Gold Loan Balod

Gold is lucrative and thus attracts one towards itself but did you know now that gold can also help you get instant cash, for a Gold Loan Balod. You can mortgage your gold and get cash with the help of services from Dialabank and get cash under 30 minutes.

What is a Gold Loan?

Gold Loan Balod, is the Loan which is issued to the applicant against the mortgage of gold. Any person can have access to gold loans after depositing the gold he/ she wants to deposit as a mortgage and following specific procedural steps. Overall procuring of gold loans has become easier and quicker.

Eligibility Criteria and Documentation required for Gold Loan Balod

- Identification proof such as Passport, Voter card, or driving license.

- Address proof which includes electricity bill, ration card, etc.

- Passport, DL or any other proof with signature needs to be submitted for signature proof.

- Two passport size photographs are also required.

- The applicant should be atleast18 years old.

- The gold ornament submitted should be at least 18 carats or above.

- The gold loan can be availed by an applicant who has at least 10 grams of gold.

Charges associated with Gold Loan Balod

1. Some of the service providers may waiver Loan, but some banks do charge a processing fee.

2. Valuation Charge is the charges to be paid to the evaluator. Such fees are specific to the service provider. Those having in-house evaluators do not charge any extra amount for valuation.

3. Most of the service providers charge for late payment; this usually varies from one institution to the other.

The applicant should consult with the loan provider before taking the Loan. These charges could change the amount that you may finally receive and should also check for the methods of repayment of the gold loan.

Advantages of Gold Loan Balod

1. The documentation required is very minimal, and so it doesn’t demand any certificate to show your salary or income. Credit card history is also not required.

2. The gold loan requires only a few documents, such as ID proof and address proof. After providing such materials, the applicant can avail of the Loan.

3. Interest rates are an attractive deal for Gold Loan Balod. Usually, the interest rate varies between 12-16% per annum and is also quite as low compared to personal loans.

4. In agricultural areas, the gold loan is available at an interest rate of only 7-8%.

5. It is the most convenient and straightforward form of Loan because all you need to do is pledge your gold here with a bank and you can avail up to 75% of the market value of the gold as Loan.

6. The borrower here has the option to pay only the interest during the term of the Loan and can pay the principal amount once the term is over.

7. The gold is 100% secure, and the Gold Loan Balod can be procured under 30 minutes.

Gold Loan Balod Interest Rates

The below table shows the Gold loan interest rates provided by various banks

Bank

Interest Rate

HDFC Bank Gold Loan

9.9% to 14%

Axis Bank Gold Loan

10.50% to 16%

Private Bank Gold Loan

10.75% to 16%

SBI Gold Loan

9.5 % to 13%

Kotak Gold Loan

11% to 14%

IIFL Gold Loan

9.24% to 24%

Muthoot Gold Loan

12% to 24%

Manappauram Gold Loan

12% to 26%

PNB Gold Loan

10.05% to 16%

Canara Bank Gold Loan

9.75 % to 13%

Andhra Bank Gold Loan

10.70% to 16%

How to Apply for Gold Loan Balod?

1. You can avail of a gold loan with a single click while sitting at home. Our customer relationship manager will be providing you the service of helping you choose the right type of loan for you.

2. Just fill a simple form so that our customer care department can look up for your finances can check your financial status and your eligibility for the loan that you have applied.

3. You will be led to the right banker for more details on your Loan. The bank executives will arrive at your doorsteps to collect the required documents from you.

4. Only at the time of submission of gold you have to pay a visit to the Bank, the rest will be taken care of by the Bank’s executives.

How to Calculate Gold Loan Interest Rate?

1. The Rate of Interest is the amount that is charged on the amount of Loan. The Gold Loan Interest Rate depends on the factors stated below:

2.Internal/External Customer: The loan seekers who have an account in the Bank from where they want to avail the Loan, then such customers are known as internal customers. Internal customers are given a rebate on the rate of interest charged by the applicant.

3.Amount of Loan: The loan amount is the primary factor that decides the rate of interest that will be charged from the applicant. The Gold Loan Interest Rate is higher for loans with lesser amounts. Thus, the more the amount of credit, the lower is the Rate of Interest.

4.LTV Ratios – Furthermore, lending institutions charge a higher rate of interest on the gold loan per gram with a high LTV ratio. Thus, the more the LTV of the gold jewelry, the higher is the Rate of Interest charged by the applicant.

Gold Loan EMI Calculator

It is essential to know the amount one has to pay every month to the Bank. Therefore, you have an option to estimate the EMI before availing a loan. You can do so very quickly. Just click below and get to know the amount of the EMI you will have to manage monthly..

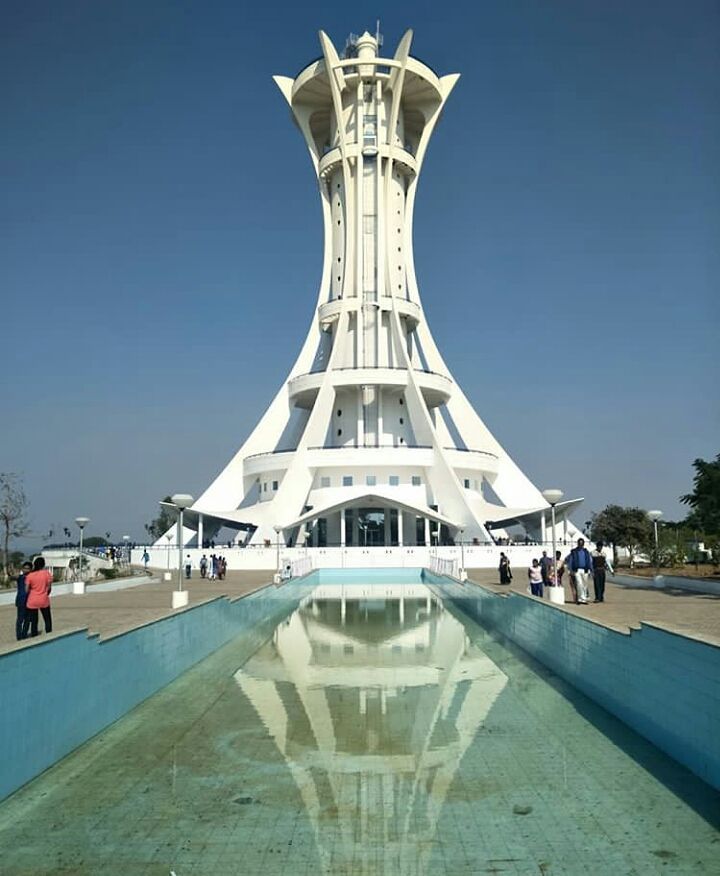

About Balod

It is a town which is located on the banks of the river Tandula under the balod district in the state of Chhatishgarh.