Best Banks for Personal Loan in Bathinda

1% - 2.5% of the Loan Amt

Personal Loan in Bathinda Features

Are you running short out of cash? Do not worry. Personal Loan is available for you. This loan is unsecured with negligible documentation and less administrative work. This Loan can get affirmed inside 48 hours after the check procedure.

Are you running short out of cash? Do not worry. Personal Loan is available for you. This loan is unsecured with negligible documentation and less administrative work. This Loan can get affirmed inside 48 hours after the check procedure.

Individual Loan is an unstable credit that gives money related guide to the clients at reasonable financing costs. To get a Personal Loan, the candidate needs to have an unbending and great wellspring of salary and has a decent record as a consumer.

Moreover, there is no closure use limitation on the utilization of the individual credit sum. You can utilize this credit sum anyplace you need to do.

Personal Loan in Bathinda Interest Rates and Charges

To check Personal Loan Interest Rate for all major banks you can visit: Personal Loan Interest Rates

Bank

Processing Fee

HDFC Bank Personal Loan

0.25% to 1.50%

Axis Bank Personal Loan

0.50% to 1.50%

Nil

Private Bank Personal Loan

0.25% to 1.50%

SBI Personal Loan

500/- to 0.50%

Nil

Kotak Personal Loan

1% to 2%

IIFL Personal Loan

Nil

Nil

Muthoot Personal Loan

Nil

Nil

Manappauram Personal Loan

Nil

Nil

PNB Personal Loan

0.70% to 1%

Nil

Canara Bank Personal Loan

0.01

Nil

Andhra Bank Personal Loan

Nil

Nil

Personal Loan in Bathinda Documents Required

Salaried Customers:

- You have to give one of these records to private confirmation Passport/Driving License/Ration Card/Aadhar Card/PAN Card/Voter ID Card/Utility bills of the most recent three months, or you can give your tenant contract papers.

- The applicant can use any one of these following documents as an identity proof Aadhar Card / PAN Card/ Voter ID Card/ Passport/ Driving License.

- Salaried applicant Income proof: 6 months of the latest bank statement and six months of salary receipt

- Passport-sized photographs – 2

*NOTE: if there should be an occurrence of leased condos, lease understanding should be joined.

Self-Employed Customers:

- Pay evidence for self-utilized: a year ago ITR return reports and examined monetary papers.

- Two visas estimated photos

- You have to give one of these reports to private evidence Passport/Driving License/Ration Card/Aadhar Card/PAN Card/Voter ID Card/Utility bills of the most recent three months, or you can give your tenant contract papers.

- The applicant can use any one of these following documents as an identity proof Aadhar Card / PAN Card/ Voter ID Card/ Passport/ Driving License.

PERSONAL LOAN

Interest Rate 9.99%

Personal Loan in Bathinda Eligibility Criteria

The personal loan eligibility criteria for both Salaried and Self-Employed are different:

Salaried Applicants

- The base age necessities of the individual should be 21 years and generally extraordinary up to 60 years.’

- The candidates must have the work understanding of the three years. What’s more, the payment ought to be gotten in their records as it were.

- The candidates must have a great financial record.

- The activity area of the candidate ought to be referenced.

Self-Employed Applicants

- The base age necessity for a free individual ought to be 25 years.

- The candidates applying for the individual advance should record ITR throughout the previous three years.

- On the off chance that the candidates are the specialist, at that point, the business ought to be running from the previous three years.

- The financial assessment of the individual candidates ought to be acceptable .there ought not to be any obligation or duty left.

- The yearly pay of the candidates ought to be at least Rs 2.5 lakh.

- The entire documentation procedure of the individual credit is the candidates need to present his money related and his bank articulation of the past a quarter of a year

Why Apply for Personal Loan Bathinda?

- No security or collateral is required.

- We don’t charge any additional expenses from our clients.

- We are consistently prepared to support our candidates and are accessible all day, every day.

- The endorsement procedure is efficient on the off chance that you apply through dialabank.

- Individual Loan Bathinda gets dispensed within 24 hours.

- Our specialists will help you, and our relationship supervisors will give direction.

How to apply for Personal Loan Bathinda?

- Visit dialabank

- At that point, you have to apply to take an individual advance.

- From that point onward, your credit demand is moved to the bank where one of the workers will experience your application and check whether it fulfills bank guidelines or not.

- Additionally, now of time bank will check your CIBIL alongside your pay qualification.

- When your application full-fills all the measures bank furnishes you with the credit sum and its individual loan fee.

- At long last, in the event that you acknowledge the credit sum, the disbursal of the advance happens.

PERSONAL LOAN

Interest Rate 9.99%

Processing Fee / Prepayment Charges on Personal Loan Bathinda

Each Bank and NBFC charges an expense for handling your Personal Loan application. These charges shift between 1% of the authorized credit sum.

In the event that you wish to dispossess your credit before the concurred advance residency, each loaning foundation charges you a corrective prepayment expense. Much of the time, you can’t close your credit before a year. Post that the charges shift contingent upon how long the credit has done. These charges change from 4% of the extraordinary credit sum in the second year to 2% in the fourth year of the advance.

Personal Loan Bathinda EMI Calculator

Compared Monthly Installments likewise know as EMI are the month to month fixed charges that you pay to the bank as a month to month reimbursement for the advance sum obtained. In light of your profile, the financing cost on your advance is resolved. Your EMI is determined premise the personal loan interest rate you are charged by the bank and the measure of credit you need to take and the period for which you appreciate the advance.

Click to learn more about EMI Calculator: Personal Loan EMI Calculator

CIBIL Score required for Personal Loan Bathinda

Each loaning establishment has its own rules for the base CIBIL score required for handling a Personal Loan application in Bathinda. Most foundations require a base score of 750 to process your credit application.

The establishments don’t simply take a gander at the general score yet, in addition, the nitty-gritty conduct on the past advances taken. This remembers subtleties for the sort of credit taken and the sum acquired. Any deferred installments for past credits can go about as an obstruction to your profiting a free

PERSONAL LOAN

Interest Rate 9.99%

Personal Loan Bathinda Agents

Dialabank is the leading agent for availing Instant Personal Loan in Bathinda. You can apply online at dialabank or give a call at 9878981166

Personal Loan Bathinda Contact Number

Call 9878981166 and get instant help and approval for Personal Loan in Bathinda.

Pre Calculated EMI Table for Personal Loan Bathinda

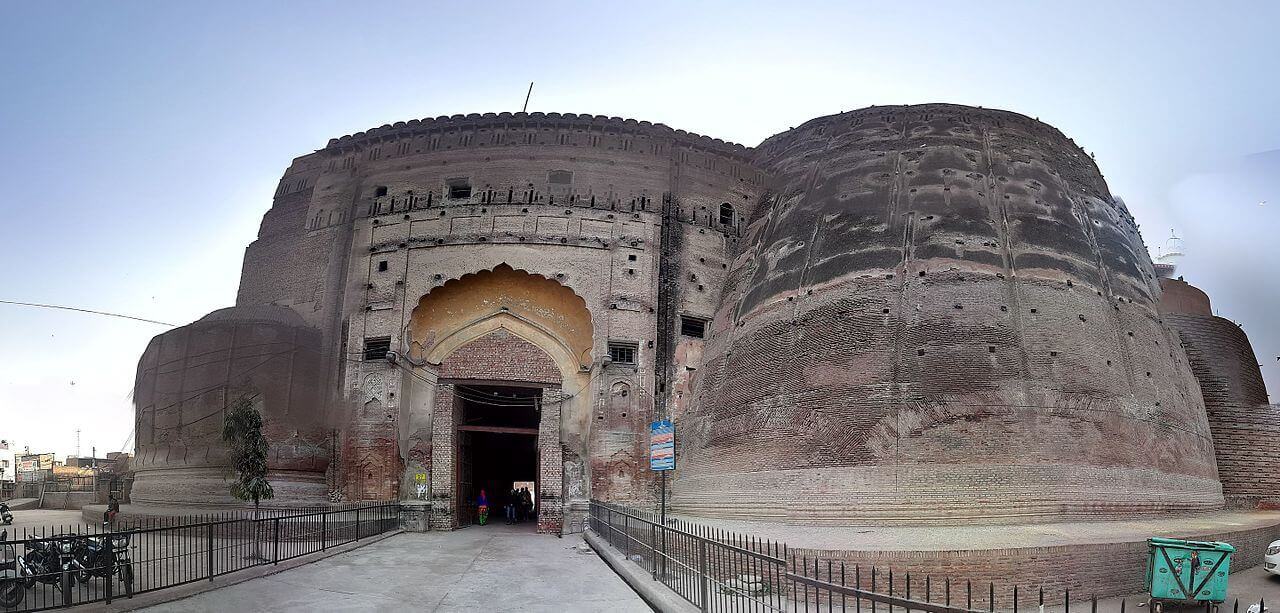

About Bathinda

Bathinda is a city located in northwest India in the Malwa region in the state of Punjab. This city is named after the Bhati Rajput kings and is one of the oldest cities in India. Bathinda is also known as “City of Lakes” and also once called “Taber-e-Hind” which means the Gateway of India.

| Personal Loan Adampur | Personal Loan Akluj |

| Personal Loan Akola | Personal Loan Akot |

| Personal Loan Alirajpur | Personal Loan Alwar |

| Personal Loan Andul | Personal Loan Arambagh |