SBI Gold Loan Key Features – Apply Online

| SBI Gold Loan Interest Rate |

7.25% per annum – Updated Apr 26 2024 |

| SBI Gold Loan Per Gram Rate | SBI Gold Loan Rate Per Gram Today is ₹ 3,800 to ₹ 4,350 |

| SBI Gold Loan Age of Borrower | 18 – 75 years |

| SBI Gold Loan Maximum Loan Amount | Up to 1 crore |

| SBI Gold Loan Maximum Loan to Gold Value Ratio | Up to 75%* |

| The purity of Eligible gold | 18 carat to 22-carat gold |

| SBI Gold Loan Tenure | Up to 36 months |

*As per RBI guidelines, LTV (Loan to Value) ratio for Gold Loan is 75%.

SBI issues a Gold Loan per gram rate of ₹ 3,800 to ₹ 4,350 in line with the current gold rate. The best SBI Gold loan Rate per gram is ₹ 3,800 to ₹ 4,350 for 22 Carat gold, measured at a maximum 85% loan to value and the average gold price for the last one month for 22-carat is ₹ 4,469.

GOLD LOAN @ 0.75%*

APPLY NOW

Introduction to SBI Gold Loan

The SBI Bank Gold Loan is the most common gold loan for the borrowers since it has the lowest interest rate starting at 7.25% per annum per annum. The interest rate on the basic Term gold loans at the State Bank of India is higher than the rate on agricultural loans. SBI’s gold loan rate per gram today ranges from ₹ 3,800 to ₹ 4,350.

- SBI provides gold loans with easy paperwork, fast processing, and no secret fees.

- You will get gold loans with a 30-month repayment period.

- SBI offers a special agricultural gold loan program for applicants who are involved in farming and need money to cover their expenses. SBI’s agricultural gold loan interest rate is smaller than its standard gold loan rate.

GOLD LOAN @ 0.75%*

APPLY NOW

SBI Gold Loan Explanation

SBI gold loan can be availed to meet an urgent need for cash by pledging one’s gold ornaments or gold coins as collateral. A Gold loan is one of the quickest and easiest ways of borrowing money and can be availed by any existing customer of the SBI as well as new borrowers. With SBI, you will not only be able to avail of the gold loan easily but it will also be at a competitive interest rate.

GOLD LOAN @ 0.75%*

APPLY NOW

SBI Gold Loan Comparison with Other Banks

| Particulars | SBI | Private Bank | HDFC Bank |

| Interest Rate | 7.00% – 7.50% | 7.0% per annum | 9.90% – 17.55% |

| Processing Fees | 0.50% of the loan amount, minimum Rs. 500 | Up to 1% of the loan amount, minimum Rs. 750 | 1.50% of the loan amount |

| Loan Tenure | 3 months to 36 months | 3 months to 10 years | 3 months to 24 months |

| Loan Amount | ₹ 20,000 to ₹ 20 Lakh | ₹ 10,000 to ₹ 1 crore | ₹ 25,000 to ₹ 50 Lakh |

| Foreclosure Charges | Nil | Up to 1% of the outstanding amount | Nil after 3 months |

| Repayment Options | Y | Y | Y |

| Lowest EMI Per Lakh | ₹ 3,111 per lakh | ₹ 8,792 per lakh | ₹ 4,610 per lakh |

GOLD LOAN @ 0.75%*

APPLY NOW

GOLD LOAN @ 0.75%*

APPLY NOW

SBI Gold Loan Details

| SBI Gold Loan Schemes | Loan Tenure |

| Gold Loan | 36 months |

| Liquid Gold Loan | 36 months |

| Bullet Repayment Gold Loan | 12 months |

- The aim of a gold loan is to cover personal and company expenses.

- Collateral: You will get a loan by pledging your gold jewellery as collateral.

- Gold jewellery weighing up to 50 grams with a purity of 18 to 22 carats is accepted.

- SBI provides jewel loans to everyone above the age of 18, including salaried and self-employed workers, traders, teachers, pensioners, and housewives.

GOLD LOAN @ 0.75%*

APPLY NOW

Features of SBI Gold Loan

- The interest rate on an SBI gold loan starts at 7.25% per annum per annum.

- SBI charges 0.50 percent of the loan volume as payment costs, for a minimum of Rs. 500.

- a loan The term of a gold loan will vary from 3 to 36 months.

- SBI offers the lowest EMI per lakh on a gold loan with the lowest gold loan interest rate of 7.25% per annum percent and the longest loan term of 36 months.

- Prepayment of jewel loans by SBI is free of charge.

Only simple KYC documents for address verification and proof of income are needed. For accepting a gold loan, the bank does not ask you to apply for proof of income or review your CIBIL ratings. SBI Bullet Repayment Scheme is one of the most common gold loan schemes in the country.

GOLD LOAN @ 0.75%*

APPLY NOW

Benefits of SBI Gold loan

The country’s largest public-sector lender, State Bank of India announced a list of festive offers for its gold loan borrowers. The bank is now offering a 100% waiver on processing fees for all gold loan customers who are applying through its digital platform YONO. Further, the gold loan customers will now have flexible repayment options for up to the lowest interest of 7.25% per annum.

- Gold has the lowest interest rates and refining costs, as well as the highest interest rates.

- There is also little evidence.

- Charges of debt foreclosure are waived.

- Repayment terms are flexible, and the LTV ratio is high.

- Loan redemption schemes come in a variety of shapes and sizes.

GOLD LOAN @ 0.75%*

APPLY NOW

Tips To Get Gold Loan From SBI Fast

- SBI accepts both hallmarked and non-hallmarked jewellery in exchange for money. However, you can get the highest gold loan per gram for any hallmark jewellery, because it reduces the chances of under-valuation by the valuer.

- SBI can adjust the price of 22-carat gold for the purity of gold. Therefore, one should also try to borrow against jewellery of higher purity because it fetches the highest amount for a gold loan.

- SBI will calculate the net weight of the jewellery to calculate the amount of loan against the gold you can get. You can always try to choose jewellery that has minimum gems and stones. Most of the banks will reduce the weight of gems and stones from the total weight of the jewellery. But SBI will rely on the report of its gold valuer to calculate the net weight. Higher the weight of gems and stones in jewellery, lower the net weight and value of jewellery which results in a lower amount of jewel loan you can are eligible to get.

GOLD LOAN @ 0.75%*

APPLY NOW

SBI Gold Loan Eligibility Criteria

Minimum and Maximum Age

Note: However, many banks require a minimum age of 23 years

Loan Amount

Interest rates are lower for a higher loan amount

Employment Type

Businessmen are increasingly taking gold loans to meet their working capital requirements.

In fact, housewives, senior citizens who are not eligible for other loans because they have no income proofs can easily avail of gold loans.

Quality of Gold

An average gold price of 22-carat gold for the preceding 30 days is adjusted down for purity. So, the price of 20 Carat jewellery can be estimated by multiplying the price of 22 Carat jewellery by a factor of 20/22

CIBIL Score

However, your repayment track record for a gold loan is counted towards your CIBIL score and hence, can be instrumental in building your CIBIL score

Gold ornaments that can be used for availing loan

Gold with 18-24 carat purity

Employment track record and income proofs

SBI Gold Loan at Home

Gold Loan at Home is a doorstep loan service that allows you to borrow money from the convenience of your own home. The service is rapid, flexible, and cost-effective because interest rates are low. You may use the gold loan calculator to calculate the value of your gold or the loan amount before completing a loan request. Obtaining a Gold Loan at home is an easy and quick process that can be done in a matter of minutes.

One of our representatives will contact you and arrive at your home within 30 minutes. The appropriate gold loan amount will be paid immediately to your bank account when all e-documentation and gold identification is completed at your home.

The benefits of getting a gold loan at your doorsteps are:

- Diverse Range of Gold Loan Schemes

- Your Gold will just be released the same day.

- You can get free insurance for your Gold

- There are no hidden fees.

- You will get the maximum value of your Gold

- Service at Your Door in 30 Minutes

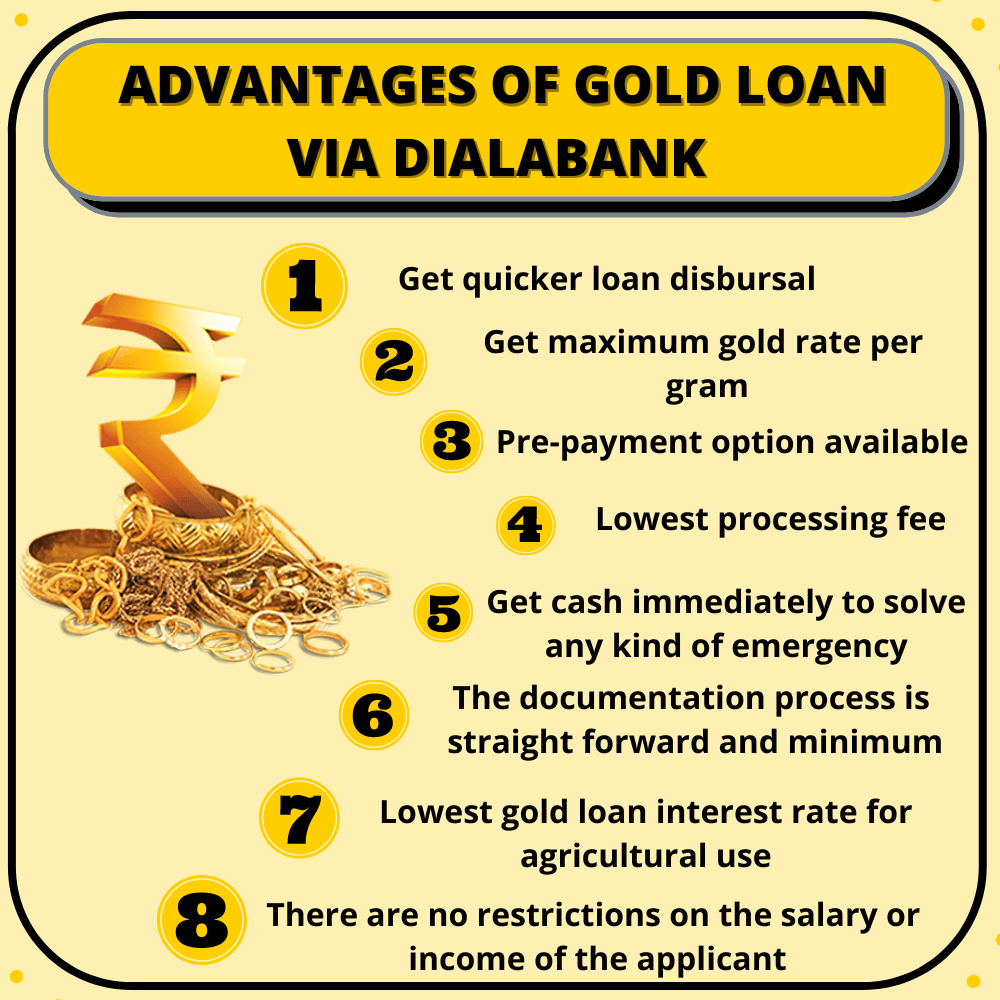

Advantages Of SBI Gold Loan

- You can avail of a Loan of up to Rs.1 Crore or more & up to 75% of value for any purpose.

- You get 100% Safety & Security from your Gold Jewelry.

- Get your Loan processed in less than 30 minutes.

- Enjoy Anytime Liquidity.

- Simple documentation and fast processing.

- SBI charges the borrower up to 1.50% of the outstanding principal loan amount of a Gold Loan.

GOLD LOAN @ 0.75%*

APPLY NOW

How Much Can I Get Through SBI Gold Loan?

As per the most advanced gold prices, SBI offers a gold loan per gram today of ₹ 3,800 to ₹ 4,350. The highest gold loan rate per gram now is ₹ 3,800 to ₹ 4,350 for 22-carat jewellery calculated at a maximum LTV of 75% and the average gold loan rates of the last 30 days in 2021 are ₹ 3,800 to ₹ 4,350 for 22 carats.

GOLD LOAN @ 0.75%*

APPLY NOW

SBI Gold Loan Rate Per Gram – Apr 26 2024

Updated - Gold Loan Per Gram Rate w.e.f Apr 26 2024 |

||||

| Gold Weight | Gold Purity 24 Carat |

Gold Purity 22 Carat |

Gold Purity 20 Carat |

Gold Purity 18 Carat |

| 1 gram | 4621 | 4290 | 3900 | 3510 |

| 10 gram | 46210 | 42900 | 39000 | 35100 |

| 20 gram | 93600 | 85800 | 78000 | 70200 |

| 30 gram | 140400 | 128700 | 117000 | 105300 |

| 40 gram | 187200 | 171600 | 156000 | 140400 |

| 50 gram | 234000 | 214500 | 195000 | 175500 |

| 100 gram | 468000 | 429000 | 390000 | 351000 |

| 200 gram | 936000 | 858000 | 780000 | 702000 |

| 300 gram | 1404000 | 1287000 | 1170000 | 1053000 |

| 400 gram | 1872000 | 1716000 | 1560000 | 1404000 |

| 500 gram | 2340000 | 2145000 | 1950000 | 1755000 |

GOLD LOAN @ 0.75%*

APPLY NOW

About SBI Gold Loan

State Bank of India (SBI) was founded in 1955 with its headquarters in Mumbai, Maharashtra. It has 15,500 branches all over the World. It provides many banking products and financial services according to the needs of the customer. There are various loan schemes from which borrowers can raise funds, but for instant finance, Gold Loan is the best option.

There are so many banking and non-banking financial organizations that provide a gold loan, but the gold loan with SBI is the best. You can use this amount of gold to fulfil any of your personal needs. It can be used for educational purposes or to boost up your business. Besides that, it can be used to pay your medical bills or for wedding purposes too. Thus, the Bank doesn’t put any restriction on the use of the amount of the Loan.

GOLD LOAN @ 0.75%*

APPLY NOW

Gold Loan Schemes of SBI:

SBI offers several gold loan products to meet your various product requirements. These include loans with different repayment options.

GOLD LOAN @ 0.75%*

APPLY NOW

SBI Gold Loan Documents Required

The documents should be mainly from the following options.

| Identity Proof | Aadhar Card/Pan Card/ Passport/ Voter ID |

| Residence Proof | Aadhar Card /Pan Card/ Ration Card/ Utility Bills on the name of the applicant/ Rental Agreement of applicant/ Voter ID card. |

| Agriculture Proof ( only if applicable) | Agriculture Land Ownership Proof |

| Photographs | 2 Passport sized coloured |

GOLD LOAN @ 0.75%*

APPLY NOW

SBI Gold Loan Interest Rate Apr 26 2024

A Gold Loan can meet all your initial short-term and long-term financial obligations. The rate of interest that you will be filled with depends on the whole loan sum, as well as the quality/purity of the gold you are to have as collateral with the bank. Gold Loan interest rates allowed by the bank are more moderate compared to other loans because it is a completely secured loan. The current SBI Gold Loan Rate is 7.25% per annum

Other Fees and Charges for SBI Gold Loan

| Updated SBI Gold Loan Interest Rate Apr 26 2024 |

|

| Interest Rate | 7.25% per annum onwards |

| Processing Fee | 0.5% of the loan amount |

| Loan Tenure | 3 months to 36 months |

| Prepayment Charges | 1% of the outstanding principal amount |

Gold Loan: Anyone with a steady source of income can avail of a gold loan by pledging his gold ornaments.

GOLD LOAN @ 0.75%*

APPLY NOW

Types of State Bank of India Gold Loan

Multi-Purpose gold loan: Mainly for agriculture purposes, the multi-purpose loan comes into handy to repay various kinds of debts.

State Bank of India Gold Loan Apply Online

Online Process: Through the Online process, the applicant gets the opportunity to avail of the service of the gold loan at the comfort of their home. Just follow the following steps:

- Visit Dialabank

- Fill an application form with all required fields.

- Our Relationship Manager will call you back to assist you through the entire process.

- You will have to submit documents to the bank.

- Your Loan will be approved in just some minutes.

Apart from the above process, you can directly call us at 9878981144.

GOLD LOAN @ 0.75%*

APPLY NOW

SBI Gold Loan EMI Calculator

GOLD LOAN @ 0.75%*

APPLY NOW

| Rate of Interest | 6 months | 1 Yr | 2 Yrs | 3 Yrs |

| 7.00% | 17008 | 8652 | 4477 | 3088 |

| 8.00% | 17058 | 8699 | 4523 | 3134 |

| 8.50% | 17082 | 8722 | 4546 | 3157 |

| 9.00% | 17107 | 8745 | 4568 | 3180 |

| 9.50% | 17131 | 8678 | 4591 | 3203 |

| 10.00% | 17156 | 8791 | 4614 | 3227 |

| 10.50% | 17181 | 8815 | 4637 | 3250 |

| 11.00% | 17205 | 8838 | 4661 | 3274 |

| 11.50% | 17230 | 8861 | 4684 | 3298 |

| 12.00% | 17254 | 8885 | 4707 | 3321 |

| 12.50% | 17279 | 8908 | 4731 | 3345 |

| 13.00% | 17304 | 8932 | 4754 | 3369 |

| 13.50% | 17329 | 8955 | 4778 | 3393 |

| 14.00% | 17354 | 8979 | 4801 | 3418 |

| 14.50% | 17378 | 9002 | 4825 | 3442 |

| 15.00% | 17403 | 9026 | 4845 | 3466 |

How To Pay State Bank Of India Gold Loan EMI?

Your SBI gold advance can be reimbursed in the following three different ways.

- Standing Instruction (SI): If you are a current record holder with SBI, Standing Instruction is the best method of repayment. Your EMI sum will be charged automatically toward the finish of the month to month cycle from the SBI account you indicate.

- Electronic Clearing Service (ECS): This mode can be utilized if you have a non-SBI account and might want your EMIs to be charged consequently toward the finish of the month to month cycle from this record.

- Post-Dated Checks (PDC): You can submit post-dated EMI checks from a non-SBI account at your closest SBI Loan Center. A new arrangement of PDCs should be submitted promptly. It would be ideal if you note Post Dated Checks will be gathered in non-ECS areas as it were.

GOLD LOAN @ 0.75%*

APPLY NOW

Compare Gold Loan Rate Per Gram and Lowest EMI of All Major banks

| Bank | Interest Rate | Lowest EMI Per Lakh |

Eligible Loan Amount For Max Tenure

|

| SBI Gold Loan | 7.50% | Rs. 3,111 |

Rs. 20 Lakh for 36 months

|

| Muthoot Gold Loan | 11.99% | Rs. 3,321 |

Rs. 50 Lakh for 36 months

|

| Manappuram Gold Loan | 12.00% | Rs. 8,885 |

Rs. 1 Cr for 12 months

|

| HDFC Bank Gold Loan | 9.90% | Rs. 4,591 |

Rs. 50 Lakh for 24 months

|

| Yes Bank Gold Loan | 9.99% | Rs. 3,226 |

Rs. 50 Lakh for 36 months

|

| Private Bank Gold Loan | 10.00% | Rs. 8,792 |

Rs. 15 Lakh for 12 months

|

| Federal Bank Gold Loan | 8.50% | Rs. 8,722 |

Rs. 75 Lakh for 12 months

|

| Canara Bank Gold Loan | 7.65% | Rs. 8,683 |

Rs. 10 Lakh for 12 months

|

| Andhra Bank Gold Loan | 10.70% | Rs. 8,824 |

Rs. 2 Cr for 12 months

|

| Axis Bank Gold Loan | 13.00% | Rs. 4,754 |

Rs. 20 Lakh for 24 months

|

| IndusInd Bank Gold Loan | 10.00% | Rs. 8,792 |

Rs. 10 Lakh for 12 months

|

| PNB Gold Loan | 8.75% | Rs. 8,734 |

Rs. 10 Lakh for 12 months

|

| Fincare Small Finance Bank Gold Loan | 12.99% | Rs. 11,721 |

Rs. 40 Lakh for 9 Months

|

SBI Gold Loan Contact Number

In case of any assistance required please contact on the number 9878981144.

GOLD LOAN @ 0.75%*

APPLY NOW

Gold Ornaments Accepted By SBI

Gold jewellery such as Gold Bangles, Gold rings, Gold anklets, and Gold necklaces, all of these are accepted for availing a Gold Loan.

Quality: The quality of gold should lie between 18 Carat to 22 Carat. Aby gold ornament which is 24 Carat cannot be used for availing a gold loan.

The current Jewel Loan Interest Rate is 7.25% per annum per annum.

GOLD LOAN @ 0.75%*

APPLY NOW

Uses Of State Bank of India Gold Loan

The funds acquired by availing the Gold Loan service can be used for several purposes such as:

- To finance personal expenses for weddings, travel, payment of higher education fees, etc.

- For all your business financial needs such as buying raw material, expansion of business, etc.

- You can also avail of a Gold Loan for agricultural purposes. The bank offers lower rates of interest for Gold Loans that are used for agriculture or allied activities.

GOLD LOAN @ 0.75%*

APPLY NOW

SBI Agricultural Jewel Loan Scheme

| Scheme | SBI Agricultural Jewel Loan Scheme |

| Interest Rate | Starting at 7.25% per annum p.a. |

| Least amount of Loan | Depends on the value of the jewel |

| Loan period | Adjustment of advance sum inside 2 months from the date of reap of yields |

GOLD LOAN @ 0.75%*

APPLY NOW

GOLD LOAN @ 0.75%*

APPLY NOW

Benefits of SBI Agricultural Jewel Loan Scheme

- For 0.30% of the loan amount, a Minimum of ₹ 300 is charged ranging from more than ₹25,000 – less than ₹ 5 lakh

- 0.28% of the credit sum, subject to at least Rs.1,500 applicable on more than Rs.5 lakh and less than Rs.1 crore

GOLD LOAN @ 0.75%*

APPLY NOW

SBI Gold Loan Overdraft Scheme

- SBI overdraft is usually issued on a temporary cash basis.

- Up to 90% of Value.

- The service is available to all users of SBI Internet Banking.

GOLD LOAN @ 0.75%*

APPLY NOW

SBI Gold Loan Highlights

| Age | 18 – 75 years |

| Minimum Loan Amount | Rs. 10,000 |

| Maximum Loan Amount | Up to Rs. 1 Crore |

| SBI Gold Loan Interest Rate | 7.50% p.a. onwards |

| Loan Tenure | From 3 months to 36 months. |

| Gold Items accepted | Jewelry and gold coins sold by banks |

| SBI Gold Loan Processing Charges | 0.85% of the loan amount |

GOLD LOAN @ 0.75%*

APPLY NOW

GOLD LOAN @ 0.75%*

APPLY NOW

What type of gold loan be used to secure a gold loan?

Failure to investigate the creditor’s credibility: A gold loan is a guaranteed loan, which means it is backed up by something (gold in this case). The borrower or trustee keeps this collateral until the debt is fully paid off. If a borrower defaults, the creditor can use the collateral to reclaim any or all of the money the borrower originally owed. This is a great way to give creditor immunity, but what about the borrower? What if the borrower proves to be a con artist? Not weighing the alternatives: All deserves the best gold loan deal possible.

There is no set formula for obtaining one since it is dependent on the needs of the borrowers. However, before signing on the dotted line, make sure you compare all of your options. It’s possible that the first bid you get isn’t the best one for you. As a result, learn as best as you can about industry dynamics, speak with various banks and financial firms to learn about their offerings, and then narrow down your choices to a few viable alternatives. Look for a borrower who will sell you a loan with a lower interest rate or a higher loan to value (LTV) ratio while weighing your options.

GOLD LOAN @ 0.75%*

APPLY NOW

How Does SBI Gold Loan Work, Here’s An Example

The suitability of the gold loan is determined based on the purity of gold, LTV, and its weight. Suppose Mr A and his two friends Mr B and Mr C have different gold values for different purity. Mr A has 50 grams of gold per 22-carat purity. Mr B has 60 grams of gold in 20 carats of purity and Mr C has 70 grams of gold in purity or 22 carats.

They approached the SBI to get a gold loan. The price used to calculate the suitability of their gold loan according to the high 85% LTV will vary with the purity of the gold and therefore, will lead to the validity of the gold loan.

How to apply for SBI Gold Loan

Online:

Applying for the SBI Gold Loan service is a trouble-free and simple process that can be done from the comfort of your home. You can do this entire process online by visiting the official website of the bank and submitting a form with mandatory information regarding yourself and the Gold Loan. But then, you will then need to visit your nearest branch with the required documents and your gold.

You can also apply for Gold Loan with Dialabank by following the steps given below:

-

Visit Dialabank’s online platform, where you will have to simply fill a form, without any registration.

-

Then our Relationship Manager will get in touch with you and guide you throughout the Gold Loan process and fulfill your financial needs.

-

You will get personalized service, giving you the option of comparing all the available deals and suggesting you the best deal according to your needs without any extra charges.

-

Using Dialabank, you can check and compare the different offers & schemes from various banks based on the Rate of interest charged and funding provided for choosing the best loan deal for yourself.

Offline:

- Visit any nearby branch of SBI with your pledged gold.

- The Branch staff will assess your gold.

- The Gold Loan amount will be sanctioned based on the evaluation and purity of gold ornaments.

Applying through the Dialabank website?

If you need funds for a medical emergency, a down payment on a home, furniture purchases, or a family holiday, a personal loan is one of the choices available to you. A personal loan is an unsecured loan that can be used for all but speculative purposes. These loans can be used everywhere.

GOLD LOAN @ 0.75%*

APPLY NOW

FAQs About SBI Gold Loan

✅ What is the SBI Gold Loan?

SBI Gold Loan is a secured loaning scheme that uses pledged gold as collateral security. Gold Loan from SBI can be used for any personal purpose and need. You can fill an inquiry form at Dialabank’s digital platform and access all the loan details from our relationship manager.

✅ How Can I Get Gold Loan From SBI?

You can easily get a Gold Loan from SBI by pledging your gold. The loan amount is dependent on the purity of your gold and the rate of interest at 7.50% per annum. You will need to visit the bank branch with basic KYC documents and your gold. Alternatively, you can apply online with Dialabank and avail of personalized assistance from the comfort of your home.

✅ How much Gold Loan Can I get per gram from SBI?

You can avail of a gold loan of Rs ₹ 3,800 to ₹ 4,350 per gram from SBI, depending on the quality of your gold.

✅ How Does SBI Gold Loan work?

The SBI Gold Loan is provided by the Banks /NBFC provides you with funds against your gold ornament. The amount depends upon the gold weight.

✅ What is the SBI Gold Loan interest rate?

The SBI gold loan interest rate is 7.25% per annum per annum.

✅ How to check gold loan status in SBI?

To check your SBI Gold Loan status online just visit the SBI’s online portal and fill in the form your Gold Loan application details

✅ How to calculate gold loan interest in SBI?

The gold loan interest rate in SBI can be calculated by simply subtracting the principal amount from the total amount to be paid.

✅ What is the maximum gold loan amount I can avail myself of on a gold loan from SBI?

You can avail a maximum of up to 75% of the gold jewelry’s market value on a gold loan from SBI.

✅ What is the loan tenure of the SBI gold loan?

The loan tenure of your SBI gold loan is up to 36 months. You will be required to renew your loan after 1-year completion tenure.

✅ How much processing fee is applicable on the SBI Gold loan?

A processing fee of up to 0.5% of the loan amount applies to the SBI gold loan.

✅ What are the charges for pre-payment in the SBI gold loan?

Pre-payment charges up to 1% of the outstanding loan amount are charged by SBI.

✅ How to renew SBI Gold Loan online?

You can renew your SBI Gold loan online by simply logging into your SBI app account with the credentials and renewing your gold loan under the Gold Loan section by entering the loan account details.

✅ How to pay SBI Gold loan interest online?

You can pay the SBI Gold loan interest online using online payment options like net banking, debit cards, or through the i-mobile app.

✅ What if I can’t pay the interest on the SBI Gold loan for 3 months?

If you do not pay your SBI loan amount for 3 months then the bank will warn you against further default. In case the defaults continue, the gold ornaments kept as a security with the bank might be sold.

✅ How can I apply for an EMI moratorium on an SBI Gold loan?

You can apply for an SBI Gold loan moratorium online by logging in with your ID and password or can also visit the bank personally.

✅ How to pay an SBI Gold loan through a credit card?

SBI Gold loans cannot be repaid through credit cards as per RBI Guidelines.

✅ What is the SBI Gold Loan customer care number?

For contacting the SBI Gold loan customer care just dial 9878981144.

✅ What is the SBI Gold Loan closure procedure?

- Just go to the bank with the documents.

- Write a letter for pre-closure of the SBI Gold loan account.

- Pay the pre-closure charges as per the State Bank of India Gold Loan.

✅ What is the SBI Gold Loan preclosure charge?

Up to 2% preclosure charge before 3 months, after that 1.50%.

✅ What is the SBI Gold Loan overdraft scheme?

- SBI overdraft is usually issued on a temporary cash basis.

- Up to 90% of Value.

- The service is available to all users of SBI Internet Banking.

✅ What is the SBI Gold Loan maximum tenure?

The maximum tenure of the SBI Gold loan is 36 months.

✅ What is the SBI gold loan minimum tenure?

The SBI Gold loan minimum tenure is 3 months

✅ What is the SBI gold loan per gram rate?

SBI Gold Loan Rate Per Gram today is ₹ ₹ 3,800 to ₹ 4,350.

✅ What is the current SBI Gold Loan Rate?

The SBI Gold Loan Rate today is 7.25% per annum.

✅ What are the foreclosure charges of the SBI Gold Loan?

SBI charges a borrower up to .50% on the principal amount in case of a Gold Loan Foreclosure.

SBI Gold Loan News

SBI offered customers to apply for Gold Loan via call or SMS

Now customers can apply for the gold loan from SBI by texting SMS GOLD at 7208933145 or give a missed call on 7208933143, and the bank will then respond with a callback. A minimum loan amount of Rs 20,000 and a maximum of up to Rs 50 lakh is sanctioned by the bank.

SBI recasts only 4,000 retail loans

Under the limited window of the RBI, SBI has recast the loans of around a number of 4,000 retail registered customers so far, which clearly indicates that barring micro, small and medium businesses, not many are availing of easier repayment norms. Around 1,00,000 retail registered customers logged into SBI Official website to check the eligibility but not many found to have met the stringent conditions set by the bank claimed the SBI.

SBI shelves plan to hive off Yono app

Owing to the drive of privatization initiated by the Central Government authorities, the State Bank of India has decided on shelving plans to hive off the Yono application. Yono would now cater to the lenders of the competing banking institution and provide them with core banking services and leveraging their banking needs and benefits.

SBI will unlock value from general insurance and mutual fund biz: Dinesh Kumar Khara

Dinesh Kumar Khara, Chairman, SBI, tells Nikunj Dalmia of ET NOW that the bank is controlling the cost whichever way it can and the overheads are almost flat. The only way forward is to augment revenue streams.

SBI home-loan rates now start at 6.8%

State Bank of India (SBI) has cut the minimum interest rate at which it will offer home loans up to ₹30 lakh to 6.80 percent from 6.90 percent. Further, for home loans above ₹30 lakh, the minimum interest rate has been pared to 6.95 percent from 7 percent.

Renovated branch of SBI at Connaught Circus inaugurated

The renovated branch of SBI at P-Block, Connaught Circus, New Delhi was inaugurated by Chairman SBI Dinesh Khara. Chief General Manager of SBI New Delhi Circle Vijuy Ronjan along with other senior officials and esteemed customers of the branch were also present on the occasion.

It provides retail banking solutions to individuals in the form of deposit accounts and retail lending in form of a Car Loan, Housing Loan, Gold Loan, and Personal Loan.

SBI Gold Loan: Want a loan for agriculture purposes? Get it now!

SBI Agriculture Gold Loan: India’s largest state lender, the State Bank of India (SBI) is offering Gold loans exclusively for agricultural purposes. If you are engaged in agricultural activity and require a quick loan, here is a golden opportunity for you to get one.