Capital Small Finance Bank Gold Loan Key Features- Apply Now

| Capital Small Finance Bank Gold Loan Interest Rate | 7.25% per annum |

| Capital Small Finance Bank Gold Loan Rate Per Gram | Rate Per Gram Today is ₹ 3,800 to ₹ 4,350 |

| Capital Small Finance Bank Gold Requirement | Minimum 18 Carat |

| Capital Small Finance Bank Gold Loan Processing Fee | 1% of the Principal Loan Amount |

| Capital Small Finance Bank Minimum Loan Amount | 90% LTV on Your Gold Market Price |

| Capital Small Finance Bank Maximum Loan Amount | Up to Rs. 10 lakh |

| Capital Small Finance Bank Prepayment Charges | 2%+GST (Within 3 Months), 0 (After 3 months) |

| Capital Small Finance Bank Repayment Tenure | 6 Months to 60 Months |

| Capital Small Finance Bank Gold Loan Schemes | Bullet Payment Scheme, EMI Scheme |

Capital Small Finance Bank issues a Gold Loan per gram rate of ₹ 3,800 to ₹ 4,350 in line with the current gold rate. The best Capital Small Finance Gold Loan Rate per gram is ₹ 4,129 for 22 Carat gold, measured at a maximum 75% loan to value, and the average gold price for the last one month for 22-carat is ₹ 4,129

Capital Small Finance Bank Gold Loan Explanation

Capital Small Finance Bank offers loans against gold at contentious interest rates. Capital Small Finance Bank as one of the major Gold Loan providers understand the needs of the applicant and disburse the loan amount in 24 hours.

The pledged gold as security is locked safely in the vault, and the borrower does not have to worry about its safety of gold. The gold rates and all other charges are transparently announced to the borrower upfront before sanctioning the Gold loan amount. Hence applicant does not have to worry about the hidden fees on their Gold Loan.

GOLD LOAN @ 0.75%*

APPLY NOW

Capital Small Finance Bank Comparison With Other Banks

| Particulars | Capital Small Finance Bank | SBI | HDFC Bank |

| Interest Rate | 7.25% per annum | 7.25% per annum | 9.90% – 17.55% |

| Processing Fees | Up to 1% of the loan amount | 0.50% of the loan amount | 1.50% of the loan amount |

| Loan Tenure | 3 months to 60 months | 3 months to 36 months | 3 months to 24 months |

| Loan Amount | Up to Rs. 1 Crore | ₹ 20,000 to ₹ 20 Lakh | ₹ 25,000 to ₹ 50 Lakh |

| Foreclosure Charges | 2%+GST (Within 3 Months), 0 (After 3 months) | Nil | Nil after 3 months |

| Repayment Options | Y | Y | Y |

| Lowest EMI Per Lakh | ₹ 5,121 per lakh | ₹ 3,111 per lakh | ₹ 4,610 per lakh |

Tips To Get Gold Loan From Capital Small Finance Bank Fast

- Capital Small Finance Bank welcomes both hallmarked and non-hallmarked jewellery for a gold loan. However, you can get a very high gold loan per gram with remarkable jewellery, as it reduces the chances of a lower rating by the average. Also, some banks charge a lower fee for processing gold jewellery.

- Capital Small Finance Bank fixes the price of 22-carat gold for pure gold. So, always try to borrow high-quality jewellery as it will bring you the highest value of gold loans.

- For faster processing of gold loans, you can apply for online gold loan application services by Capital Small Finance Bank.

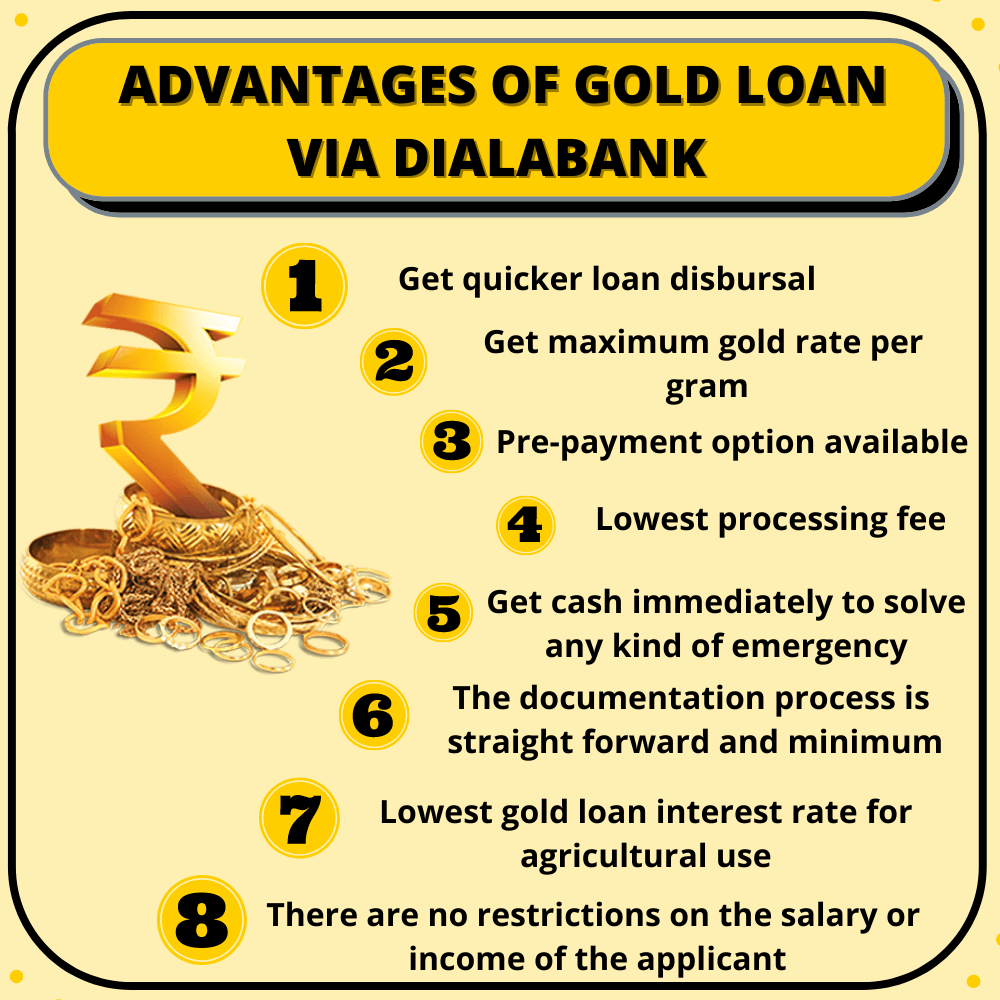

Advantages Of Capital Small Finance Bank Gold Loan

- Multipurpose – Capital Small Finance Bank Gold loan can be used for any legitimate purpose, ranging from education to housing or business.

- Quick approval – You can avail of Capital Small Finance Bank Gold Loan without any hassles, with minimal paperwork and lenient eligibility criteria.

- High quantum – Borrowers can avail of a Gold loan of different denominations, subject to their requirement and background.

- Competitive interest – Capital Small Finance Bank Gold loan comes at a competitive rate of interest on Term Loan, Overdraft and EMI based loan and making repayment light on the pocket. Repay your gold loan in lower EMI, over a tenor of your choice.

- Prepayment – Borrowers can choose to prepay the Capital Small Finance Bank Gold loan without any worry of prepayment charges.

- Collateral Held securely – Any gold surrendered to the Capital Small Finance Bank as collateral is kept safely in a locker, so you don’t have to concern about the safety or security of your gold.

- Quick and Efficient Servicing – Over the counter disbursement in just 50 minutes with minimal documentation.

- Complete Transparency – Gold Loan rates and other charges are communicated upfront in writing, along with the quotation, so you don’t have to worry about any hidden costs or fees.

- Foreclosure – In the case of a Gold Loan Foreclosure Capital Small Finance Bank charges a borrower up to .50% on the principal outstanding.

GOLD LOAN @ 0.75%*

APPLY NOW

How Much Can I Get Through Capital Small Finance Bank Gold Loan

According to the most recent gold costs, Small Finance Bank offers a gold credit for each gram of ₹ 4,621. The most elevated Small Finance Bank gold advance rate per gram today is ₹ 4,129 for 22-carat gems determined at the greatest LTV of 75% and normal gold advance costs of most recent 30 days in 2021 is ₹ 5,121 of 22 carats.

Capital Small Finance Bank Gold Loan Per Gram-Update Apr 26 2024

About Capital Small Finance Bank Gold Loan

Capital Small Finance Bank Limited started operating as India’s first small bank on 24 April 2016, after being transformed from Capital Local Area Bank. Prior to the transformation of the Microfinance Bank, Capital Local Area Bank had been the largest local bank in India since January 14, 2000.

The Bank pioneered the provision of modern banking facilities in rural areas at a low cost. The Bank has introduced a 7-day branch bank with additional banking hours since its inception. Focusing on personal service and local profitability has given the Bank the opportunity to compete with other banks operating in the region. In a short time, many branches became market leaders of their institutions. The Bank provides secure, efficient and well-resourced resources to the local community while reducing their dependence on lenders by making easily needed loans more readily available.

The Bank has shifted from Local Area Bank to Small Finance Bank with 47 branches. In a short time, 111 new branches were operational, bringing the total number of Branches to 158. After gaining a strong track record in Punjab province, the Bank has now begun to expand to Delhi, Haryana, Rajasthan and Union Chandigarh counties.

- Capital Small Finance Bank Gold Loan Interest Rates is 7.25% per annum.

- Capital Small Finance Bank Gold Loan Rate Per Gram is ₹ 3,800 to ₹ 4,350.

- Capital Small Finance Bank Gold Loan Tenure is 60 months.

- Capital Small Finance Bank Gold Loan processing fee is 1% of the Principal Loan Amount.

Capital Small Finance Bank Gold Loan Eligibility

Age

18-70 years of age

Nationality

Indian

Employment Status

Salaried, Self-Employed

Gold Quality, Quantity

Minimum 18 Carats, minimum 10 grams

Requirements

Gold ornaments (18-22 carats)

CIBIL score

Above 500

Capital Small Finance Bank Gold Loan at Home

Gold Loan at Home is a doorstep loan service that allows you to borrow money from the convenience of your own home. The service is rapid, flexible, and cost-effective because interest rates are low. You may use the gold loan calculator to calculate the value of your gold or the loan amount before completing a loan request. Obtaining a Gold Loan at home is an easy and quick process that can be done in a matter of minutes.

One of our representatives will contact you and arrive at your home within 30 minutes. The appropriate gold loan amount will be paid immediately to your bank account when all e-documentation and gold identification is completed at your home.

The benefits of getting a gold loan at your doorsteps are:

- Diverse Range of Gold Loan Schemes

- Your Gold will just be released the same day.

- You can get free insurance for your Gold

- There are no hidden fees.

- You will get the maximum value of your Gold

- Service at Your Door in 30 Minutes

Documents Required For Capital Small Finance Bank Gold Loan

Photographs

2 Passport Size, clear, latest, coloured

Identity Proof

Aadhar Card, Passport, PAN Card, etc. (Only 1 is required)

Residence Proof

Aadhar Card, Driving License, Ration Card, etc. In the case of Rented House then the rent agreement or water/electricity bills for the last three months can be considered. (Only 1 is required)

Agricultural Land Proof

Required only if the Loan is taken for Agricultural Purpose

Note: Capital Small Finance Bank can ask for additional documents as per the needs and requirements.

Capital Small Finance Bank Gold Loan Interest Rates

In general loan on gold, credit is available at a low interest rate. The reason behind this is that the gold loan is a fully secured loan.

Gold Loan Interest Rate

7.25% per annum

Repayment Scheme

Bullet Repayment Scheme, Overdraft Scheme

Prepayment Charges

0-2%

Service Charges

variable

Document Charges

variable

Gold Valuation Charges

variable

Processing Fee

1%

Note: The interest rate mentioned here is updated with the rate expected to change.

Know More – Top Reasons why Gold Loan is the best borrowing option

Capital Small Finance Bank Gold Loan Apply Online

- Visit Dialabank. You will see many loan options on the menu.

- Fill the Gold Loan form. Make sure you fill in your phone number.

- Wait for a call from us. We will guide you through the entire process.

Know More – Gold Loan Per Gram

Capital Small Finance Bank Gold Loan EMI Calculator

Rate of Interest

6 months

1 Yr

2 Yrs

3 Yrs

7.00%

17008

8652

4477

3088

8.00%

17058

8699

4523

3134

8.50%

17082

8722

4546

3157

9.00%

17107

8745

4568

3180

9.50%

17131

8678

4591

3203

10.00%

17156

8791

4614

3227

10.50%

17181

8815

4637

3250

11.00%

17205

8838

4661

3274

11.50%

17230

8861

4684

3298

12.00%

17254

8885

4707

3321

12.50%

17279

8908

4731

3345

13.00%

17304

8932

4754

3369

13.50%

17329

8955

4778

3393

14.00%

17354

8979

4801

3418

14.50%

17378

9002

4825

3442

15.00%

17403

9026

4845

3466

How To Pay Your Capital Small Finance Bank Gold Loan EMI?

Your Capital Small Finance Bank gold advance can be reimbursed in the following three different ways.

- Standing Instruction (SI): Existing record holders with Capital Small Finance Bank can avail of this exiting repayment method. Your Capital Small Finance Bank account predefined by you will be debited automatically for the EMI at the end of the monthly cycle.

- Electronic Clearing Service (ECS): This method is for the customer with Non-Capital Small Finance Bank accounts. They can use this method for the repayment and the EMI are charged accordingly at the end of the monthly cycle.

- Post-Dated Cheques (PDC): PDC is also an interesting and easy mode of repayment as you can submit post-dated cheques to the nearest Loan department of the Capital Small Finance Bank. Make sure to provide new arrangements of PDC’s on time.

Gold Ornaments Accepted By Capital Small Finance Bank

- Capital Small Finance Bank accepts any form of gold jewellery. The only requirement is that the weight of the gold in the jewellery should be a minimum of 10 grams and the purity should be 18 to 22 carats.

- Capital Small Finance Bank does not accept forged coins. Minted coins can be submitted for a maximum weight of 50 grams.

- Capital Small Finance Bank does not accept raw gold.

- Capital Small Finance Bank does not accept gold bars.

Uses Of Capital Small Finance Bank Gold Loan

A Capital Small Finance Bank gold loan gives you a chance to fund many important moments of your life from personal to business to agricultural ones. These loans can be availed of by almost everyone. Housewives can use it for any personal expense, while a businessman can avail of it for expansion, while at the same time a farmer can use it to buy agricultural implements. Parents or students can use it for higher education.

Capital Small Finance Agricultural Jewel Loan Scheme

Scheme

Capital Small Finance Bank Agricultural Jewel Loan Scheme

Interest Rate

Starting from 7.25% per annum (depends on the sum of the loan

Least amount of Loan

Depends on the value of the jewel which is being kept as security

Loan period

Adjustment of advance sum inside 2 months from the date of reap of yields

Benefits Of Capital Small Finance Bank Agricultural Jewel Loan Scheme

- There is no processing fee is applicable up to ₹ 25,000.

- 0.30% of the loan amount, Minimum of ₹ 300 charge is applicable to the amount ranging from above ₹ 25,000 – less than ₹ 5 lakh.

- 0.28% of the credit sum, subject to at least Rs.1,500 is applicable to the amount more than Rs.5 lakh however under Rs.1 crore.

Capital Small Finance Bank Gold Loan Overdraft Scheme

Capital Small Finance Bank Offers an Overdraft Scheme. It works like a Credit Card, where you can spend your Gold Loan Amount as you want anytime anywhere. The overall loan amount will have a Credit/Loan Limit. In the Capital Small Finance Bank Gold Loan Overdraft facility, the bank charges interest only on the withdrawn amount.

Capital Small Finance Bank Gold Loan Highlights

Age

18 – 70 years

Minimum Loan Amount

Rs. 1000

Maximum Loan Amount

Rs. 1 Crore

Capital Small Finance Bank Gold Loan Interest Rate

7.25% per annum

Loan Tenure

Up to 60 months

Gold Items accepted

Jewellery and gold coins sold by banks

Capital Small Finance Bank Gold Loan Processing Charges

1% of the loan amount

How Does Capital Small Finance Bank Gold Loan Work, Here’s An Example

The suitability of the loan is determined on the basis of the purity of gold, LTV, and the weight of gold. Suppose Mr A and his two friends Mr B and Mr C have different gold values for different purity. Mr A has 50 grams of gold per 22-carat purity. Mr B has 60 grams of gold in 20 carats of purity and Mr C has 70 grams of gold in purity or 22 carats. They approached the Capital Small Finance Bank to get a gold loan. The price used to calculate the suitability of their gold loan according to the high 85% LTV will vary with the purity of the gold and therefore, will lead to the validity of the gold loan.

Know More – Gold Loan Interest Rate

FAQs About Capital Small Finance Bank Gold Loan

✅ What is Capital Small Finance Bank Gold Loan?

Capital Small Finance Bank gold loan is provided to individuals to fulfil their monetary requirement for business or personal consumption purposes but not for speculative purposes. You can get these loans at attractive and competitive interest rates for a tenure of your choosing. The bank gives easy repayment options with an overdraft facility as well.

✅ How Can I Get Gold Loan From Capital Small Finance Bank?

Getting a Gold loan from Capital Small Finance Bank is easy and burdensome. You can start applying for the advance online as well as offline. You can visit the bank’s branch and fill a form to apply for the loan or you can also apply online through Dialabank’s digital platform to get a special rate of interest on your gold loans. Contact us at 9878981144 for the best assistance.

✅ How much Gold Loan Can I get per gram from Capital Small Finance Bank?

Capital Small Finance Bank Gold Loan Rate Per Gram is ₹ 3,800 to ₹ 4,350.

✅ How Does Capital Small Finance Bank Gold Loan work?

Working with the Capital Small Finance Bank Gold Loan is very facile depending upon whether you are eligible for the loan or not. You need id proof, address proof, income proof along with gold jewellery as collateral to be eligible for the loan. You get quick disbursal if you’re eligible and the loan is given at interest rates starting from 7.0% depending upon the amount of your loan.

✅ What is the Gold Loan interest rate in Capital Small Finance Bank?

The Capital Small Finance Bank gold loan interest rate starts from 7.25% per annum depending upon the amount of the loan that is to be taken.

✅ How to check gold loan status in Capital Small Finance Bank?

You can check the Capital Small Finance Bank gold loan status by emailing the bank’s executive and asking them about your application or by visiting the branch and meeting the loan officer. Usually, the disbursal of the amount is done on the same day of the approval of the application.

✅ Does Capital Small Finance Bank give Bank Overdraft?

Yes, Capital Finance Bank Gold Loan does provide a Bank overdraft facility.

✅ How to calculate gold loan interest in the Capital Small Finance Bank?

To calculate the Capital Small Finance Bank gold loan interest which you are expected to pay, deduct the loan principal from the loan amount.

✅ What is the maximum gold loan amount I can avail of on a gold loan from Capital Small Finance Bank?

You can avail of a maximum Capital Small Finance Bank gold loan amount of Rs. 10 lakhs. The amount you can apply for in a gold loan can be a maximum of 70% of the value of your gold collateral.

✅ What is the loan tenure of the Capital Small Finance Bank gold loan?

The tenure of a Capital Small Finance Bank gold loan ranges from 6 months to 5 years. You can get it renewed after paying a small fee.

✅ How much processing fee is applicable to the Capital Small Finance Bank Gold loan?

The processing fee for a Capital Small Finance Bank gold loan is around 1% of the loan amount. Thus, it is very cheap to avail of this loan.

✅ What are the charges for pre-payment in the Capital Small Finance Bank gold loan?

Capital Small Finance Bank gold loan prepayment fee is nil. The bank allows the borrowers to prepay their loans for free.

✅ How to renew Capital Small Finance Bank Gold Loan online?

Renewal of the Capita Small Finance Bank Gold Loan online can be done by visiting the branch along with all the loan documents or by applying for it online on the bank’s official website. The gold is released and revalued based on new market rates and new terms are agreed upon for the renewal of the loan.

✅ How to pay Capital Small Finance Bank Gold loan interest online?

The Capital Small Finance Bank gold loan gives you easy online interest repayment options which include paying the EMI or the servicing interest of the loan through a Standing Instruction on your account or an ECS on your other bank account. For more information, you can visit the nearest branch.

✅ What if I can’t pay the interest on the Capital Small Finance Bank Gold loan for 3 months?

If someone is unable to pay the Capital Small Finance Bank gold loan amount due at the end of the tenure then the bank charges a penalty fee on the amount due and then auctions off the gold kept as security to recover the amount of the defaults are continued.

✅ How can I apply for the EMI moratorium on the Capital Small Finance Bank Gold loan?

You can apply for a Capital Small Finance Bank gold loan EMI moratorium by providing the bank with your loan details online or in person by visiting the bank branch. This option can only be availed of until 5 days before the decided EMI payment date.

✅ How to pay the Capital Small Finance Bank Gold loan through credit card?

A credit card cannot be used to pay a Capital Small Finance Bank gold loan. The borrowers can repay their loans using debit cards, cash, cheques, demand drafts, and net banking apps like Paytm.

✅ What is the Capital Small Finance Bank Gold Loan customer care number?

For contacting the Capital Small Finance Bank Gold loan customer care just dial 9878981144.

✅ What is the Capital Small Finance Bank Gold Loan closure procedure?

- Just go to the bank with the documents.

- Write a letter for pre-closure of the Capital Small Finance Bank Gold loan account.

- Pay the pre-closure charges as per Capital Small Finance Bank Gold Loan.

✅ What is the Capital Small Finance Bank Gold Loan preclosure charge?

Up to 2% preclosure charge before 3 months, after that 0.50%.

✅ What is the Capital Small Finance Gold Loan maximum tenure?

The maximum tenure of the Capital Small Finance Bank Gold loan is 24 months.

✅ What is the foreclosure procedure for Capital Small Finance Bank Gold Loan?

The Bank gives a borrower 0.50% on the key excellent if there should be an event of a Gold Loan Foreclosure.

✅ What is the minimum gold loan tenure?

The minimum gold loan tenure is 6 months.

News about Capital Small Finance Bank Gold Loan

Capital Small Finance Bank presenting top gold rates

Capital Small Finance Bank gold Loans is trying to make a mark in the gold loan market by offering low-interest rates and less processing fees not just to their pre-existing customers but also to the new ones trying to offer the most benefits. With the Capital Small Finance Bank gold loan, a maximum of Rs. 10 lakhs can be loaned by the customer if their gold holds that much value.

Other Major Gold Loan Providers

✅ What is Capital Small Finance Bank Gold Loan?

Capital Small Finance Bank gold loan is provided to individuals to fulfil their monetary requirement for business or personal consumption purposes but not for speculative purposes. You can get these loans at attractive and competitive interest rates for a tenure of your choosing. The bank gives easy repayment options with an overdraft facility as well.

✅ How Can I Get Gold Loan From Capital Small Finance Bank?

Getting a Gold loan from Capital Small Finance Bank is easy and burdensome. You can start applying for the advance online as well as offline. You can visit the bank’s branch and fill a form to apply for the loan or you can also apply online through Dialabank’s digital platform to get a special rate of interest on your gold loans. Contact us at 9878981144 for the best assistance.

✅ How much Gold Loan Can I get per gram from Capital Small Finance Bank?

Capital Small Finance Bank Gold Loan Rate Per Gram is ₹ 3,800 to ₹ 4,350.

✅ How Does Capital Small Finance Bank Gold Loan work?

Working with the Capital Small Finance Bank Gold Loan is very facile depending upon whether you are eligible for the loan or not. You need id proof, address proof, income proof along with gold jewellery as collateral to be eligible for the loan. You get quick disbursal if you’re eligible and the loan is given at interest rates starting from 7.0% depending upon the amount of your loan.

✅ What is the Gold Loan interest rate in Capital Small Finance Bank?

The Capital Small Finance Bank gold loan interest rate starts from 7.25% per annum depending upon the amount of the loan that is to be taken.

✅ How to check gold loan status in Capital Small Finance Bank?

You can check the Capital Small Finance Bank gold loan status by emailing the bank’s executive and asking them about your application or by visiting the branch and meeting the loan officer. Usually, the disbursal of the amount is done on the same day of the approval of the application.

✅ Does Capital Small Finance Bank give Bank Overdraft?

Yes, Capital Finance Bank Gold Loan does provide a Bank overdraft facility.

✅ How to calculate gold loan interest in the Capital Small Finance Bank?

To calculate the Capital Small Finance Bank gold loan interest which you are expected to pay, deduct the loan principal from the loan amount.

✅ What is the maximum gold loan amount I can avail of on a gold loan from Capital Small Finance Bank?

You can avail of a maximum Capital Small Finance Bank gold loan amount of Rs. 10 lakhs. The amount you can apply for in a gold loan can be a maximum of 70% of the value of your gold collateral.

✅ What is the loan tenure of the Capital Small Finance Bank gold loan?

The tenure of a Capital Small Finance Bank gold loan ranges from 6 months to 5 years. You can get it renewed after paying a small fee.

✅ How much processing fee is applicable to the Capital Small Finance Bank Gold loan?

The processing fee for a Capital Small Finance Bank gold loan is around 1% of the loan amount. Thus, it is very cheap to avail of this loan.

✅ What are the charges for pre-payment in the Capital Small Finance Bank gold loan?

Capital Small Finance Bank gold loan prepayment fee is nil. The bank allows the borrowers to prepay their loans for free.

✅ How to renew Capital Small Finance Bank Gold Loan online?

Renewal of the Capita Small Finance Bank Gold Loan online can be done by visiting the branch along with all the loan documents or by applying for it online on the bank’s official website. The gold is released and revalued based on new market rates and new terms are agreed upon for the renewal of the loan.

✅ How to pay Capital Small Finance Bank Gold loan interest online?

The Capital Small Finance Bank gold loan gives you easy online interest repayment options which include paying the EMI or the servicing interest of the loan through a Standing Instruction on your account or an ECS on your other bank account. For more information, you can visit the nearest branch.

✅ What if I can’t pay the interest on the Capital Small Finance Bank Gold loan for 3 months?

If someone is unable to pay the Capital Small Finance Bank gold loan amount due at the end of the tenure then the bank charges a penalty fee on the amount due and then auctions off the gold kept as security to recover the amount of the defaults are continued.

✅ How can I apply for the EMI moratorium on the Capital Small Finance Bank Gold loan?

You can apply for a Capital Small Finance Bank gold loan EMI moratorium by providing the bank with your loan details online or in person by visiting the bank branch. This option can only be availed of until 5 days before the decided EMI payment date.

✅ How to pay the Capital Small Finance Bank Gold loan through credit card?

A credit card cannot be used to pay a Capital Small Finance Bank gold loan. The borrowers can repay their loans using debit cards, cash, cheques, demand drafts, and net banking apps like Paytm.

✅ What is the Capital Small Finance Bank Gold Loan customer care number?

For contacting the Capital Small Finance Bank Gold loan customer care just dial 9878981144.

✅ What is the Capital Small Finance Bank Gold Loan closure procedure?

- Just go to the bank with the documents.

- Write a letter for pre-closure of the Capital Small Finance Bank Gold loan account.

- Pay the pre-closure charges as per Capital Small Finance Bank Gold Loan.

✅ What is the Capital Small Finance Bank Gold Loan preclosure charge?

Up to 2% preclosure charge before 3 months, after that 0.50%.

✅ What is the Capital Small Finance Gold Loan maximum tenure?

The maximum tenure of the Capital Small Finance Bank Gold loan is 24 months.

✅ What is the foreclosure procedure for Capital Small Finance Bank Gold Loan?

The Bank gives a borrower 0.50% on the key excellent if there should be an event of a Gold Loan Foreclosure.

✅ What is the minimum gold loan tenure?

The minimum gold loan tenure is 6 months.

News about Capital Small Finance Bank Gold Loan

Capital Small Finance Bank presenting top gold rates

Capital Small Finance Bank gold Loans is trying to make a mark in the gold loan market by offering low-interest rates and less processing fees not just to their pre-existing customers but also to the new ones trying to offer the most benefits. With the Capital Small Finance Bank gold loan, a maximum of Rs. 10 lakhs can be loaned by the customer if their gold holds that much value.

Other Major Gold Loan Providers

|

|

|