Dena Bank Gold Loan Features – Apply Now

| Dena Bank Gold Loan Interest Rate | 7.25% per annum |

|

Dena Bank Gold Loan Rate Per Gram

|

Rate Per Gram is ₹ 3,800 to ₹ 4,350 |

|

Dena Bank Processing Fee

|

0.75% of the Principal Loan Amount

|

| Dena Bank Maximum Loan Amount |

Up to Rs. 1 Crore (With Income Proof)

|

| Dena Bank Minimum Loan Amount |

75% LTV

|

|

Dena Bank Gold Prepayment Charges

|

2%+GST (Within 3 Months), 0 (After 3 months)

|

|

Dena Bank Gold Repayment Tenure

|

Up to 36 Months

|

|

Dena Bank Gold Repayment Scheme

|

Bullet Payment Scheme, Overdraft Scheme

|

Dena Bank issues a Gold Loan per gram rate of ₹ 3,800 to ₹ 4,350 in line with the current gold rate. The best Dena Bank Gold Loan Rate per gram is ₹ 3,800 to ₹ 4,350 for 22 Carat gold, measured at a maximum 75% loan to value, and the average gold price for the last one month for 22-carat is ₹ 3,800 to ₹ 4,350.

Dena Bank Gold Loan Explanation

Dena Bank’s gold loan can be the easiest and safest way to finance your immediate needs at an attractive interest rate. With small documents and secure storage, Dena Bank’s gold loan is an effective way to get funding quickly. The money thus obtained from a gold loan can be used for marriage, education, business expansion and other similar purposes.

Dena Bank Comparision With Other Banks

| Particulars | Dena Bank | SBI | HDFC Bank |

| Interest Rate | 7.25% per annum | 7.25% per annum | 9.90% – 17.55% |

| Processing Fees | Up to 0.75% of the loan amount | 0.50% of the loan amount | 1.50% of the loan amount |

| Loan Tenure | 3 months to 36 months | 3 months to 36 months | 3 months to 24 months |

| Loan Amount | Up to Rs. 1 Crore | ₹ 20,000 to ₹ 20 Lakh | ₹ 25,000 to ₹ 50 Lakh |

| Foreclosure Charges | 2%+GST (Within 3 Months), 0 (After 3 months) | Nil | Nil after 3 months |

| Repayment Options | Y | Y | Y |

| Lowest EMI Per Lakh | ₹ 5,121 per lakh | ₹ 3,111 per lakh | ₹ 4,610 per lakh |

Tips To Get Gold Loan From Dena Bank Fast

- Dena Bank welcomes both hallmarked and non-hallmarked jewellery for a gold loan. However, you can get a very high gold loan per gram with remarkable jewellery, as it reduces the chances of a lower rating by the average. Also, some banks charge a lower fee for processing gold jewellery.

- Dena Bank fixes the price of 22-carat gold for pure gold. So, always try to borrow high-quality jewellery as it will bring you the highest value of gold loans.

- For faster processing of gold loans, you can apply for online gold loan application services by Dena Bank.

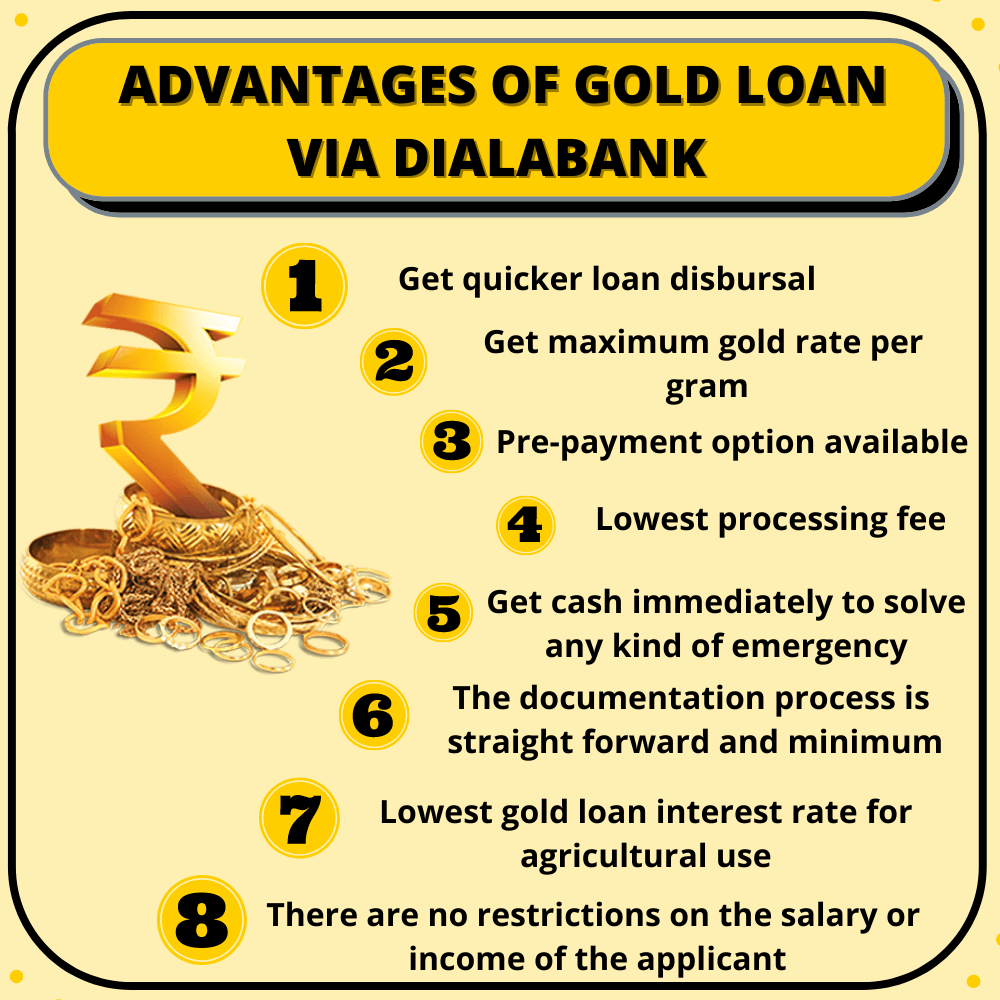

Advantages Of Dena Bank Gold Loan Scheme

- Gold Loan at Dena Bank is straightforward to apply. One can apply for a gold loan online within a few minutes.

- If a borrower is eligible, the loan can be approved within 30 minutes.

- After the approval of the loan, if the borrower has its complete documents, it can be disbursed quickly.

- The rates of interest provided by the Dena bank are quite affordable.

- Gold Loan from Dena Bank comes with competitive interest rates on Term Loan, Overdraft and EMI based loans. Repay your gold loan in easy lower EMIs, over a tenor of your choice.

- The documentation process is easy and simple.

- Dena Bank will not ask the reason behind the gold loan; one can use this loan amount according to their requirement.

- Different forms of Gold ornaments were accepted.

- Gold Bangles, Gold rings, Gold anklets and Gold necklaces many more, Gold bars, Gold Bricks, Gold biscuits, and Gold coins are acceptable. The purity of gold that is acceptable here is 18carat-22carat.

- Dena Bank charges a borrower up to .50% on the principal outstanding in case of a Gold Loan Foreclosure.

How Much Gold Loan Can I Get Through Dena Bank Gold Loan?

According to the latest gold prices, Dena Bank is offering gold loans per gram ₹ 3,800 to ₹ 4,350 of 22 carats.

Dena Bank Gold Loan Per Gram-Updated Apr 26 2024

₹ 3,800 to ₹ 4,350About Dena Bank Gold Loan

Dena Bank is one of the oldest private banks in India, headquartered in Mumbai. The bank was established on 26 May 1938, by the family of Devkaran Nanjee under the name Devkaran Nanjee Banking Company Ltd. The bank is one of the nationalized banks of India.

The bank was established under a Public Limited Company in December 1939, and later the name was changed to Dena Bank Ltd. The bank has 1874 branches.

Dena Bank of India offers loans against gold at contentious interest rates. The pledged gold is safe in the bank locker, and the borrower does not have to worry about their Gold safety. The prices of gold, as well as all other charges, are transparently announced to the borrower upfront before sanctioning the Gold Loan amount.

Hence the applicant does not have to worry about the hidden fees on their gold loan. A gold loan is a loan in which a borrower can get a loan against their gold. The loan is secured. The bank will take a borrower’s gold as a security.

- Dena Bank Gold Loan Interest Rate is 7.25% per annum

- Dena Bank Gold Loan Per Gram Rate is ₹ 3,800 to ₹ 4,350

- Dena Bank Gold Loan Tenure: Up to 36 months

- Dena Bank Gold Loan Processing Fee is Up to 0.75% of the Loan Amount + GST

Dena Bank Gold Loan Eligibility

Primary Eligibility criteria for availing the Dena Bank Loan against Gold is:

| Age | 18-75 years |

| Requirements | Gold ornaments (18-22 carats) |

| CIBIL score | Above 500 |

| Nationality | Indian |

Dena Bank Gold Loan At Home

Gold Loan at House is a doorstep loan service that allows you to borrow money from the convenience of your own home. The service is rapid, flexible, and cost-effective because interest rates are low. You can use the gold loan calculator to assess the value of your gold or the loan amount before completing a loan request. Obtaining a Gold Loan at home is an easy and quick process that can be done in a matter of minutes.

Within 30 minutes, one of our employees will contact you and arrive at your home. When all e-documentation and gold identification are completed at your residence, the appropriate gold loan amount will be sent directly to your bank account.

Furthermore, there are many benefits of Dena Bank Gold Loan at Home:

- Fast loan approval

- Lower interest rates

- Maximum value of gold

- Flexible repay tenures

- Easy payment options

- No additional charges

- 24*7 customer support

- Full security of the gold

- No hidden fees

- Service at your doorstep within 30 minutes

Dena Bank Gold Loan Documents Required

Documents required to avail of Gold Loan at Dena Bank are :

| Identity Proof | Aadhar Card/Passport/ Voter ID/ Pan Card/ (Any one) |

| Residence Proof | Aadhar Card /Pan Card/ Ration Card/ Rental Agreement of applicant/ Voter ID card/ Utility Bills on the name of the applicant (Anyone) |

| Agriculture Proof ( if applicable) | Agriculture Land Ownership Proof |

| Photographs | 2 Passport sized colored |

Dena Bank Gold Loan Interest Rate, Fees, and Charges

| Dena Bank Gold Loan Interest Rate | 7.25% per annum per annum |

|

Processing Fee

|

0.75% of the Principal Loan Amount

|

|

Prepayment/Foreclosure Charges

|

2%+GST (Within 3 Months), 0 (After 3 months)

|

| Valuation Fee |

Rs 250 for a loan up to Rs 1.5 lacs and Rs 500 for a loan over and above Rs 1.5 lacs

|

|

Late Repayment Charges

|

2% p.a. + Applicable rate of interest.

|

|

Renewal Processing Fees

|

Rs 350 + GST |

Apply Dena Bank Loan Against Gold Online

- Visit Dialabank‘s website.

- Fill a gold loan application form.

- Our relationship manager will contact you on your provided number.

- With the help of our experts, find and choose the best and apply gold loan for yourself.

- For any assistance regarding a gold loan in Dena Bank, you can contact on the number 9878981144.

Dena Bank Gold Loan EMI Calculator

| Rate of Interest | 6 months | 1 Yr | 2 Yrs | 3 Yrs |

| 7.00% | 17008 | 8652 | 4477 | 3088 |

| 8.00% | 17058 | 8699 | 4523 | 3134 |

| 8.50% | 17082 | 8722 | 4546 | 3157 |

| 9.00% | 17107 | 8745 | 4568 | 3180 |

| 9.50% | 17131 | 8678 | 4591 | 3203 |

| 10.00% | 17156 | 8791 | 4614 | 3227 |

| 10.50% | 17181 | 8815 | 4637 | 3250 |

| 11.00% | 17205 | 8838 | 4661 | 3274 |

| 11.50% | 17230 | 8861 | 4684 | 3298 |

| 12.00% | 17254 | 8885 | 4707 | 3321 |

| 12.50% | 17279 | 8908 | 4731 | 3345 |

| 13.00% | 17304 | 8932 | 4754 | 3369 |

| 13.50% | 17329 | 8955 | 4778 | 3393 |

| 14.00% | 17354 | 8979 | 4801 | 3418 |

| 14.50% | 17378 | 9002 | 4825 | 3442 |

| 15.00% | 17403 | 9026 | 4845 | 3466 |

GOLD LOAN @ 0.75%*

APPLY NOW

How To Pay Your Dena Bank Gold Loan EMI?

- Standing Instruction (SI): for Dena Bank record holders.

- Electronic Clearing Service (ECS): for non-Dena Bank account holders.

- Post-Dated Checks (PDC): to enable post-dated EMI cheques from a non-Dena Bank account.

Gold Ornaments Accepted By Dena Bank

All kinds of gold jewellery such as Gold Bangles, Gold rings, Gold anklets, and Gold necklaces, (18-24 carats) all of these are accepted for availing a Gold Loan.

Uses Of Dena Bank Gold Loan

- To finance personal expenses like vacation expenses, tuition fees etc.

- Finance business needs like buying inventory, plant etc.

- Gold against the loan for agricultural purposes.

Dena Bank Agricultural Jewel Loan Scheme

| Scheme | Agricultural Jewel Loan Scheme |

| Interest Rate | Starting from 7.25% per annum (depends on the sum of the loan |

| Least amount of Loan | Depends on the value of jewel which is being kept as security |

| Loan period | Adjustment of advance sum inside 2 months from the date of reap of yields |

GOLD LOAN @ 0.75%*

APPLY NOW

Benefits Of Dena Bank Agricultural Jewel Loan Scheme

- There is no processing fee is applicable up to ₹ 25,000.

- 0.30% of the loan amount, Minimum of ₹ 300 charge is applicable to the amount ranging from above ₹ 25,000 – less than ₹ 5 lakh.

- 0.28% of the credit sum, subject to at least Rs.1,500 is applicable to the amount more than Rs.5 lakh however under Rs.1 crore.

Dena Bank Gold Loan Overdraft Scheme

Dena Bank Offers an Overdraft Scheme. With this, you are provided a loan amount as an overdraft facility. It works like a Credit Card, where you can spend your Gold Loan Amount as you want anytime anywhere. The overall loan amount will have a Credit/Loan Limit. In the Dena Bank Gold Loan Overdraft facility, the bank charges interest only on the amount you withdraw/utilize.

Dena Bank Gold Loan Highlights

| Age | 18 – 70 years |

| Minimum Loan Amount | Rs. 1000 |

| Maximum Loan Amount | Rs. 1 Crore |

| Dena Bank Gold Loan Interest Rate | 7.25% per annum |

| Loan Tenure | Up to 36 months |

| Gold Items accepted | Jewellery and gold coins sold by banks |

| Dena Bank Gold Loan Processing Charges | 0.75% of the loan amount |

How Does Dena Bank Gold Loan Work, Here’s An Example

The suitability of the loan is determined on the basis of the purity of gold, LTV, and the weight of gold. Suppose Mr A and his two friends Mr B and Mr C have different gold values for different purity. Mr A has 50 grams of gold per 22-carat purity. Mr B has 60 grams of gold in 20 carats of purity and Mr C has 70 grams of gold in purity or 22 carats. They approached the Dena Bank to get a gold loan. The price used to calculate the suitability of their gold loan according to the high 85% LTV will vary with the purity of the gold and therefore, will lead to the validity of the gold loan.

FAQs About Dena Bank Gold Loan

✅ What is Dena Bank Gold Loan?

Dena Bank Gold Loan is a loan against a gold scheme that comes with the maximum funding of 75% of the total market value of your gold. The loan amount can be used for all your personal and business needs. Gold Loan by Dena Bank is a financial product that can fulfil your short term fiscal requirements. If you are above 18 years and are a permanent resident of the country with possession of gold, you can apply for Dena Bank Gold Loan.

✅ How can I get a Gold Loan from Dena Bank?

- Fill in your required information in the gold loan form available on Dialabank.

- Our trained Relationship Manager will help you find the best offers in 2021.

- We will suggest you the loan according to your eligibility.

- Kindly visit the nearest assigned branch by the manager.

- Get the loan in your accounts instantly.

✅ How much Gold Loan can I get per gram in Dena Bank?

Per gram Gold Loan rates in Dena Bank varies according to the purity of your gold and the current prevailing market rates. ₹ 3,800 to ₹ 4,350 is the standard price for gold per gram.

✅ What is the Gold Loan interest rate in Dena Bank?

Dena Bank Gold Loan interest rates can be as low as 7.25% per annum depending on the amount and the purpose of your loan. They also charge some documentation, valuation, and processing fee from the applicant.

✅ How to check Dena Bank Gold Loan status?

You can immediately check the status of the Gold Loan by contacting the loan officer at your loan branch.

✅ How to calculate Gold Loan Interest in Dena Bank?

You can easily calculate the gold loan interest rate in Dena Bank by subtracting the principal amount from the total sum to be paid.

✅ What is the maximum loan amount I can avail myself on Gold Loan from Dena Bank?

You can get a maximum amount of Rs 1 crore on a Dena Bank Gold Loan as the bank offers around 75% of the gold ornaments’ market value.

✅ What is the loan tenure of Dena Bank Gold Loan?

The maximum tenure of your Dena Bank Gold Loan is up to 36 months. However, kindly renew your loan plan after a year.

✅ How much is the Processing Fee applicable on Dena Bank Gold Loan?

A processing fee of 0.75% of the loan amount is charged.

✅ How to renew Dena Bank Gold Loan?

Renewal of Gold Loan can be done after the end of tenure by visiting the bank with all the loan documents. New terms are decided after the revaluation of your gold, and the loan is renewed for another time.

✅ How to renew Dena Bank Gold Loan online?

Renew your Gold Loan with Dena Bank by visiting the branch with your loan documents. Your gold will undergo a revaluation process, and upon confirmation of terms, your Gold Loan will be renewed for another tenure.

✅ What are the charges for renewal in Dena Bank Gold Loan?

Bank charges approximately Rs. 250- Rs. 500 for renewal of the gold loan.

✅ What are the charges for Pre-payment in Dena Bank Gold Loan?

Dena Bank charges 0-2% for pre-payment of the gold loan.

✅ How to pay Dena Bank Gold Loan Interest online?

For Dena Bank account holders, online payments can be made through the bank’s online portal or mobile application via net banking, debit cards or mobile wallets such as Paytm.

✅ What if I cannot pay the interest on Dena Bank Gold Loan for 3 months?

If someone defaults on the payments of Dena Bank Gold Loan interest for 3 months, a penalty fee will be charged by Dena Bank. Many defaults can lead to the bank selling off your gold jewellery.

✅ How can I apply for EMI Moratorium on Dena Bank Gold Loan?

You can apply for EMI Moratorium on Dena Bank Gold loan online by logging in to the bank’s portal with your credentials or by personally visiting the main branch. The moratorium request should be submitted at least five working days before the due date of your EMI.

✅ How to pay Dena Bank Gold loan through a credit card?

Paying Dena Bank gold loan through a credit card is not permitted as per RBI issued guidelines.

✅ What is Dena Bank Gold Loan Overdraft Scheme

Dena Bank Offers an Overdraft Scheme. With this, you are provided with a loan amount as an overdraft facility. It works like a Credit Card, where you can spend your Gold Loan Amount as you want anytime anywhere. The overall loan amount will have a Credit/Loan Limit. In the Dena Bank Gold Loan Overdraft facility, the bank charges interest only on the amount you withdraw/utilize.

✅ What is the foreclosure procedure for Dena Bank Gold Loan?

Dena Bank empowers a borrower to .50% on the key excellent if there should be an event of a Gold Loan Foreclosure.

✅ What is the Dena Bank Gold Loan closure procedure?

The Gold loan will only close after the payment is done in full.

✅ What are Dena Bank Gold Loan Preclosure charges?

The Bank preclosure charges are 2%+GST (Within 3 Months), 0 (After 3 months)

✅ What is the maximum gold loan tenure?

The maximum gold loan tenure is 36 months.

✅ What is the minimum gold loan tenure?

The minimum gold loan tenure is 6 months.

✅ What is the customer care number for Dena Bank Gold Loan?

All the queries regarding Dena bank are answered at 9878981144.