Federal Bank Gold Loan Key Features – Apply Now

| Federal bank Gold Loan Interest Rate | 7.25% per annum |

| Federal bank Gold Loan Rate Per Gram | ₹ 3,800 to ₹ 4,350 |

| Federal bank Gold Loan Processing Fee |

0.5% or ₹1000 whichever is higher

|

|

Federal bank Gold Loan Amount

|

Up to Rs. 1 Crore (With Income Proof) |

|

Federal bank Gold Loan Prepayment Charges

|

0-1% |

|

Federal bank Gold Loan Repayment Tenure

|

Up to 12 months

|

|

Federal bank Gold Loan Repayment Scheme

|

Bullet Payment Scheme, Overdraft Scheme

|

GOLD LOAN @ 0.75%*

APPLY NOW

Advantages of Federal Bank Gold Loan

- A gold loan is a fast loan as compares to other loans individuals get cash within a day

- The gold loan can be taken for educational purpose

- It tends to help extend a business or working capital requirement

- To enhance agribusiness by purchasing apparatus for the water system and different needs

- At the point when a healing crisis strikes, a gold loan can be a friend in need.

- To get urgent money while going on a trip

- Gives the feeling of utilizing a possess advantage to fund your requirements

- Federal Bank charges a borrower up to .50% on the principal outstanding in case of a Gold Loan per gram Foreclosure.

You just need to call on 9878981144 to avail Gold Loan.

GOLD LOAN @ 0.75%*

APPLY NOW

How Much Gold Loan can I get through Federal Bank Gold Loan

Federal Bank Gold Loan Per Gram – Apr 26 2024

Updated - Gold Loan Per Gram Rate w.e.f Apr 26 2024

Gold Weight

Gold Purity

24 CaratGold Purity

22 CaratGold Purity

20 CaratGold Purity

18 Carat

1 gram

4621

4290

3900

3510

10 gram

46210

42900

39000

35100

20 gram

93600

85800

78000

70200

30 gram

140400

128700

117000

105300

40 gram

187200

171600

156000

140400

50 gram

234000

214500

195000

175500

100 gram

468000

429000

390000

351000

200 gram

936000

858000

780000

702000

300 gram

1404000

1287000

1170000

1053000

400 gram

1872000

1716000

1560000

1404000

500 gram

2340000

2145000

1950000

1755000

GOLD LOAN @ 0.75%*

APPLY NOW

Introduction to Federal Bank Gold Loan

As the future is uncertain, we never know when we may face an urgent need for some financial resources. There is nothing bad or wrong about facing situations like that, as one said when nothing goes right, turn left and in a situation to meet financial emergency Gold Loan service is the left turn for you.

Federal Bank Gold Loan is here to provide a helping hand to you so that you can reach your final destination. Gold Loan in Federal Bank comes with a lot of benefits and special features.

Thus, make use of your gold in your bad time, and overcome the financial problems. Though there is a lot of financial banking and non-banking companies that provide you with a gold loan, Federal Bank is considered to be one of the best.

- Federal Bank Gold Loan Interest Rate is 7.25% per annum.

- Federal Bank Gold Loan Rate Per Gram is ₹ 3,800 to ₹ 4,350.

- Federal Bank Gold Loan Tenure is 12 Months.

- Federal Bank Gold Loan processing fee is 0.5% or Rs.1000, the higher amount.

GOLD LOAN @ 0.75%*

APPLY NOW

Benefits of Federal Bank Gold Loan

There are certain benefits if you apply for the Federal Bank Gold Loan:

- Lower rate of interests and processing fees

- Minimum documentation required

- A waiver on loan foreclosure charges

- Flexible Reimbursement procedure and higher LTV Ratio

- Different types of loan reimbursement schemes

GOLD LOAN @ 0.75%*

APPLY NOW

Federal Bank Gold Loan Eligibility

Federal Bank Gold Loan is a financial product provided by the Bank which caters to your needs of short-term or long-term funds. It is easy to avail of commercial service provided by banks at low rates of interest and also requires minimal documentation for the same. Federal Bank gives you the Loan amount within an hour of application as the valuation and approval process is quickly done, keeping in mind your urgency regarding the need for funds.

Major Eligibility criteria for availing of the Federal Bank Gold Loan is:

| Age | 18-70 years of age |

| Nationality | Indian |

| Employment Status | Salaried, Self-Employed |

| Gold Quality | Minimum 18 Carats |

GOLD LOAN @ 0.75%*

APPLY NOW

Federal Bank Gold Loan at Home

Gold Loan at Home is a doorstep loan service that allows you to borrow money without leaving your home. The service is quick, flexible, and cost-effective, with low-interest rates. Before submitting a loan request, you may use the gold loan calculator to determine the worth of your gold or the loan amount. Getting a Gold Loan at home is a simple and quick process that takes only a few minutes.

One of our employees will contact you and visit your home within 30 minutes. The necessary gold loan amount will be delivered immediately to your bank account after all e-documentation and gold identification are completed at your home.

The benefits of getting a gold loan at your doorsteps are:

- Access To Your Loan Account 24 X 7

- Diverse Range of Gold Loan Schemes

- You can get free insurance for your Gold

- There are no hidden fees.

- You will get the maximum value of your Gold

- You can avail your Gold Loan in just 1 visit

- Service at Your Door in 30 Minutes

- Pre & Part Payment Facility

- Your Gold will just be released the same day.

Federal Bank Gold Loan Documents Required

A loan against Gold is a loan product offered to the borrowers by the Federal Bank, wherein funds are provided to fulfil the applicant’s financial needs. The gold embellishments of the candidate are kept as a settlement by the Bank in trade for the funds. The whole Federal Bank Gold Loan method is hassle-free and straightforward to get with minimum documentation. The Bank guarantees the high safety of your gold ornaments until the loan is settled.

Documents required for Applying for Federal Bank Gold Loan are :

A duly filled and signed Gold Loan application form shall be submitted along with the following documents:

| Photographs | 2 Passport Size |

| Identity Proof | Aadhar Card, Passport, PAN Card, etc. (Only 1 is required) |

| Residence Proof | Aadhar Card, Driving License, Ration Card, etc. In the case of Rented House then the rent agreement or water/electricity bills for the last three months can be considered. (Only 1 is required) |

|

Agricultural Land Proof

|

Required only if the Loan is taken for Agricultural Purpose |

**Any other documents as requested by the Bank shall be duly submitted.**

GOLD LOAN @ 0.75%*

APPLY NOW

Federal Bank Gold Loan Interest Rate, Fees and Charges

Federal Bank Gold Loan can fulfil all your urgent short-term and long-term monetary requirements. The rate of interest that you will be charged depends on the total loan amount as well as the quality/purity of the gold you are to keep as security with the Bank. Federal Bank Gold Loan interest rates offered by the Bank are lower in comparison to other loans because it is a fully secured loan.

The Gold Loan interest rates in the Federal Bank start at 7.25% per annum.

The Bank also charges some additional fees along with the rate of interest in some cases, which are :

| Federal Bank Gold Loan Interest Rate | 7.25% per annum |

|

Processing Fee

|

0.5% or ₹1000 whichever is higher |

|

Prepayment/Foreclosure Charges

|

0-2% |

Know More – Gold Loan Interest Rate

GOLD LOAN @ 0.75%*

APPLY NOW

Federal Bank Gold Loan Apply Online

Applying for the Federal Bank Gold Loan service is a simple and hassle-free process that can be done from the comfort of your home. You can do it online by visiting the Bank’s official website and submitting a form with basic information regarding yourself and the Gold Loan you wish to avail yourself. You will then need to visit the branch with the required documents and your gold.

You can also apply with Dialabank by following the below-mentioned steps to get a Gold Loan as per your need.

- Attend Dialabank’s digital stage, where you will have to fill a piece of information without any booking.

- Our Connection Director will reach you and help you during the Gold Loan method and escort you in satisfying your monetary requirements.

- You will get personalized help, granting you the alternative of analyzing and getting the best chance according to your wants without any extra costs.

- With Dialabank, you can analyze the various offers and plans from multiple banks based on funding granted and the rate of interest required for determining the best loan deal for yourself.

GOLD LOAN @ 0.75%*

APPLY NOW

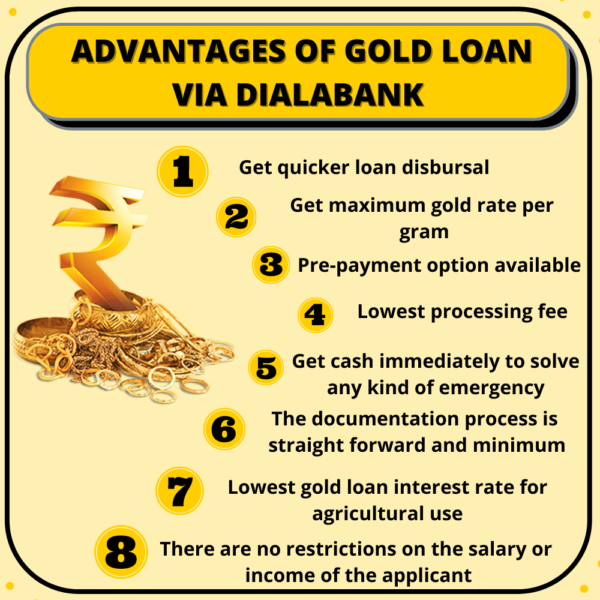

Why should you apply for a Bank of India Gold Loan with Dialabank?

Here are certain points of why one should apply with Dialabank.

- Firstly, we are here to listen to you, understand your situation, and provide you with a solution. We provide customer support in order to gain a deeper understanding of you and to establish a friendship with you.

- Second, we will not take up much of your time. We’re here to help you get everything you need in a more convenient and timely manner.

- Finally, there are simple disbursements. Please contact us so that we can better understand you and your needs and assist you in any way we can.

GOLD LOAN @ 0.75%*

APPLY NOW

Federal Bank Gold Loan EMI Calculator

| Rate of Interest | 6 months | 1 Yr | 2 Yrs | 3 Yrs |

| 7.00% | 17008 | 8652 | 4477 | 3088 |

| 8.00% | 17058 | 8699 | 4523 | 3134 |

| 8.50% | 17082 | 8722 | 4546 | 3157 |

| 9.00% | 17107 | 8745 | 4568 | 3180 |

| 9.50% | 17131 | 8678 | 4591 | 3203 |

| 10.00% | 17156 | 8791 | 4614 | 3227 |

| 10.50% | 17181 | 8815 | 4637 | 3250 |

| 11.00% | 17205 | 8838 | 4661 | 3274 |

| 11.50% | 17230 | 8861 | 4684 | 3298 |

| 12.00% | 17254 | 8885 | 4707 | 3321 |

| 12.50% | 17279 | 8908 | 4731 | 3345 |

| 13.00% | 17304 | 8932 | 4754 | 3369 |

| 13.50% | 17329 | 8955 | 4778 | 3393 |

| 14.00% | 17354 | 8979 | 4801 | 3418 |

| 14.50% | 17378 | 9002 | 4825 | 3442 |

| 15.00% | 17403 | 9026 | 4845 | 3466 |

- Gold Loan EMI Calculator is an online tool that can be accessed by individuals to calculate the EMI against the gold loan they plan to avail against the self-owned gold.

- The gold ornaments have to be kept as security with the lender until the loan is fully reimbursed.

- Gold Loan EMI calculator can help the applicant to get approx.

- EMI Calculator can try different rates of interest and reimbursement tenure offered by financial institutions

GOLD LOAN @ 0.75%*

APPLY NOW

How to Pay Your Federal Bank Gold Loan EMI?

Your Federal Bank gold advance can be reimbursed in the following three different ways.

- Standing Instruction (SI): If the person is a current account owner with Federal Bank, Standing Instruction is the most reliable way of repayment. Your EMI amount will be credited automatically near the end of the month to month cycle from the Federal Bank account you designate.

- Electronic Clearing Service (ECS): This method can be employed if you have a non-Federal Bank account and might want your EMIs to be imposed consequently toward the close of the month to month cycle from this account.

- Post-Dated Checks (PDC): You can offer post-dated EMI checks from a non-Federal Bank account at your closest Federal Bank Loan Branch. A new transcription of PDCs should be conferred on time. It will be excellent if you note Post Dated Checks will be handled non-ECS fields as it were.

GOLD LOAN @ 0.75%*

APPLY NOW

Federal Bank Gold Loan Contact Number

Federal Bank offers loans against gold at the lowest Interest rate. Being one of the significant gold loan suppliers, Federal Bank understands the necessities of the clients and disburses the loan amount in 60 minutes. The gold promised is securely secured in the bank locker, and you don’t need to stress over its safety.

You just need to call on 9878981144 to avail a Gold Loan.

GOLD LOAN @ 0.75%*

APPLY NOW

Details about Federal Bank Gold Loan

- The minimum loan amount is Rs 1,000 and the maximum is Rs 150 Lacs.

- Flexible reimbursement options

- The maximum cost per gram is 75% of the gold price.

- Lower rate of interests and processing fees

- 0-1% processing fees is to be paid.

| Federal Bank Gold Loan Rate | 7.25% per annum |

| Processing Fee | 0.5% or ₹1000 whichever is higher |

| Loan Reimbursement Tenure | Up to 12 months |

| Loan Amount | Up to Rs. 1 Crore (With Income Proof) |

| Processing Charges | 0.5% or ₹1000 whichever is higher |

| Gold Loan Scheme | Bullet Repayment Scheme |

GOLD LOAN @ 0.75%*

APPLY NOW

Gold Ornaments Accepted for Federal Bank Gold Loan

Not every type of gold is accepted by the banks to provide the Gold Loan. There are various restrictions regarding the valuation of Gold.

- The purity or quality of the gold should be between 18 Karats to 22 Karats.

- The raw form of gold is not acceptable.

- Gold coins that weigh less than 50 Grams are accepted.

Know More – Top Reasons why Gold Loan is the best borrowing option

GOLD LOAN @ 0.75%*

APPLY NOW

Use of Federal Bank Gold Loan

The funds acquired by availing the Federal Bank Gold Loan service can be used for several purposes such as:

- To finance any personal expenses such as a wedding, travel, payment of higher education fees, etc.

- For all your business needs, such as buying raw material, expansion of business, etc.

- You can also avail of a Gold Loan for agricultural purposes. The Bank offers lower rates of interest for Gold Loans that are used for agriculture or allied activities.

GOLD LOAN @ 0.75%*

APPLY NOW

Federal Bank Agricultural Jewel Loan Scheme

| Scheme | Federal Bank Agricultural Jewel Loan Scheme |

| Interest Rate | Starting from 7.25% per annum (depends on the sum of the loan |

| Least amount of Loan | Depends on the value of the jewel which is being kept as security |

| Loan period | Adjustment of advance sum inside 2 months from the date of reap of yields |

Benefits of Federal Bank Agricultural Jewel Loan Scheme

- No processing fee is required for up to ₹ 25,000.

- 0.30% of the total loan amount, ₹ 300 down payment applies to amounts ranging from ₹ 25,000.

- 0.28% of total debt, subject to at least Rs.1500 applies to more than Rs.5 lakh yet less than Rs.1 crore.

GOLD LOAN @ 0.75%*

APPLY NOW

Federal Bank Gold Loan Overdraft Scheme

Federal Bank offers an Overdraft Scheme. With this, the loan amount is provided as an overdraft facility. It functions as a Credit Card, where you can spend your Gold Loan Amount as per your wishes, anytime anywhere. The overall loan amount will have a Credit/Loan Limit. In the Federal Bank Gold Loan Overdraft facility, the bank charges interest only on the amount you withdraw/utilize.

What type of gold is used to secure the Bank of India Gold Loan

Gold jewellery with a karat value of 18 to 24 can be used. You may use gold bars or gold coins. Digital gold is the third alternative. To ensure the security of your loan, the digital gold must first be exchanged for cash or jewellery.

GOLD LOAN @ 0.75%*

APPLY NOW

FAQs About Federal Bank Gold Loan

✅ What is Federal Bank Gold Loan?

Federal Bank Gold loan is funding provided by the bank against your gold ornaments. Any Individual can avail Federal Gold Loan from Federal Bank with minimal documents for a loan amount of up to ₹1.5 crores. The loan can be availed for personal, business, or agricultural purposes.

✅ How Can I Get Gold Loan?

Fulfil your urgent monetary needs with a Gold Loan. You can apply with Dialabank and compare the offers of different banks and financial companies to get the best deals. For any queries, you may contact us on the number 9878981144.

✅ How much Gold Loan Can I get per gram from Federal Bank?

Gold Loan rate per gram depends on the quality of your gold and the current market rates. Federal Bank gives funding of up to 75% of your gold’s value for non-agricultural purposes and financing of up to 82% for agricultural purposes. Federal bank Gold Loan Rate Per Gram is ₹ 3,800 to ₹ 4,350 as the basic rate.

✅ How Does Federal Bank Gold Loan work?

Taking a Federal Bank Gold Loan is a hassle-free process with minimal documentation (just your Aadhar card and PAN card) and your gold ornaments. Visit the nearest branch or apply online with Dialabank. You will have to fill up an application form and your loan will be sanctioned if you match the eligibility criteria.

✅ What is the Gold Loan interest rate in Federal Bank?

Federal Bank Gold Loan Interest Rate is 7.25% per annum per annum. You can avail of a loan with low interest rates if you have a high CIBIL score.

✅ How to check gold loan status in Federal Bank?

You can check your Gold Loan status by visiting the branch in person or contacting the customer care executive.

✅ How to calculate gold loan interest in the Federal Bank?

The gold loan interest rate in the Federal bank can be calculated by subtracting the principal (loan amount you applied for) from the amount (you have to repay).

✅ What is the maximum gold loan amount I can avail of on a gold loan from Federal Bank?

Any Individual can avail Federal Gold Loan from Federal Bank for a loan amount of up to ₹1 crore. The loan can be availed for personal, business, or agricultural purposes.

✅ What is the loan tenure of the Federal Bank gold loan?

The gold loan tenure in the Federal Bank ranges from 6 months to 12 months. You can choose your tenure. You can also avail yourself of the renewal option.

✅ How much processing fee is applicable to the Federal Bank Gold loan?

To enable the Federal bank to process and sanction your gold loan, you have to pay a meagre fee of about 0.5% of your loan amount or Rs. 1000, whichever is higher.

✅ What are the charges for pre-payment in the Federal Bank gold loan?

For prepayment or foreclosure of the Federal Bank gold loan, you have to pay a fee that amounts up to 1% of the outstanding gold loan amount.

✅ How to renew Federal Bank Gold Loan online?

Renewal of Federal Bank Gold Loan can be done by visiting the branch with all the documents related to your loan and getting your gold released for revaluation. The new loan terms are decided and agreed upon for completing the renewal process.

✅ How to pay Federal Bank Gold loan interest online?

Federal Bank provides online payment facilities to repaying your Gold Loan. You can also give a Standing Instruction or use ECS to pay directly from your bank account. For more information on your repayment options, you can contact the customer care executive of the Bank.

✅ What if I can’t pay the interest on the Federal Bank Gold loan for 3 months?

If someone is unable to pay the amount due at the end of the tenure, then the Bank charges a penalty fee on the amount due and may even auction the gold kept to recover the amount. This also reduces your CIBIL score making you ineligible for future loans.

✅ How can I apply for the EMI moratorium on the Federal Bank Gold loan?

If you don’t want to begin to repay your loan right away, you can apply for a moratorium. You can do so through the Federal Bank’s online portal or by visiting its branch and providing the bank with your application details. Please make sure you do it at the slightest five days before the date of your EMI payment.

✅ How to pay the Federal Bank Gold loan through a credit card?

The Reserve bank of India guidelines doesn’t provide a gold loan to be repaid through credit cards, but the same can be done through debit cards. Besides this, you can also use cash, cheques, DDs, net banking, PayTM, etc.

✅ What is the Overdraft Scheme for Federal Bank Gold Loan?

Federal Bank does provide an Overdraft Scheme and the overall loan amount will have a Credit/Loan Limit. In the Federal Bank Gold Loan Overdraft facility, the bank charges interest only on the amount that you will withdraw/utilize.

✅ What is the Federal Bank Gold Loan closure procedure?

Once the loan is paid, the bank will close your gold loan immediately.

✅ What is the Federal Bank customer care number?

The customer care number for the Federal Bank is 9878981144

✅ What are Federal Bank Gold Loan Preclosure charges?

The Federal Bank does not charge any preclosure charges.

✅ What is the maximum gold loan tenure?

The maximum gold loan tenure for Federal Bank Gold Loan is up to 12 months

✅ What is the minimum gold loan tenure for Federal Bank Gold Loan?

The minimum gold loan for Federal Bank Gold Loan is 6 months.

✅ What are the foreclosure charges of the Federal Bank Gold Loan?

Federal Bank charges an interested borrower up to .50% on the principal amount in case of a Gold Loan Foreclosure.