva UP Gramin Bank’s online portal and filling the form for applying for a personal loan, or you can simply follow the given steps for applying for a Sarva UP Gramin Bank Personal Loan:

- Visit Dialabank.

- Fill the Application form and submit it.

- Wait for a call from one of our Relationship Managers who are experts in this field.

- Get personalized service for availing Personal Loan by comparing between features of various banks and selecting the one that you need.

Personal Loan Verification Process

The following steps are a must after you apply for a Personal Loan in Sarva UP Gramin Bank which is as mentioned below:

- As soon as you complete the application procedure with Dialabank, your application for a Personal Loan is further proceeded by the Bank.

- After the bank verifies your application form, they give you a verification call.

- when the verification on a telephonic conversation is done, the bank schedules a pick up for document submission.

- Once all the required documents are attached the further verification takes place.

- Post that interest rate, the loan amount is finalized and disbursed.

- The bank patiently waits for the customer’s affirmation, and once the customer confirms the loan amount is instantly disbursed.

Check your Sarva UP Gramin Bank Personal Loan Application Status

The Sarva UP Gramin Bank Loan application can be tracked in simple easy steps as follows:

- The offline method applies, the applicant has to visit the bank branch and take updates on the application status.

- From the Sarva UP Gramin Bank Online website, submit your name and reference proposal number.

- Submit the request and you will receive an update regarding your Personal Loan.

- Via the mobile application, the loan application can easily be tracked.

How to Login to Sarva UP Gramin Bank Portal

- Navigate through the Sarva UP Gramin Bank Website.

- Log in with your Sarva UP Gramin Bank login ID and Password.

- Hit the login key and get access to the bank portal easily.

Sarva UP Gramin Bank Personal Loan Statement

- Visit the official website of Sarva UP Gramin Bank.

- Navigate through the page and click on the “Register New Loan”.

- Fill in all the required information and click on the submit key.

- after receiving an OPT that will direct you to register for Loan Statement.

Sarva UP Gramin Bank Personal Loan Restructuring (COVID – 19)

the strain of COVID-induced lockdown, The Sarva UP Gramin Bank took AN initiative to minimize the burden on its borrowers. The bank mandated the run moratorium that led to September. Subsequently, all the borrowers were anticipated to resume back to the previous EMI schedules. However, the borrowers were still in mayhem on a way to repay the outstanding with current monetary crunches. Considering the adverse scenario Sarva UP Gramin Bank introduced a replacement framework that supports the reason for its borrowers permissible by the RBI.

The relief framework is geared toward destressing the borrowers by plummeting financial stress. This new framework offers the receiver liberty to increase the reimbursement tenure up to two years at sure consequences. The extended relaxation can welcome one more charge per unit on the outstanding quantity and thus, the loan is termed as “Restructured” within the credit report of the beneficiary. leading to a remark on the borrower’s credit score, thus, the borrowers are suggested to prefer the mechanism in most unfavourable circumstances otherwise the repayment schedules should obtain the threads as before.

Sarva UP Gramin Bank Customer Care

- Via Phone: The customers get in touch with the bank via call on 9878981166

- Via Chatbox: The chatbox is open for any suggestion or query on the official site.

- Visiting The Bank: The applicant can visit the bank branch for any information on loan approval.

Benefits of Applying for Personal Loan on Dialabank

- Accessible Customer care Services: When the candidate applies for a personal loan with Dialabank. The customer can easily get in touch with the bank and have 24*7 accessibility.

- Minimum Documentation: While applying for a Personal Loan with Dialabank the applicant goes through a very simple procedure along with the perks of basic documentation.

- Various Platforms: The applicant is recommended not to limit their options as Dialabank gives you the liberty to select and compare different financial institutions at once.

- EMI Calculator: You can easily know the applicable EMI on your Personal Loan with Dialabank’s customer-friendly EMI Calculator that gives accurate EMI Payable on your Personal loan based on the interest rate.

Important Aspects

The mentioned below are a few points that should be taken into consideration before you apply for a Personal Loan:

- It is better to keep the loan quantity as minimum as possible. Since the compensation of a lesser amount is simple and brief. The repayment capability of the human is of utmost importance whereas applying for a private loan that the loan amount ought to be availed as per the necessity instead of availing higher loan amount because of its easy availability.

- The credit score determines if the applicant is eligible for the given credit, thus it’s recommended to require a glance over the Credit Score before pitching a Loan application. In most of the scenarios, the weak credit score solely ends up in a straight rejection of the application.

- Go for the bank or establishment giving the simplest at service and rate of interest for the loan quantity you require. Compare and analyze before sinking for one bank. within the Credit World, the banks are offering competitive interest rates and tenures for the loan amount thus a review into the banks can only profit you.

How to Apply for Sarva UP Gramin Bank Personal Loan?

The following steps are required for availing of a personal loan:

- Visit Dialabank and fill the application form.

- You will get a call from the bank.

- Our instructors will guide you through the entire process and tell you the details of the loan.

- For any query, call at 9878981166.

FAQs About Sarva UP Gramin Bank Personal Loan

✅ How to apply for Sarva UP Gramin Bank Personal Loan?

You can apply for a personal loan from Sarva UP Gramin Bank by visiting the bank branch or by submitting the form with Dialabank. You can get comfort to apply from anywhere with Dialabank.

✅ What is the Interest Rate for Sarva UP Gramin Bank Personal Loan?

The interest rate charges by Sarva UP Gramin Bank’s Personal Loan is 9.99% p.a. which varies from time to time.

✅ What is the minimum age for getting a Personal Loan from Sarva UP Gramin Bank?

You must be 21 years old for availing of a personal loan from Sarva UP Gramin Bank.

✅ What is the maximum age for getting a Personal Loan from Sarva UP Gramin Bank?

To be eligible for a personal loan from Sarva UP Gramin Bank, the maximum age for availing of a personal loan is 58 years.

✅ What is the minimum loan amount for Sarva UP Gramin Bank Personal Loan?

The minimum loan amount for Sarva UP Gramin Bank’s Personal Loan is Rs. 50,000.

✅ What is the maximum loan amount for Sarva UP Gramin Bank Personal Loan?

You can take advantage of the maximum loan amount for Sarva UP Gramin Bank’s Personal Loan is Rs. 25 lakhs.

✅ What are the documents required for Sarva UP Gramin Bank Personal Loan?

The documents required for Sarva UP Gramin Bank’s Personal Loan are an Aadhaar card, driving license, voter ID, salary certificate, and form number 16, ITR file of 2 financial years.

✅ What is the Processing Fee for Sarva UP Gramin Bank Personal Loan?

The processing fee for personal loan charges is 1%-2% of the loan amount in Sarva UP Gramin Bank.

✅ How to get Sarva UP Gramin Bank Personal Loan for Self Employed?

There is a provision of personal loans for Self Employed from Sarva UP Gramin bank to meet their economic needs. You should have ITR files for the last two assessment years.

✅ What is the Maximum Loan Tenure for Sarva UP Gramin Bank Personal Loan?

The maximum Loan Tenure duration for Sarva UP Gramin Bank is 60 months.

✅ What should be the CIBIL Score for Sarva UP Gramin Bank Personal Loan?

For availing of a personal loan from Sarva UP Gramin Bank, you must have a 750 and above CIBIL score.

✅ Do I have a preapproved offer for Sarva UP Gramin Bank Personal Loan?

You can avail of a preapproved offer for Sarva UP Gramin Bank’s Personal Loan through Dialabank. You just fill a form and the bank will check out the best options for you.

✅ How to calculate EMI for Sarva UP Gramin Bank Personal Loan?

To calculate your personal loan EMI for Sarva UP Gramin Bank Personal Loan, you can use the EMI calculator available at Dialabank’s website.

✅ How to pay Sarva UP Gramin Bank Personal Loan EMI?

Your EMIs of Sarva UP Gramin Bank are automatically subtracted from your bank account. You can use net banking.

✅ How to close Sarva UP Gramin Bank Personal Loan?

If you want to close your personal loan, make sure that you have paid your outstanding loan amount and then contact the Sarva UP Gramin Bank branch and get a no dues certificate.

✅ How to check Sarva UP Gramin Bank Personal Loan Status?

You must visit the Sarva UP Gramin Bank branch for checking out your loan status. On the other hand, you can visit Dialabank and fill a form to allow us to do work for you.

✅ How to close Sarva UP Gramin Bank Personal Loan Online?

The following instructions are to be followed for closing your Sarva UP Gramin Bank Personal Loan Online:

- Visit the Sarva UP Gramin Bank’s net banking page.

- Login with your details.

- Pay for your personal loan.

- Save the transaction receipt.

✅ How to pay Sarva UP Gramin Bank Personal Loan EMI Online?

Your personal loan EMIs can be paid through net-banking services provided by Sarva UP Gramin bank. Dialabank allows you to compare different banks and choose the best for you.

✅ How to check Personal Loan Balance in Sarva UP Gramin Bank?

You require to contact the customer care number to check your personal loan balance from Sarva UP Gramin Bank. If you look after the low-interest personal loans, you can visit Dialabank and fill a form for Personal Loan Balance Transfer and the bank will provide you with the best offers.

✅ How to download Sarva UP Gramin Bank Personal Loan Statement?

You can download the personal loan statement of Sarva UP Gramin bank by using the Sarva UP Gramin bank’s mobile banking app. You can visit the online platform of Dialabank.

✅ How to Top Up Personal Loan in Sarva UP Gramin Bank?

You will visit the bank branch if you need a top-up personal loan from Sarva UP Gramin bank. Or fill a form with Dialabank at Personal Loan Top Up.

✅ What happens if I don’t pay my Sarva UP Gramin Bank Personal Loan EMIs?

Sarva UP Gramin Bank charged a penal interest for not paying your personal loan EMIs on time. You can apply for a transfer of balance with Dialabank to avail of low-interest personal loans.

✅ How to find Sarva UP Gramin Bank Personal Loan account number?

Just contact your Sarva UP Gramin Bank branch to know about your account number. You can fill a form with Dialabank and we will do our best for you.

✅ What is the Sarva UP Gramin Bank personal loan closure procedure?

Visit the bank with the complete set of documents (as mentioned above). You may be required to fill a form or write a letter requesting pre-closure of the Personal Loan account. Pay the pre-closure amount. Sign the required documents, if any. Take acknowledgement of the balance amount you have paid.

✅ What is Sarva UP Gramin Bank personal loan maximum tenure?

The maximum tenure of the Sarva UP Gramin Bank personal loan is 60 months.

✅ What is Sarva UP Gramin Bank personal loan minimum tenure?

The minimum tenure of the Sarva UP Gramin Bank personal loan is 12 months.

✅ What is the Sarva UP Gramin Bank personal loan customer care number?

The customer care number of Sarva UP Gramin Bank personal loan is 9878981166.

✅ What are the Sarva UP Gramin Bank Personal Loan pre-closure charges?

Sarva UP Gramin Bank gives you the option of pre-closing your loan after a period of a minimum of 12 months of taking the loan and paying 12 successful EMIs on your mortgage. However, Sarva UP Gramin Bank charges a Prepayment or Pre-closure charge. Refer to the table mentioned above.

Other Banks For Personal Loan

| Barclays Finance Personal Installment Loans | |

| Uttrakhand Gramin Bank Personal Loan | |

| Vidharbha Konkan Gramin Bank Personal Loan | |

| Utkal Grameen Bank Personal Loan |