Indian Overseas Bank (IOB) Gold Loan Key Features – Apply Now

| IOB Gold Loan Interest Rate | 7.25% per annum |

|

IOB Gold Loan Per Gram

|

Rate Per Gram is ₹ 3,800 to ₹ 4,350 |

| IOB Gold Loan Processing Charges | 1% or ₹1000 whichever is higher |

| IOB Gold Loan Loan Amount |

Up to Rs. 1 Crore (With Income Proof)

|

|

IOB Gold Loan Prepayment Charges

|

NIL

|

|

IOB Gold Loan Repayment Tenure

|

35 Months

|

|

IOB Gold Loan Repayment Scheme

|

Bullet Payment Scheme, Overdraft Scheme

|

Indian Overseas Bank issues a Gold Loan per gram today rate of ₹ 3,800 to ₹ 4,350 in line with the current gold rate. The best Indian Overseas Bank Gold loan Rate per gram is ₹ 3,800 to ₹ 4,350 for 22 Carat gold, measured at a maximum of 75% loan to value and the average gold price for the last one month for 22-carat is ₹ 3,800 to ₹ 4,350.

GOLD LOAN @ 0.75%*

APPLY NOW

Indian Overseas Bank (IOB) Gold Loan Explanation

Indian Overseas Bank offers anti-gold loans at competitive interest rates. As one of the largest providers of gold loans, Indian Overseas Bank understands customer needs and issues a loan amount per hour. The promised gold is securely locked in a digital banking environment and you do not have to worry about its security. Gold prices and all other payments will be communicated to you in advance in advance of approving the loan amount. So you don’t have to worry about hidden charges and fees charged on gold loans.

GOLD LOAN @ 0.75%*

APPLY NOW

Indian Overseas Bank (IOB) Comparison With Other Banks

| Particulars | Indian Overseas Bank | SBI | HDFC Bank |

| Interest Rate | 7.25% per annum | 7.25% per annum | 9.90% – 17.55% |

| Processing Fees | Up to 0.85% of the loan amount | 0.50% of the loan amount | 1.50% of the loan amount |

| Loan Tenure | 35 months | 3 months to 36 months | 3 months to 24 months |

| Loan Amount | Up to Rs. 1 Crore | ₹ 20,000 to ₹ 20 Lakh | ₹ 25,000 to ₹ 50 Lakh |

| Foreclosure Charges | Up to 1% of the outstanding amount | Nil | Nil after 3 months |

| Repayment Options | Y | Y | Y |

| Lowest EMI Per Lakh | ₹ 5,121 per lakh | ₹ 3,111 per lakh | ₹ 4,610 per lakh |

GOLD LOAN @ 0.75%*

APPLY NOW

GOLD LOAN @ 0.75%*

APPLY NOW

Tips To Get Gold Loan From Indian Overseas Bank (IOB) Fast

- Indian Overseas Bank welcomes both hallmarked and non-hallmarked jewellery for a gold loan. However, you can get a very high gold loan per gram with a piece of remarkable jewellery, as it reduces the chances of a lower rating by the average. Also, Indian Overseas Bank charges a lower fee for processing gold jewellery.

- Indian Overseas Bank fixes the price of 22-carat gold for pure gold. So, always try for high-quality jewellery as it will bring you the highest value by Indian Overseas Bank gold loans.

- Also for faster processing, you can apply for an online Indian Overseas Bank gold loan application.

GOLD LOAN @ 0.75%*

APPLY NOW

GOLD LOAN @ 0.75%*

APPLY NOW

All About Indian Overseas Bank (IOB) Gold Loan

Indian Overseas Bank offers Gold Loan at a 7% Interest Rate per annum. Indian Overseas Bank is one of the significant gold loan providers as it understands the needs of the customers and disburses the loan amount in less than one hour.

Also, the pledged gold is locked safely in the bank vault, and the borrower does not have to worry about its safety. Indian Overseas Bank Gold Loan Interest Rates and all other charges are transparently announced to the borrower upfront before sanctioning and disbursing the loan amount.

Hence, the borrower does not have to worry about the hidden costs and fees on Indian Overseas Bank Gold Loan. Moreover, with Dialabank’s service, hassles stay miles away for the borrower.

GOLD LOAN @ 0.75%*

APPLY NOW

What Is A Gold Loan?

Indian Overseas Bank Gold Loan is a loan in which a borrower can get a loan against gold. Indian Overseas Bank Gold Loan is a secured loan.

In Indian Overseas Bank Gold Loan, the Bank will take the borrower’s gold to give credit to the borrower. Also, the Bank will take the borrower’s gold as a security. Bank will take full responsibility for the safety and security of the borrower’s gold.

GOLD LOAN @ 0.75%*

APPLY NOW

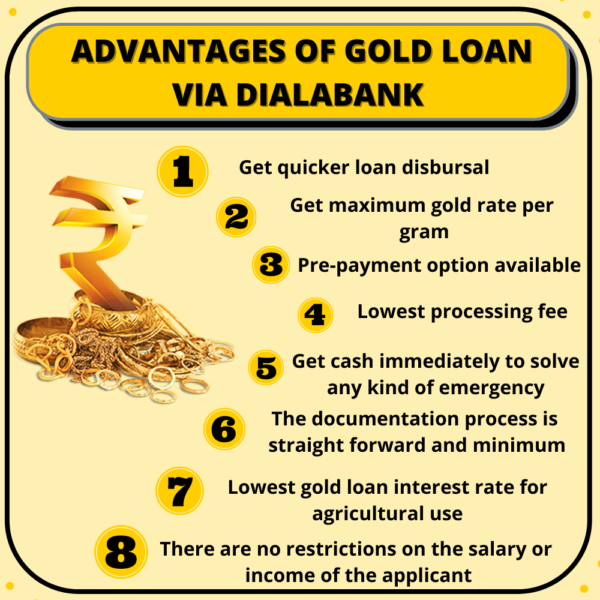

IOB Gold Loan Benefits

- Indian Overseas Bank Gold Loan is simple and easy to apply for. One can apply for Gold Loan Online within a few minutes by applying online at Dialabank or by visiting the nearest branch.

- Indian Overseas Bank approves a Gold Loan application within 5 minutes if the Applicant is eligible for the loan according to the terms and conditions of the bank.

- Complete documents in the hands of the applicant make it easy for the bank to approve and disburse the loan within 45 minutes.

- Indian Overseas Bank gives funding of up to 75% of the total market price of your Gold keeping the remaining 25% as a security margin.

- The borrower should be carefree as gold jewellery will be kept under very tight and fireproof security. The bank takes full responsibility for your gold.

- The rates of interest provided by the Bank are low and affordable.

- The documentation process is simple as basic documentation is required and in some cases, no documents are required.

- Indian Overseas Bank charges the borrower up to 1% of the outstanding principal debt in the event of a Gold Loan.

- One can use the Gold Loan amount according to their needs as the Bank does not ask the reason for taking the gold loan. The end use of the funds is at the discretion of the borrower.

Know More – Gold Loan Features and Benefits

GOLD LOAN @ 0.75%*

APPLY NOW

Indian Overseas Bank (IOB) Gold Loan Interest Rate

A Gold Loan can fulfil all your urgent short term and long term monetary requirements. The rate of interest that you will be charged, depends upon the total loan amount as well as the quality/purity of the gold you are willing to keep as security with the bank. Gold Loan interest rates offered by the Indian Overseas Bank are lower in comparison to other loans because of Gold Loan being a fully secured loan.

| IOB Gold Loan Interest Rate | 7.25% per annum |

| IOB Repayment Scheme |

Bullet Repayment Scheme, Overdraft Scheme

|

| IOB Gold Valuation charges | varies depending on the loan amount |

| Service Charges | varies depending on the loan amount |

| Document Charges | varies depending on the loan amount |

| Gold Required | Minimum 18 Carat |

| Processing Fee | 1% or ₹1000 whichever is higher |

| Prepayment Charges | Nil |

Know More – Gold Loan Interest Rate

GOLD LOAN @ 0.75%*

APPLY NOW

Indian Overseas Bank Gold Loan Per Gram – Apr 27 2024

The amount of Gold Loan that you get per gram of your gold is directly dependent on the purity of your gold and the current prevailing rates of that purity of Gold in the market. The rate of gold changes daily in the market and therefore, the Indian Overseas Bank Gold Loan Per Gram also varies every day. You will get ₹ 3,800 to ₹ 4,350 for a gram of Gold depending on its purity and the market price for your Indian Overseas Bank Gold Loan.

**Keep in mind that only the weight of gold is considered and not the weight of stones on your jewellery**

IOB Gold Loan Per Gram – Updated Apr 27 2024

Updated - Gold Loan Per Gram Rate w.e.f Apr 27 2024 |

||||

| Gold Weight | Gold Purity 24 Carat |

Gold Purity 22 Carat |

Gold Purity 20 Carat |

Gold Purity 18 Carat |

| 1 gram | 4621 | 4290 | 3900 | 3510 |

| 10 gram | 46210 | 42900 | 39000 | 35100 |

| 20 gram | 93600 | 85800 | 78000 | 70200 |

| 30 gram | 140400 | 128700 | 117000 | 105300 |

| 40 gram | 187200 | 171600 | 156000 | 140400 |

| 50 gram | 234000 | 214500 | 195000 | 175500 |

| 100 gram | 468000 | 429000 | 390000 | 351000 |

| 200 gram | 936000 | 858000 | 780000 | 702000 |

| 300 gram | 1404000 | 1287000 | 1170000 | 1053000 |

| 400 gram | 1872000 | 1716000 | 1560000 | 1404000 |

| 500 gram | 2340000 | 2145000 | 1950000 | 1755000 |

GOLD LOAN @ 0.75%*

APPLY NOW

Uses Of Indian Overseas Bank (IOB) Gold Loan

The funds acquired by availing the Indian Overseas Bank Gold Loan service can be used for a number of purposes such as:

- To finance any personal expenses such as a wedding, travel, payment of higher education fees, and etc.

- For all your business needs such as buying raw material, expansion of business, and etc.

- You can also avail of a Gold Loan for agricultural purposes. The bank offers lower rates of interest for Gold Loans that are used for agriculture or allied activities.

GOLD LOAN @ 0.75%*

APPLY NOW

Indian Overseas Bank Gold Loan Eligibility

Indian Overseas Bank Gold Loan is a financial product provided by the bank which caters to your needs of short term or long term funds. It is easy to avail of financial services provided by Indian Overseas Bank at low rates of interest and also requires minimal documentation for the same. Indian Overseas Bank gives you the Loan amount within an hour of application as the valuation and approval process is quickly done keeping in mind your urgency regarding the need for funds.

Indian overseas bank has some basic eligibility:

| Age | 18-70 years of age |

| Nationality | Indian |

| Employment Status | Salaried, Self-Employed |

| Gold Quality | Minimum 18 Carats |

| Requirements | Gold ornaments (18-22 carats) |

| CIBIL score | Above 500 |

A good Credit or CIBIL score is not required to apply for the Gold Loan as it is a fully secured financial service against your Gold as collateral security. This is unlike a Personal Loan where your CIBIL score plays a very important criterion for getting approval.

GOLD LOAN @ 0.75%*

APPLY NOW

Indian Overseas Bank (IOB) Gold Loan At Home

Gold Loan at House is a doorstep loan service that allows you to borrow money from the convenience of your own home. The service is rapid, flexible, and cost-effective because interest rates are low. You can use the gold loan calculator to assess the value of your gold or the loan amount before completing a loan request. Obtaining a Gold Loan at home is an easy and quick process that can be done in a matter of minutes.

Within 30 minutes, one of our employees will contact you and arrive at your home. When all e-documentation and gold identification are completed at your residence, the appropriate gold loan amount will be sent directly to your bank account.

Furthermore, there are many benefits of Indian Overseas Bank (IOB) Gold Loan at Home:

- Fast loan approval

- Lower interest rates

- Maximum value of gold

- Flexible repay tenures

- Easy payment options

- No additional charges

- 24*7 customer support

- Full security of the gold

- No hidden fees

- Service at your doorstep within 30 minutes

Why IOB Gold Loans?

The Gold Loan is always considered as a better option to borrow money from the bank. The reason behind this, the India Overseas Bank Gold Loan Interest Rate is low as compared to other services like a personal loan.

So if you have a choice between a gold loan or a personal loan, then you are always advised to go for an Indian Overseas Bank Gold Loan. Because, of unsecured service, the personal loan has higher rates of interest.

Your gold assets would be in tight security if you get a gold loan free of cost. On the other hand, if you want to put your jewellery in a bank, they will charge you a fee for using the locker. So, if you are getting a gold loan, you are killing two birds with one stone. That is, You are getting funds and security of your gold simultaneously. Finally, You don’t have to pay charges for the safety of the gold.

Know More – Gold Loan From Top banks And NBFCs in India

GOLD LOAN @ 0.75%*

APPLY NOW

Forms Of Gold Acceptable For Indian Overseas Bank

- The Indian Overseas bank accepts only gold jewellery and gold coins as collateral, and not bars biscuits or raw gold.

- A maximum of only 50 grams of Minted coins can be given.

- Gold jewellery of minimum of 10 grams is required (excluding the weight of stones)

- Forged coins are not accepted.

Know More – Gold Loan Per Gram

GOLD LOAN @ 0.75%*

APPLY NOW

Indian Overseas Gold Loan Documents Required

Gold Loan or Loan Against Gold is a loan product offered to the borrowers by the Indian Overseas Bank wherein funds are provided for fulfilling the financial needs of the applicant. The gold ornaments of the applicant are kept as security by the bank in exchange for the funds. The entire Indian Overseas Bank Gold Loan process is hassle-free and easy to get with minimal documentation. The bank ensures the high security of your gold ornaments till the loan is closed.

Documents required for Applying for IOB Gold Loan are:

A duly filled and signed Gold Loan application form shall be submitted along with the following documents:

| Photographs | 2 Passport Size |

| Identity Proof |

Aadhar Card, Passport, PAN Card, etc. (Only 1 is required)

|

| Residence Proof |

Aadhaar Card, Driving License, Ration Card, etc. In the case of Rented House then the rent agreement or water/electricity bills for the last three months can be considered. (Only 1 is required)

|

| Agricultural Land Proof |

Required only if the Loan is taken for Agricultural Purpose

|

If you are an existing customer of the bank you may not be required to submit any documents as the bank will already have your verified details.

**Any other documents as requested by the bank shall be duly submitted.**

GOLD LOAN @ 0.75%*

APPLY NOW

How To Apply For IOB Gold Loan?

- Visit our website that is Dialabank.

- The applicant has to fill a form Online that involve necessary information.

- You will get a call back from our Relationship Manager to clear all doubts as well as to assist you in the entire process of the Gold Loan.

- The applicant can check his /her eligibility for further clarification of the approval of a gold loan.

- Submit all the documents need as proof in the bank.

- Gold loan is approved in some minutes and disbursed within a day.

- Call us directly for any queries at 9878981144 about Indian Overseas Bank Gold Loan details

GOLD LOAN @ 0.75%*

APPLY NOW

IOB Gold Loan EMI Calculator

| Rate of Interest | 6 months | 1 Yr | 2 Yrs | 3 Yrs |

| 7.00% | 17008 | 8652 | 4477 | 3088 |

| 8.00% | 17058 | 8699 | 4523 | 3134 |

| 8.50% | 17082 | 8722 | 4546 | 3157 |

| 9.00% | 17107 | 8745 | 4568 | 3180 |

| 9.50% | 17131 | 8678 | 4591 | 3203 |

| 10.00% | 17156 | 8791 | 4614 | 3227 |

| 10.50% | 17181 | 8815 | 4637 | 3250 |

| 11.00% | 17205 | 8838 | 4661 | 3274 |

| 11.50% | 17230 | 8861 | 4684 | 3298 |

| 12.00% | 17254 | 8885 | 4707 | 3321 |

| 12.50% | 17279 | 8908 | 4731 | 3345 |

| 13.00% | 17304 | 8932 | 4754 | 3369 |

| 13.50% | 17329 | 8955 | 4778 | 3393 |

| 14.00% | 17354 | 8979 | 4801 | 3418 |

| 14.50% | 17378 | 9002 | 4825 | 3442 |

| 15.00% | 17403 | 9026 | 4845 | 3466 |

Indian Overseas Bank Agricultural Jewel Loan Scheme

| Scheme | Indian Overseas Bank Agricultural Jewel Loan Scheme |

| Interest Rate | Starting from 7.25% per annum (depends on the sum of the loan |

| Least amount of Loan | Depends on the value of the jewel which is being kept as security |

| Loan period | Adjustment of advance sum inside 2 months from the date of reap of yields |

GOLD LOAN @ 0.75%*

APPLY NOW

Benefits of Indian Overseas Bank Agricultural Jewel Loan Scheme

- There is no processing fee is applicable up to ₹ 25,000

- 0.30% of the loan amount, Minimum of ₹ 300 charge is applicable to the amount ranging from above ₹ 25,000 – less than ₹ 5 lakh

- 0.28% of the credit sum, subject to at least Rs.1,500 is applicable to the amount more than Rs.5 lakh however under Rs.1 crore

GOLD LOAN @ 0.75%*

APPLY NOW

India Overseas Bank Gold Loan Overdraft Scheme

An overdraft is usually issued on a temporary cash basis. The fee is not payable as for a standard loan and has both options, secured and unsecured ODs depending on your preferences and eligibility. One of these banks provides a place for the overuse of Indian Overseas Bank. The Overdraft Center at Indian Overseas Bank is simple and easy to understand. An overdraft may be allowed up to a maximum amount of Rs. 15 lakh.

GOLD LOAN @ 0.75%*

APPLY NOW

Indian Overseas Bank Gold Loan Highlights

| Age | 18 – 70 years |

| Minimum Loan Amount | Rs. 1000 |

| Maximum Loan Amount | Rs. 1 Crore |

| Indian Overseas Bank Gold Loan Interest Rate | 7.25% per annum onwards |

| Loan Tenure | 35 months |

| Gold Items accepted | Jewellery and gold coins sold by banks |

| Indian Overseas Bank Gold Loan Processing Charges | 1% of the loan amount |

GOLD LOAN @ 0.75%*

APPLY NOW

GOLD LOAN @ 0.75%*

APPLY NOW

How Does Indian Overseas Bank Gold Loan Work, Here’s An Example

The suitability of the loan is determined as per the purity of gold, suppose the borrower has 100 gm of gold jewellery. Many banks offer different rates for gold loans per gram as well as interest rates for gold loans based on their assessment of the weight of the gold, the purity and the value of the loan. Bank X measures gold jewellery at 22-carat net worth 75 gm (after removing the weight of gemstones and stones). The bank uses a 70% LTV rate and offers a loan rate of 9.90% interest.

GOLD LOAN @ 0.75%*

APPLY NOW

FAQs About India Overseas Bank Gold Loan

✅ What is Indian Overseas Bank Gold Loan?

An Indian Overseas Bank Gold Loan is a type of secured loan that Indian Overseas Bank provides in exchange for your gold to be kept as security. You can fulfil all your urgent financial needs with quick disbursing Gold Loans.

✅ How Can I Get Gold Loan From Indian Overseas Bank?

You can easily take an Indian Overseas Bank Gold Loan by visiting the nearest branch with your gold. You can also apply online with Dialabank to avail of personalized assistance and get the best deals. You can call us on 9878981144 for trustworthy assistance.

✅ How much Gold Loan Can I get per gram from Indian Overseas Bank?

Indian Overseas Bank Gold Loans per gram are provided at competitive rates. The loan per gram of gold is ₹ 3,800 to ₹ 4,350.

✅ How Does Indian Overseas Gold Loan work?

Indian Overseas Bank Gold Loans work quickly and are hassle-free loans that you can apply for any urgent monetary need. All you need to do is visit the nearest branch of Indian Overseas Bank with your gold ornaments and documents. Your gold loan will consequently be sanctioned and disbursed.

✅ What is the Gold Loan interest rate in Indian Overseas Bank?

The Gold Loan interest rate online in Indian Overseas Bank starts from as low as 7.25% per annum. This rate of interest depends on your gold’s purity and loan amount to be sanctioned.

✅ How to check gold loan status in Indian Overseas Bank?

You can check your Indian Overseas Bank Gold Loan status by visiting your loan branch in person or through the customer care number of the Indian Overseas Bank.

✅ How to calculate gold loan interest in the Indian Overseas Bank?

Indian Overseas Bank gold loan Interest Rate is a monthly charge that a bank charges you for its loan availing service. It is the difference between the loan principal and the final loan amount.

✅ What is the maximum gold loan amount I can avail of on a gold loan from Indian Overseas Bank?

With a stable income and a 750+ CIBIL score, an applicant can avail of a maximum Indian Overseas Bank gold loan amount of up to 1 crore. This amount is usually 75% of the value of the collateral. This can go up to 90% if the interest rates are high.

✅ What is the loan tenure of the Indian Overseas Bank gold loan?

The maximum Indian Overseas Bank gold loan tenure is 35 months. You can choose your tenure for a gold loan.

✅ How much processing fee is applicable to the Indian Overseas Bank Gold loan?

The processing fee is charged by the bank to process your loan. The processing fee charged for an Indian Overseas Bank gold loan is 1% of the outstanding loan amount or Rs. 1000, whichever is higher.

✅ What are the charges for pre-payment in the Indian Overseas Bank gold loan?

The Indian Overseas Bank gold loan prepayment or foreclosure can be done by the borrower without paying any extra fee.

✅ How to renew Indian Overseas Bank Gold Loan online?

You will be required to visit the branch in order to renew your Indian Overseas Bank Gold Loan. Your pledged gold will undergo a revaluation process and upon verification, new loan terms will be set.

✅ How to pay Indian Overseas Bank Gold loan interest online?

You can pay your Indian Overseas Bank Gold Loan EMIs online by visiting the bank’s website and clicking on the Bill Payment option. You will be redirected to a page where you will be required to fill in your loan details. For detailed information, contact the customer care executive of the bank.

✅ What if I can’t pay the interest on the Indian Overseas Bank Gold loan for 3 months?

Defaulting on your Indian Overseas Bank Gold Loan will decrease your credit score making it difficult to get a loan in the future. Also, repeated defaults will give your bank the right to auction your gold and recover the loan money.

✅ How can I apply for the EMI moratorium on the Indian Overseas Bank Gold loan?

An EMI moratorium helps you free yourself from the burden of repayment for a predefined period. You can apply for an Indian Overseas Bank Gold Loan EMI Moratorium by giving the bank your loan application details in person or online. You can only apply for it 5 days before the EMI payment date.

✅ How to pay the Indian Overseas Bank Gold loan through credit card?

You cannot repay the Indian Overseas Bank gold loan using a credit card. A debit card, cash, cheque, demand draft, or online payment apps like Paytm can be used for the same.

✅ What is the Indian Overseas Bank Gold Loan customer care number?

For contacting the Indian Overseas Bank Gold loan customer care just dial 9878981144. You can also call for Indian Overseas Bank Gold Loan details

✅ What is the Indian Overseas Bank Gold Loan closure procedure?

- Just go to the bank with the documents.

- Write a letter for pre-closure of the Indian Overseas Bank Gold loan account.

- Pay the pre-closure charges as per Indian Overseas Bank Gold Loan.

✅ What is the Indian Overseas Bank Gold Loan preclosure charge?

Up to 2% preclosure charge before 3 months, after that 1%.

✅ What is the Indian Overseas Bank Gold Loan overdraft scheme?

An overdraft is usually issued on a temporary cash basis. The fee is not payable as for a standard loan and has both options, secured and unsecured ODs depending on your preferences and eligibility. One of these banks provides a place for the overuse of Indian Overseas Bank. The Overdraft Center at Indian Overseas Bank is simple and easy to understand. An overdraft may be allowed up to a maximum amount of Rs. 15 lakh.

✅ What is the Indian Overseas Bank Gold Loan maximum tenure?

The maximum tenure of the Indian Overseas Bank Gold loan is 35 months.

✅ What is the Indian Overseas Bank Gold Loan minimum tenure?

The minimum tenure for the Indian Overseas Bank Gold Loan is 12 months.

✅ What is the Indian Overseas Bank Gold Loan Per Gram Rate?

The Indian Overseas Bank Gold Loan Per Gram ₹ 3,800 to ₹ 4,350.

✅ What are the foreclosure charges of the Indian Overseas Bank Gold Loan?

Indian Overseas Bank charges a borrower up to .50% on the principal amount in case of a Gold Loan Foreclosure.